Q3 in Review: PTAB Rulemaking Push Continues as US Weighs More Active SEP Approach

October 10, 2023

NPE litigation was down by 34% in Q1-Q3 2023, a dip once again caused by two significant changes last year: a pause in new complaints from former top filer IP Edge LLC, and a judge assignment order that has made the Western District of Texas less tempting for some NPEs. Yet while West Texas has remained less popular as a result of those new rules, IP Edge has recently put a cautious toe back into the litigation waters—launching its first new case since November 2022.

Additionally, the Patent Trial and Appeal Board (PTAB) remains in a state of flux, as the USPTO weighs which changes to keep from a sweeping but nonfinal rulemaking proposal that could reshape the America Invents Act (AIA) review system in fundamental ways—including the potential addition of a standing requirement for inter partes reviews (IPRs). The Biden administration, meanwhile, is signaling a potential return to a more active approach on issues related to fair, reasonable, and nondiscriminatory (FRAND) disputes in response to a widely criticized EU proposal for a centralized SEP licensing regime.

Finally, BlackBerry’s divestment of substantially all of its non-core patent assets may be in the rearview, but the transaction continued to spark new litigation during Q3. On the litigation finance front, Burford Capital escaped sanctions in Taction Technology, Inc.’s suit against Apple, but its client might be on the hook for attorney fees and expert fees now that Apple has been granted summary judgment of noninfringement. Also related to litigation finance, RPX has flagged noteworthy developments involving Arizona’s Alternative Business Structure program, under which nonlawyers can own and operate law firms in that state.

RPX members also have exclusive access to an on-demand RPX Community webinar covering highlights from this post; CLE credit may be available.

Litigation Update: NPE Filings Drop Due to Since-Ended IP Edge Pause and Downturn in West Texas

Venue Update: East Texas Stays in First Place as Delaware Disclosure Drama Continues

PTAB Update: Vidal Teases Upcoming Rules Package as Reexam Filings Plateau

FRAND Update: EU SEP Proposal Triggers Renewed FRAND Policy Debate in US

Litigation Update: NPE Filings Drop Due to Since-Ended IP Edge Pause and Downturn in West Texas

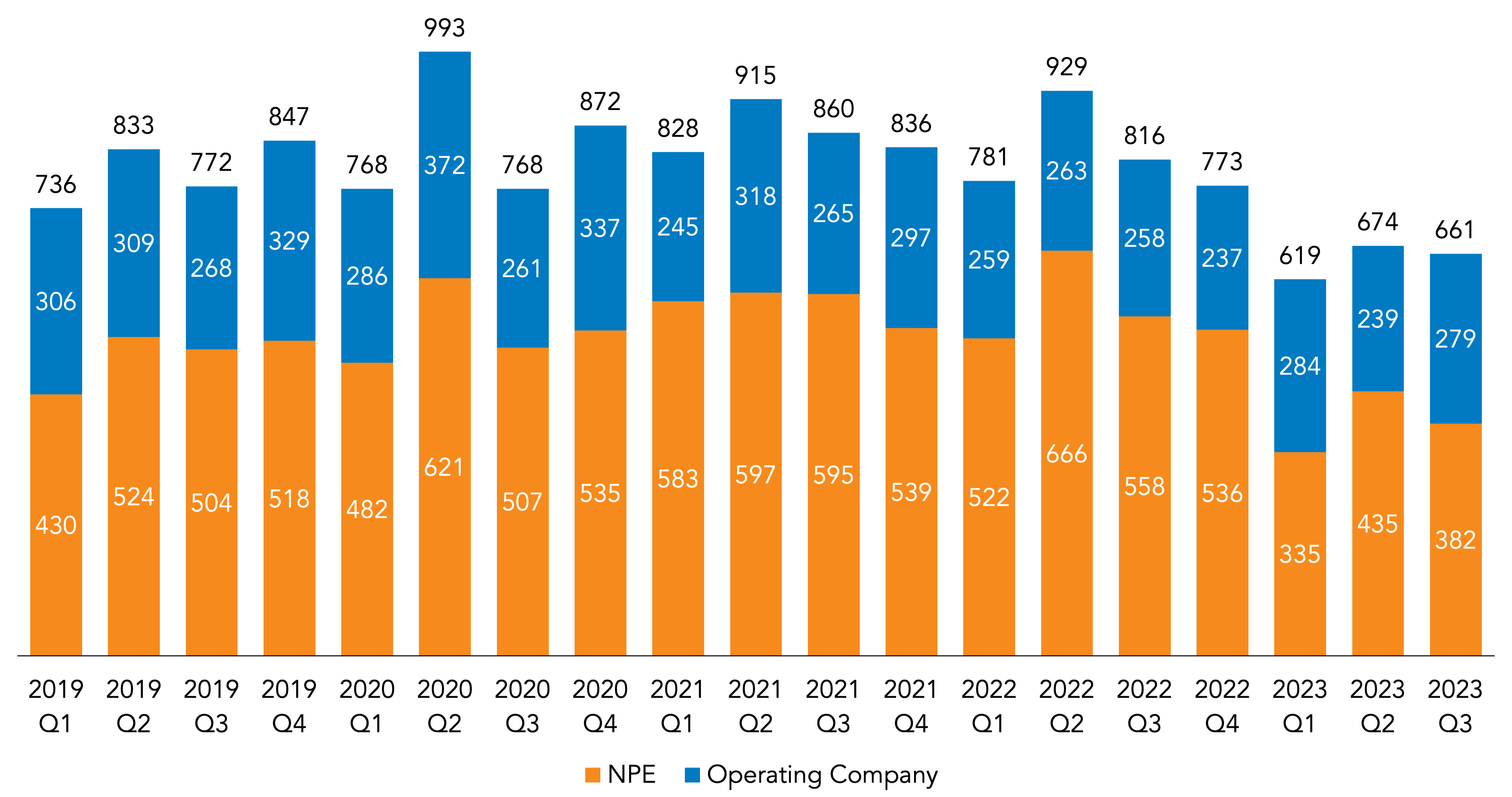

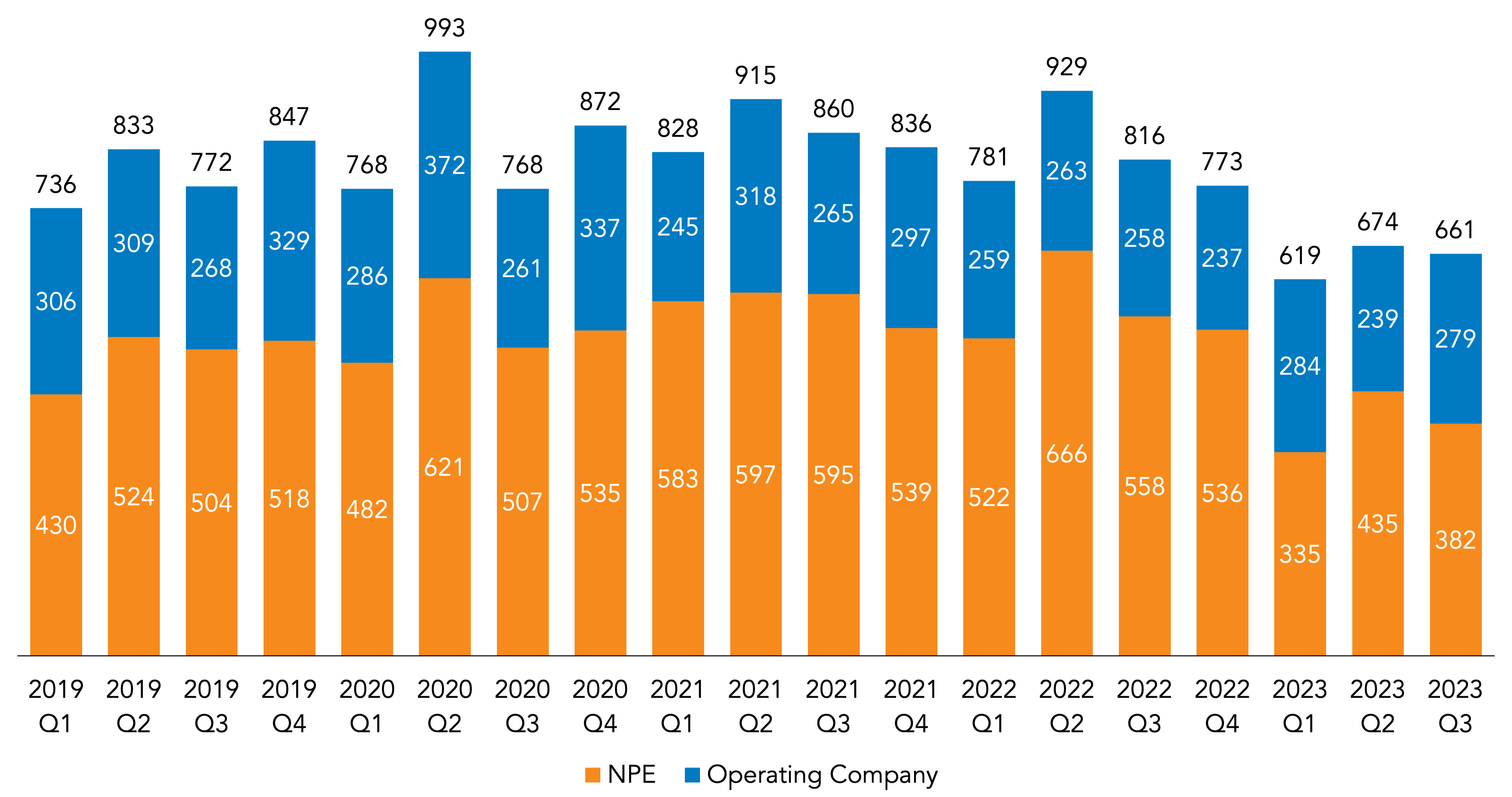

So far this year, NPEs have added 1,152 defendants to patent litigation campaigns as of the end of September, a 34% drop from that same period last year (when NPEs added 1,746 defendants). In contrast, operating company litigation was up slightly in Q1-Q3 2023 at 802 defendants added, a 3% uptick compared to that same timeframe in 2022 (during which operating companies added 780 defendants).

In the third quarter of 2023, NPEs added 382 defendants, down 32% from the same quarter this past year (when NPEs added 558 defendants). This also marked a 31% dip from the trailing third-quarter average for 2020-2022 and a 12% drop from Q2 2023. Meanwhile, operating companies added 279 defendants in Q3 2023, up by 8% from the year-ago quarter, up by 7% compared to the trailing average, and up by 17% compared to the preceding quarter.

| Defendants Added | Change Compared to: | ||||

| Q3 2023 | Q3 2022 | Q3 2020-2022 Average | Q2 2023 | ||

| NPE | 382 | -32% | -31% | -12% | |

| Operating Company | 279 | 8% | 7% | 17% | |

| Total | 661 | -19% | -19% | -2% | |

The decline in NPE filings during Q1-Q3 is largely the result of two primary developments last year. The most impactful has been a prolonged pause in litigation by patent monetization firm IP Edge LLC. While IP Edge, through plaintiffs under its apparent control, had long been the most prolific filer of patent cases by a wide margin, it stopped bringing new litigation in December 2022, likely due to pressure that it has faced from disclosure rules in the courtroom of Delaware Chief Judge Colm F. Connolly (as detailed further below). The sheer volume of IP Edge’s prior litigation meant that its subsequent pause caused a significant slide in the overall NPE numbers: Though it added roughly 50 defendants per month before it hit the brakes, for a total of 455 defendants in Q1-Q3 2022, nearly zero were added during that same period this year. That difference alone accounts for more than three fourths (76.5%) of the drop in NPE litigation so far this year. Excluding IP Edge from both periods, NPE litigation was down by just 10.9% compared to Q1-Q3 2022.

That said, early signs point to an IP Edge revival, as the firm ended its litigation pause on September 13 by filing its first new case since November 2022, targeting Roku over products compliant with H.265/HEVC video compression standards and HDR10+ technology in a complaint filed by new plaintiff Communication Advances LLC. Certain aspects of this new campaign suggest that IP Edge is doubling down on a more recently introduced business formation and litigation strategy. Prior IP Edge campaigns largely tended to be brought by plaintiffs controlled by a series of individual “passive investors” not otherwise connected to patent monetization (a strategy flagged as potentially fraudulent in Delaware, as detailed further below), would assert patents first acquired by an intermediate entity also linked to IP Edge (rather than plaintiffs obtaining patents directly), and would largely bring short-lived file-and-settle cases. In contrast, there are signs that the Communication Advances campaign may follow an “IP Edge 2.0” model pioneered by a smaller and more recently formed group of IP Edge plaintiffs that have shown a greater willingness to litigate on substance—at least one of which has also indicated that it has received litigation funding. Like those other recent IP Edge entities, Communication Advances was formed directly by the principals of IP Edge—Texas attorneys Lillian Woung, Gautham (Gau) Bodepudi, and Sanjay Pant—and acquired its patents directly from the source. More details on those “2.0” entities, and this potential IP Edge revival, can be found on RPX Insight.

The second development impacting NPE litigation this year was a downturn in NPE filings within the Western District of Texas, where a July 2022 order from the district’s chief judge targeted the concentration of litigation before Waco District Judge Alan D. Albright. Plaintiffs previously took advantage of filing rules allowing complaints to be filed in a specific division, thus guaranteeing they could get Judge Albright—who has demonstrated a restrictive approach to transfer motions, PTAB stays, and Alice motions—by filing in Waco (where he is the only district judge). Yet the July order created an exception, ordering that Waco’s patent cases be randomly distributed among a group now comprised of 11 judges, including Judge Albright. While the district has since developed a practice of assigning new cases in existing campaigns (those with the same parties and patents) to the judge who oversaw prior litigation, meaning that Judge Albright has received the bulk of new cases in those “legacy” campaigns, the assignment of complaints filed in entirely new campaigns has been far more random. By eliminating the guarantee that cases would end up before Judge Albright, it appears that the July order has undercut the district’s overall appeal for NPEs: Such plaintiffs added 282 defendants in Waco from Q1-Q3 2023, compared to 544 during that same period last year.

Added together, the reductions from IP Edge and in Waco—633 defendants in total, adjusting for the overlap in IP Edge and Waco cases—accounted for 100% of the decline in NPE activity in Q1-Q3 2023 and then some. The net decrease was 594 defendants, a partial offset caused by other plaintiffs shifting from West Texas to other districts in smaller numbers.

Additionally, the operating company data above leave out another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e-seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to what one might consider the usual patent suit. These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts or aliases for the same ultimate parent. Also, plaintiffs primarily seek injunctive relief instead of damages, and their cases often end with the e-seller defendant’s failure to answer, followed by a default judgment.

This category of litigation, which began to spike in Q3 2020, is shown in grey below to illustrate its magnitude. As evident from the rightmost bar, e-seller litigation in Q3 2023 accounted for 1,639 defendants added, or 71% of all litigation during the quarter (though note that this number is subject to the caveat about defendants with multiple online storefronts outlined above).

Apart from the following graph, the remaining analyses in this report exclude pure design patent and e-seller litigation.

Venue Update: East Texas Stays in First Place as Delaware Disclosure Drama Continues

The Eastern District of Texas was the top district for all patent litigation and for NPE litigation in the third quarter after vaulting into first place in Q2. Holding onto second place in both categories was the Western District of Texas, knocked out of the top spot due to last year’s changes targeting Judge Albright. The District of Delaware was the most popular venue for operating company litigation but maintained a distant third place for both all litigation (for which it held the top spot in Q1) and NPE litigation.

Delaware’s fall in the rankings is likely the result of a battle over the stringent disclosure rules that Chief Judge Colm F. Connolly imposed in his courtroom in April 2022. Since this past winter, several entities affiliated with Texas monetization firm IP Edge LLC have been embroiled in a heated back-and-forth with Judge Connolly over their initial failure to make sufficient disclosures under those new rules, leading him to order them to produce reams of information about their ownership and legal representation. Those orders were prompted by Judge Connolly’s concerns over IP Edge’s historical business model: as noted above, it has frequently hired individuals with no prior connection to patent monetization as the owners/managers of its litigating LLCs in exchange for the promise of passive income from its litigation proceeds. That practice, per Judge Connolly, raised concerns that by assigning patents to those LLCs without disclosing connections to IP Edge and a related firm, MAVEXAR LLC, those two entities had perpetrated a fraud on the USPTO and/or the district court. As those inquiries ramped up late last year, IP Edge’s Delaware filings fell by the end of Q3 2022, with the firm bringing no new cases in the district after the end of September (pausing its filings altogether by the close of November). As IP Edge accounted for the bulk of Delaware’s NPE activity, the district’s numbers tumbled as a result, and they have not rebounded since.

Though most of the aforementioned IP Edge-linked plaintiffs have since provided the materials ordered by Judge Connolly after a lengthy battle, two remained locked in conflict with him as of the end of the third quarter. One was Backertop Licensing LLC, which attracted the court’s scrutiny after both of its attorneys tried to withdraw from representation, citing an apparent breakdown in the relationship with their client. Judge Connolly then ordered its sole owner, Texas paralegal Lori LaPray, to appear in person to answer questions about the unusual situation, but she refused to do so multiple times in a contentious, drawn-out fight—ultimately leading the court to impose a $200-per-day fine for contempt after she failed to appear at an August 1 hearing. On October 3, Judge Connolly refused to stay the fines against Ms. LaPray, holding that she was unlikely to succeed in her pending appeal and that to conclude otherwise would undermine the court’s authority. He further noted that in any event, simply complying with the court’s order would eliminate the fines altogether and observed that neither Ms. LaPray nor Backertop had provided any evidence of her alleged financial hardship. Also failing to appear was Jacob LaPray, the owner of the other aforementioned IP Edge NPE, Creekview IP LLC, whose failure to appear at that same hearing has not yet led to a contempt order.

Meanwhile, Eastern District of Texas Judge Rodney Gilstrap remained the nation’s top district judge in Q3, with 12% of all new patent litigation falling in his courtroom. Once again, Western District of Texas Judge Alan D. Albright held a distant second place at 7%, his patent caseload slimmed down as a result of those judge assignment rule changes in Waco.

As Judge Albright’s caseload has shifted, so has his dynamic with the Federal Circuit over a familiar issue: motions to transfer for convenience. Starting in 2020, the appellate court began to repeatedly reverse him on that issue, in each instance identifying a series of recurring legal errors, in response to mandamus petitions from parties with transfer motions that he had either denied outright or ignored while moving on to other substantive matters. However, after reversing Judge Albright 18 times in 2021 alone, that wave of reversals became a trickle as he adjusted his analyses to account for the Federal Circuit’s rulings on both his application of the substantive convenience transfer factors and on the issue of timing—overturning him on mandamus just six times in all of 2022.

The Federal Circuit has done so only twice in 2023: most notably, in its precedential February In re: Google ruling, which took an even more limiting view of a district judge’s discretion than before (deferring to Judge Albright’s factfinding on issues like time to trial, but not necessarily his conclusions of law) and held that NPEs lack an interest in getting cases to trial quickly. The second reversal, issued in June, largely just applied that same rationale to a pre-Google transfer denial. In the meantime, Judge Albright has further shifted his approach in response to the Google decision, albeit begrudgingly—while the Federal Circuit issued no mandamus reversals against him whatsoever in Q3.

Defendants in his courtroom have also recently hit a mandamus wall on two other types of issue. The first was improper venue: In late September, the Federal Circuit declined to disturb Judge Albright’s ruling that a plaintiff can establish venue based on an in-district property not leased until after the case was filed, facts that were not pleaded until an amended complaint. The decision appeared to stretch a prior Federal Circuit opinion that concerned an amended complaint grounding venue in newly pleaded facts, but where those facts predated the original complaint. The second issue was alternative means of service on foreign defendants, an issue on which Judge Albright has lately shown significant flexibility—recently allowing service against a Taiwanese company’s limited-purpose outside counsel.

Market Sector Update: Monetization Firms, Familiar Assertion Professionals, and Inventors Hit E-Commerce and Software in Q3

The top market sector for NPE litigation in Q3 2023 was E-Commerce and Software, accounting for 34% of new defendants added to patent litigation campaigns. Consumer Electronics and PCs saw the second highest amount of NPE litigation in the third quarter, followed by Networking, Mobile Communications and Devices, and Consumer Products.

A wide variety of plaintiffs hit this sector throughout the third quarter, including several linked to patent monetization firms. Among them was SitNet LLC, an entity formed by the principal of CAsE Analysis, which in late July launched its first campaign over social networking technologies—including crisis communications services, targeted advertisement services, and underlying software architecture for such advertising—with the backing of a well-known litigation funder. Additionally, two plaintiffs controlled by Equitable IP Corporation added cases to existing campaigns in Q3: Scale Video Coding LLC filed a new complaint in early September targeting teleconference products that support the H.264 video codec and related scalable video coding (SVC) technology, while Communication Interface Technologies, LLC brought a host of new cases in August against companies offering push notification features in their respective mobile apps. Other monetization firms hitting this sector in Q3 were Ortiz & Lopez, PLLC (d/b/a OL PATENTS), which through associated plaintiff FlickIntelligence, LLC filed a new trio of complaints in its ongoing augmented reality campaign in early September; and the once-prolific Empire IP LLC, which through Nearby Systems LLC added a pair of suits to its ongoing location-based mapping campaign in late August.

Also joining the fray were a variety of plaintiffs associated with notable individuals active in the patent assertion space. One was OptiMorphix, Inc., which in late September kicked off a campaign asserting former Citrix patents against products related to cloud infrastructure and web search. The plaintiff is controlled by an individual linked to multiple other litigating NPEs, including DIFF Scale Operation Research, LLC; Dynamic Data Technologies, LLC; Castlemorton Wireless, LLC; and, most recently, NexGen Control Systems LLC. Two other NPEs starting their first campaigns were Accessify, LLC and ThinkLogix, LLC, both of which are controlled by an entity formed by two former Intellectual Ventures LLC (IV) alums. The two plaintiffs have asserted patents from a larger portfolio divested by IV in February 2023; Accessify’s litigation alleges infringement through the provision of technology related to purchasing and accessing digital content on a website, while ThinkLogix has focused on a wide array of products, ranging from multicamera systems to smart home solutions. Also hitting this sector in the third quarter were multiple NPEs apparently associated with another familiar figure in patent monetization—a former inventor who in recent years has shifted to the assertion of patents acquired from others. Those plaintiffs include GeoSymm Ventures LLC, which filed its first litigation over augmented reality (AR) technology in mid-July; Scancomm LLC, which filed two more complaints targeting social networking apps in late August; Attestwave LLC, which filed litigation over products with trusted software validation and execution features in late July; and RecepTrexx LLC, which added another lawsuit to its ongoing voice assistant campaign in mid-July.

Still other NPEs zeroing in on E-Commerce and Software products in Q3 were a variety of inventor-controlled plaintiffs—including Anonymous Media Research Holdings LLC, which brought its first litigation in August over “automatic content recognition” technology for use in targeted advertising. Also launching a new campaign was RavenWhite Licensing LLC; its litigation over web tracking technologies (e.g., beacons, cookies, and pixels) and online advertising systems marked the fifth campaign to assert patents by the same inventor, following Security Technology LLC; Crypto Research, LLC; ZapFraud, Inc.; RightQuestion LLC; and Carbyne Biometrics, LLC, in that order, starting in 2013. Another inventor-controlled NPE, Gatekeeper Solutions, Inc., initiated an electronic communications campaign in late July, its complaint filed by an attorney linked to numerous file-and-settle NPEs who has recently been hit with a sanctions motion for repeated failures to correct pleading deficiencies, among other controversies. Several other inventor-led plaintiffs also filed additional litigation in existing campaigns, including ENOVSYS LLC, which revived its sole campaign with a suit targeting location-tracking services used for ride-sharing services in early September; and Virtual Creative Artists, LLC, which filed new complaints in its social media campaign in late July and mid-September. In addition, September saw a second suit from individual inventor Sholem Weisner, who asserts three location history patents related to another four that were invalidated under Alice in his first case—two of which were later revived by the Federal Circuit.

PTAB Update: Vidal Teases Upcoming Rules Package as Reexam Filings Plateau

The Patent Trial and Appeal Board (PTAB) saw 264 petitions for America Invents Act (AIA) review in the third quarter of 2023, including 250 petitions for inter partes review (IPR) and 14 petitions for post-grant review (PGR). Filings were down by 22% compared to Q3 2022, which saw 340 petitions filed; and down by 12% compared to the preceding quarter, during which 301 petitions were filed.

The PTAB instituted trial for 65% of the AIA review petitions addressed in Q3, down from that same quarter last year (during which the institution rate was 71%) and from the prior quarter this year (68%). The institution rate for Q1-Q3 2023 was 66%, down slightly from that same period last year (68%).

The PTAB’s institution practices have been top-of-mind for many stakeholders over the past few years—in particular, its use of discretionary denials under the NHK-Fintiv rule, which in part allows the Board to deny institution based on the status of a parallel district court proceeding. The ongoing debate over NHK-Fintiv became even more heated in April, when the USPTO released an Advance Notice of Proposed Rulemaking (ANPRM) that detailed a potentially sweeping revamp of PTAB proceedings that would, in part, codify certain aspects of the rule and exempt petitions from discretionary denials if they meet a new “compelling merits” standard. Another proposed rule would essentially impose a standing requirement, limiting what types of entities may and may not file PTAB petitions based on an expanded view of corporate relationships and certain exceptions concerning business models.

USPTO Director Kathi Vidal has since clarified in public comments that the agency designed the ANPRM as more of a kitchen-sink approach to soliciting feedback than a final package. In late July, Vidal confirmed in testimony to the Senate IP Subcommittee that the USPTO would only move forward on some of the proposals in the ANPRM in response to stakeholder comments, and that the ANPRM was overinclusive by design, encompassing outside proposals not necessarily favored by the Patent Office: “Instead of the USPTO making a decision without data, we decided to float all of those in the [notice] so that we could receive data from stakeholders and determine what to move forward on”. Moreover, Vidal floated the possibility that the USPTO would release two rulemaking notices to vet the final rules with the public, “one more procedurally focused and one more substantively focused”.

Vidal has not conclusively stated which substantive proposals will make the cut, but she expressed some openness to a standing requirement for the PTAB at that July hearing. In particular, Vidal remarked that such a requirement could serve to prevent parties from “trying to monetize and otherwise use the PTAB for personal gain as opposed to its original intent”—ostensibly, a reference to the debacle over third-party gamesmanship that culminated earlier this year.

Reexam Filings Continue to Dip in the Wake of the USPTO’s June 2022 NHK-Fintiv Guidance

A recurring criticism of the NHK-Fintiv rule has been that it introduces undue uncertainty by conditioning AIA review institution on factors outside of a petitioner’s control. A notable early result of this uncertainty was a shift by frequent defendants from AIA reviews to ex parte reexaminations, which are not subject to discretionary denials to the same extent. The number of reexam requests went up by 21% in 2020 and then by 53% in 2021, with an increasing share of those patents having previously been litigated in district court and subjected to PTAB challenges—together, indicating that this prior uptick was the result of NHK-Fintiv.

However, discretionary denials began to fall in 2021, according to a USPTO study, and RPX data indicate that they have since remained lower in the wake of a June 2022 guidance designed to address criticisms of the NHK-Fintiv rule—including some changes that were later folded into the April ANPRM. As those changes began to reduce the impact of NHK-Fintiv, this in turn appears to have caused a corresponding decline in reexam filings. After one last spike in the second quarter of 2022, reexam requests dipped in Q3 (the first full quarter after Vidal’s late-Q2 guidance) and flattened out in Q4. Reexams then dropped even further in Q1 2023 and subsequently plateaued in Q2 and Q3. Year-to-date reexam filings are now 17% lower compared to Q1-Q3 2022. Moreover, the share of patents at issue in those reexam requests that have also been challenged at the PTAB continues to fall, falling from 33% in 2022 to 24% so far this year. That said, the number of patents that have been hit with reexam requests and also litigated in district court remains relatively steady at 61% so far this year (compared to 59% last year).

FRAND Update: EU SEP Proposal Triggers Renewed FRAND Policy Debate in US

In the third quarter of 2023, the Biden administration gave signs that it is considering a return to a more active, “whole of government approach” toward standard essential patent (SEP) issues—prompted by the increasing momentum of a push toward a centralized SEP bureaucracy in Europe.

The move would be a dramatic about-face from last June, when the USPTO, Department of Justice (DOJ), and National Institute of Standards and Technology (NIST) withdrew a 2019 policy endorsing injunctions in litigation over fair, reasonable, and nondiscriminatory (FRAND) licensing without replacing it, instead adopting a case-by-case approach to disputes over SEPs. While the withdrawal was framed at the time in solely domestic terms, USPTO Director Kathi Vidal later stated that one of the goals behind the withdrawal was to underscore the need for international SEP solutions—indicating in an October 2022 webinar that SEP issues are inherently international and must be dealt with “at an international level”. Yet at that point, with the EU’s Unified Patent Court (UPC) yet to launch (which it ultimately did this past June), most movement in the arena of multijurisdictional SEP disputes had otherwise come at the national level—specifically, in the form of national court decisions, including some in the UK and China, asserting jurisdiction to set the terms of global FRAND licenses.

Then came the European Commission’s SEP framework, which would instead impose an EU-wide regime for FRAND licensing and dispute resolution. As detailed in both a leaked draft and final version introduced in spring 2023, the regulation includes three overarching proposals. First, to address concerns over ownership transparency, the framework would create a public register in which patent owners would be required to register patents they believe to be essential before they would be allowed to assert them in litigation—either before national courts or the UPC. Second, the framework would also include a system requiring essentiality checks, wherein “[i]ndependent evaluators” would determine whether an annually selected subset of an owner’s registered SEPs are actually essential to their declared standards. The results of the essentiality checks would be legally nonbinding and also subject to appeal. Third, and perhaps most controversially, the framework would require SEP owners to use a new, out-of-court process for determining FRAND licensing terms that would be administered by the EU Intellectual Property Office (EUIPO). The completion of this process would also be mandatory for patent owners seeking to enforce their SEPs in national courts or the UPC, though again the results would be nonbinding unless both parties agree to the EUIPO’s determination.

The proposal soon attracted criticism both within and outside the EU—including comments from both US Secretary of Commerce Gina Raimondo and USPTO Director Vidal. In late April, shortly before the release of the regulation’s final draft, Raimondo testified at a at a Senate Appropriations Committee oversight hearing in which Senator Chris Coons (D-DE) expressed concerns that the leaked draft, which contemplated regional rate-setting, would validate alleged “abuse of royalty setting practices” by China. Raimondo responded that the administration “very much shares [those] concerns” and stated that they were already in the process of conducting outreach on the topic to EU officials. While the final proposal contemplates just global rate-setting, Senator Coons subsequently expressed concerns at another hearing, this time during testimony by Vidal before the Senate IP Subcommittee, that the final regulation would “essentially be an SEP rate court” that would enable the same Chinese practices he previously highlighted. Vidal responded by tying the previously expressed rationale for last year’s US SEP policy withdrawal—that the administration sees “standards as an international issue”—to China, stating “that individual countries weighing in, in these ways, can be extremely problematic”. Perhaps more significantly, Vidal indicated for the first time that the administration planned to ask for stakeholder feedback to shape an upcoming “all-of-government” response to the EU regulation, adding that US officials had continued to meet with their EU counterparts on the subject.

Two standards-related initiatives announced since the release of the EU’s proposal have focused in part on the role that the US plays in the global SEP ecosystem relative to other jurisdictions. For instance, a National Standards Strategy announced in May 2023, which states that it is designed to bolster the US’s leadership and competitiveness in standards development, explicitly cites the need to counter the efforts of certain strategic competitors, including China, that “seek to undermine the integrity of longstanding standards development processes” to reinforce their own market and standards dominance, among other priorities. Building upon that strategy, a Request for Comment filed by the USPTO, NIST, and International Trade Administration (ITA) on September 11 casts an even wider net in a series of 12 questions posed to stakeholders. Topics covered include whether other countries’ SEP policies have negatively impacted the US’s ability to participate in international standard-setting and US companies’ ability to license SEPs; and whether the US’s current FRAND policies would foster US innovation and competitiveness, or whether those followed by other countries could serve as a model. Stakeholders are also asked to weigh in on what are the proper incentives to encourage innovation, ways the Department of Commerce can facilitate the resolution of FRAND disputes, and other actions it might take on these and other issues.

For more on this new standards policy debate, including commentary from stakeholders in response to the Request for comment, see RPX Insight.

Patent Market Update: More Intrigue over BlackBerry Patent Sale; Taction’s Funder Narrowly Avoids Sanctions; Arizona Rules Allowing Nonlawyer Ownership of Law Firms Eyed by Lit Fin Industry

BlackBerry Patent Sale Spawns More Litigation, This Time from Tech+IP

BlackBerry’s divestment of substantially all of its non-core patents assets to Malikie Innovations Limited may be in the rearview, the transaction having closed in May of this year, but the deal has continued to spark new litigation: first from Catapult IP Innovations, Inc., which failed to complete its earlier attempt to buy the BlackBerry portfolio; and then, during Q3, from Tech+IP Advisory, which was hired to facilitate BlackBerry’s patent sale.

In July, RPX flagged the voluntary dismissal of Catapult’s Eastern District of Virginia case, which had sought to compel Malikie to participate in an arbitration against BlackBerry to unwind the transaction. In-depth coverage of that suit is available here.

Still ongoing, however, is litigation brought by Tech+IP, which claims that it is owed payment for the years of work its personnel put into the sale of BlackBerry’s portfolio. According to Tech+IP’s complaint, the firm’s sole compensation for its work was a “success-based fee, calculated as a percentage of the value of a completed patent sale”—and not tied to any specific buyer. Further, it claims that as a result of its efforts and the patent sale to Malikie (which it reports keeping warm, at BlackBerry’s request, while the Catapult IP deal dragged on), BlackBerry has recognized revenues of $218M; yet, BlackBerry has refused to compensate Tech+IP for its services rendered in connection with that transaction.

BlackBerry argues that the transaction fee was to be paid to Tech+IP only if a deal with a “Contacted Party”, as defined by the Tech+IP and BlackBerry advisory agreement, closed either during the term of that agreement or within [redacted] months after the expiration or termination of that agreement. BlackBerry also refutes Tech+IP’s claims as to an oral extension of the agreement, pointing to the agreement’s alleged “no-oral modification clause”.

In its coverage of this dispute, IAM pointed out that there are “bigger strategic moves” playing out at BlackBerry, which in May announced that its board was considering “various strategic alternatives to drive enhanced shareholder value”. Those alternatives, said BlackBerry, might include “the possible separation of one or more of BlackBerry’s businesses”.

Meanwhile, in August, Reuters reported that BlackBerry had received a takeover bid from New York City-based private equity firm Veritas Capital. Neither company has publicly acknowledged the bid as of the publication date of this blog post.

Taction’s Litigation Funders Avoid Sanctions, but Apple Awarded Summary Judgment and Moves for a $5M Award

Q3 saw good news for Taction Technology, Inc.’s litigation funders—i.e., Burford Capital and two special purpose vehicles associated with the litigation finance firm—which skirted sanctions threatened by a California magistrate judge. However, that upside was tempered by Southern District of California Judge Todd W. Robinson’s grant of summary judgment of noninfringement, bringing the case against Apple to an end, at least for the moment, and making it less likely that the funders will see a return—at least for the time being.

Since then, Apple has filed a motion seeking $4.5M in attorney fees plus nearly $450K in expert expenses to cover the price tag of continuing to litigate the case beyond the court’s late September 2022 claim construction order, which, per Apple, contained a ruling that “gutted [Taction’s] infringement theory across every asserted claim”.

This October was to have seen a trial over Apple’s alleged infringement of claims from the two asserted patents, which name S. James Biggs, Taction’s founder and CTO, as their sole inventor and which concern “tactile transducers that produce bass frequency vibrations for perception by touch”. Taction targeted the provision of iPhones and Apple Watches that implement haptic technology. Per Apple, as soon as the court limited all asserted claims to transducers with “highly damped output”, Taction should have ended the case to take up an appeal.

Taction pressed forward, among other things, bringing forward new infringement theories via expert report that the court struck in August when it granted Apple summary judgment of noninfringement. Apple’s motion for attorney fees points to other aspects of the court’s Markman order that were problematic for Taction, as well as to Taction’s attempt to amend its complaint to add marking allegations in a motion that the court denied as both “untimely and futile”. Should the court grant Apple’s motion to deem this case exceptional, it plans to submit detailed billing records to justify the requested shift of attorney fees ($4.5M) and reimbursed expert expenses ($444K).

Meanwhile, Taction’s litigation funders (the identity of which are explored here) will have to sit tight with respect to any monetary return on their investment in the case.

As expected, Taction has filed an appeal. RPX members can dig into the background of this extensively contested case, including the events leading up to Magistrate Judge Burkhardt’s order to show case, here.

Owner of Alternative Business Structure PatentVest Is Now Trading on the NASDAQ

Shares of IP-focused investment company MDB Capital Holdings began trading on the NASDAQ in late Q3—a development of particular interest to those following the evolution of Arizona’s Alternative Business Structure program, under which nonlawyers can own and operate law firms in that state. MDB is the corporate parent of patent database and search company PatentVest, Inc., which earlier this year received approval from Arizona’s Committee on Alternative Business Structures to become an “end-to-end law firm”.

Formed in 1997, MDB Capital is a Dallas-based investment company; it reports having taken 16 companies public to date, including VirnetX Holding Corporation (the licensing arm of which has spent years litigating against each of Apple and Cisco, among others).

RPX flagged public filings and investor presentations indicating that MDB Capital was intending to go public in September; shares of the company began trading on the NASDAQ on September 21, raising $19,999,992.

According to MDB, it has two wholly subsidiaries: Public Ventures, LLC, a members-only fundraising platform for venture and growth stage companies); and Patentvest, Inc., which started as a proprietary patent database and search solution.

In September of last year, Arizona’s ABS committee opened the door for PatentVest to practice law while still being 100% owned by MDB Capital.

Arizona Alternative Business Structures: The Basics

A version of Rule 5.4 of the American Bar Association Model Rules of Professional Conduct, which bars nonlawyer ownership of law firms and also prohibits fee-sharing with nonlawyers, is in effect in nearly every state in the US.

However, Arizona’s version of Rule 5.4 was abolished by that state’s supreme court (effective January 1, 2021), allowing for the formation of alternative business structures (ABS) in Arizona—and making Arizona the only state in the country, according to Forbes, “to eliminate its 5.4 rule entirely and allow lawyers to share fees with anyone, including paralegals on staff, marketing professionals, business development managers and others that refer clients to a law firm”.

An ABS is defined by Arizona law as…

…a business entity that includes nonlawyers who have an economic interest or decision-making authority in a firm and provides legal services in accord with Supreme Court Rules 31 and 31.1(c). According to the Task Force on the Delivery of Legal Services, the purpose of the ABS program is “rooted in the idea that entrepreneurial lawyers and nonlawyers would pilot a range of different business forms” that will ultimately improve access to justice and the delivery of legal services. Complaints against Alternative Business Structures are received, investigated, and prosecuted by the State Bar of Arizona in the same manner as complaints against lawyers.

Arizona’s Committee on Alternative Business Structures, which is currently chaired by the Honorable Scott Bales (former Chief Justice of the Arizona Supreme Court) plus ten other “retired judges, lawyers, and business people”, reviews applications for ABS licensure and recommends to the Arizona Supreme Court, which in return issues ABS licenses that are subject to annual renewal.

In March of this year, Bloomberg reported that Arizona’s ABS program had approved 40 businesses to practice law; according to a directory published by the program, as of July (when the directory was last updated), that number had grown to 52. Meeting minutes posted by the committee signal that there is a steady pipeline of entities applying for licensure.

Rule 5.4 Reform in Other States

According to the American Bar Association, alternative business structures have been allowed in Australia, the UK, and other nations for several years, but they have historically been prohibited in the US. A notable exception, however, is Washington, DC, which in 1991 modified its version of Rule 5.4 to allow lawyers to form partnerships or other organizations in which nonlawyers have a financial interest—as partners or otherwise—so long as specified conditions are met.

In addition, in 2020, the Utah Supreme Court issued a standing order (effective August 14, 2020) that established a “regulatory sandbox”, in which law firms may operate without prohibitions on nonlawyer ownership. That order has been amended twice, most recently in September 2022, and the program is set to continue until at least 2027.

Meanwhile, Bloomberg reports that some states, including Connecticut, Michigan, and North Carolina, are observing how the reform plays out in Arizona and Utah and are considering their own changes to law firm ownership regulations. However, California “went the other direction” last year, with Governor Gavin Newsom signing a law “that essentially barred the state from moving forward with its own sandbox”.

Litigation Finance Firms Are Watching, and Making Moves, Too

Bloomberg also reports that prominent litigation finance firms like Burford Capital and Longford Capital (both of which are particularly active in the patent space) “have expressed interest in taking advantage of Arizona’s revised rules”.

Indeed, the ABS Committee recently reviewed—and recommended for approval—an application for ABS license submitted by the CEO of a litigation finance firm. RPX members can get the full details here.

Additional RPX Patent Market Intelligence

For further analysis and up-to-date information on patent litigation and market trends, visit RPX Insight.