Q3 in Review: Patent Litigation Swings Upward as SEP Owners Benefit from Major Rulings

October 13, 2020

As the US continues to contend with COVID-19, patent disputes remain relatively unaffected—even increasing despite the ongoing pandemic.

In particular, the number of defendants named in district court filings skyrocketed in the third quarter, although a majority of the increase was caused by an unprecedented spike in cases asserting only design patents. But even excluding those cases, patent litigation was up by nearly 4% compared to the same quarter last year. Some of the nation’s top patent venues also resumed jury trials in Q3, including one Texas case that recently produced a notable infringement verdict.

The Patent Trial and Appeal Board (PTAB), furthermore, saw pushback over recent rule changes that allow the Board to consider the status of parallel district court litigation in deciding whether to institute an America Invents Act (AIA) review—potentially narrowing the window during which defendant-petitioners may file such validity challenges. Meanwhile, the US Supreme Court has denied yet another petition challenging the application of Alice as Section 101 invalidation rates hover at post-Berkheimer levels.

Owners of standard essential patents (SEPs), moreover, benefited from several favorable developments among the world’s most important IP jurisdictions. On the domestic front, the US Department of Justice has argued with increasing success against the application of antitrust law against licensors in fair, reasonable, and non-discriminatory (FRAND) patent licensing disputes. SEP owners may also begin to seek out the UK as a patent venue more frequently after that country’s Supreme Court ruled that UK courts may set global FRAND rates, while Germany’s top court imposed a higher bar on implementers in SEP disputes. Moreover, Chinese courts issued the country’s first anti-suit injunctions, a key procedural tool already in use in other top jurisdictions.

Finally, the patent space continued to see the impact of litigation finance as even more plaintiffs filed patent suits with outside backing—while others have geared up to do so. Intellectual Ventures LLC has also continued to cast a long shadow—both by filing more of its own litigation and by fueling other NPE campaigns through the divestiture of its patents. In addition, operating company patents continued to make their way into NPE hands, triggering even more new filings and teeing up additional future campaigns.

Litigation Update: Design Patent Litigation Spikes, While Other Patent Litigation Trends Upward

COVID-19 Update: First Patent Jury Trials During Pandemic Held in East and West Texas

Market Sector Update: Automotive, Medical, and Networking Litigation Outpaces 2019

PTAB Update: CBM Review Program Sunsets as Tech Companies Challenge Discretionary Denial Rule

Section 101 Update: Supreme Court Declines to Revisit Alice as Berkheimer Dip Persists

FRAND Update: DOJ’s Policy Advocacy Bears Fruit as Top FRAND Jurisdictions Expand SEP Jurisprudence

Back to topLitigation Update: Design Patent Litigation Spikes, While Other Patent Litigation Trends Upward

Most analyses of patent litigation have generally not focused on cases asserting primarily design patents. The reason is mainly twofold: NPEs rarely, if ever, assert design patents, while most operating company patent disputes involving technology typically do not depend on such assets. Moreover, purely design patent cases have historically accounted for a relatively small share of overall filings.

However, the third quarter of 2020 was a notable exception to that trend. While 2,466 defendants were added to patent litigation campaigns in Q3 (with no filter by patent or plaintiff type), more than double the prior-year period, RPX data reveal that this increase is largely the result of a dramatic spike in defendants added to campaigns asserting only design patents. These cases account for 67.8% of all defendants added in the quarter. This quarterly share is much higher than in recent years: since Q1 2018, the number of defendants added to pure design patent campaigns has ranged from 2.3% to 17.8% of total patent litigation—a significant amount at the upper end, but well below Q3.

Pulling back to a yearly view of district court litigation data, we can see that pure design patent cases account for 42% of all patent litigation filed in 2020 to date.

It is also important to recognize that just a handful of plaintiffs are responsible for the massive spike in design patent cases observed in the third quarter. In particular, two companies account for 73% of design patent defendants added in Q3: Deckers Outdoor, which added 776 defendants (or 39% of the Q3 total); and EssilorLuxotica (Oakley), which added 716 defendants (or 36%). While many of the docket entries in campaigns from those two defendants are sealed, they generally appear to target alleged purveyors of counterfeit products (footwear and sunglasses, respectively).

Excluding cases asserting only design patents, the data show that the numbers still rose in the third quarter compared to the same period last year: 795 defendants were added to patent campaigns in Q3 2020, an increase of 3.9% over Q3 2019 (during which 765 defendants were added), though filings decreased by 22.4% from Q2 2020 (during which 1,024 defendants were added). Third-quarter 2020 filing levels were below the Q3 2016-2019 average by 8.9%.

For their part, NPEs were responsible for 65.3% of the patent litigation filed in Q3 2020, adding 519 defendants, beating the trailing Q3 average by 2.6%. NPEs filed 5.5% more litigation than in the third quarter of 2019 (during which they added 492 defendants) and 16.7% less than in Q2 2020 (during which they added 623 defendants).

Meanwhile, operating companies accounted for 34.7% of the patent litigation filed in Q3, adding 276 defendants, 24.8% less than the Q3 2016-2019 average. Operating companies brought 1.1% more litigation than they did in Q3 2019 (during which they added 273 defendants) but 31.2% less than in Q2 2020 (during which they added 401 defendants).

| Defendants Added | Change Compared to: | ||||

| Q3 2020 | Q3 2019 | Q3 2016-2019 Average | Q2 2020 | ||

| NPE | 519 | +5.5% | +2.6% | -16.7% | |

| Operating Company | 276 | +1.1% | -24.8% | -31.2% | |

| Total | 795 | +3.9% | -8.9% | -22.4% | |

Note: Unless otherwise specified, the patent litigation trends discussed in the remainder of this report do not include pure design patent cases.

Venue Update: West Texas Remains the Top District Overall, While Design Patent Plaintiffs Flock to Northern Illinois

Applying the same filter as in the above filing trend analysis (excluding pure design patent cases) to a breakdown of the top patent venues for Q3 reveals that the Western District of Texas remains the most popular venue for overall patent litigation (i.e., with no filter for plaintiff type) and for litigation filed by NPEs, also rising to second place for operating company litigation. The District of Delaware, meanwhile, was the top operating company venue and the number-two district for both overall and NPE litigation. The Eastern District of Texas—the favored venue of NPEs prior to the Supreme Court’s decision in TC Heartland—took third place for overall and NPE litigation but was in fifth place for operating company litigation.

Meanwhile, an analysis of pure design patent cases (again, excluded from the immediately preceding analysis and the graph below) reveals that nearly all of that litigation (94%) has been filed in the Northern District of Illinois. All other districts saw very few defendants added to pure design patent cases; the Southern District of New York, for instance, held a distant second place with just 32 defendants added.

COVID-19 Update: First Patent Jury Trials During Pandemic Held in East and West Texas

Among the more closely watched distinctions between the top districts has been their handling of jury trials—specifically, whether courts would proceed with in-person jury trials despite the ongoing COVID-19 pandemic.

As detailed in a recent RPX analysis, the most popular patent venues have taken different approaches, with the Western and Eastern Districts of Texas giving judges certain levels of discretion over whether to proceed with jury trials. August saw District Judge Rodney Gilstrap hold the nation’s first such trial since the start of the pandemic in litigation between subsidiaries of PanOptis Holdings, LLC and Apple, leading to a $506.2M infringement verdict. District Judge Alan D. Albright of the Western District of Texas has now followed suit, greenlighting the resumption of patent jury trials in his district in late September—citing declining local COVID-19 infection rates—and beginning his district’s first such trial on October 5 in litigation between inventor-controlled MV3 Partners LLC and Roku. The proceeding is also Judge Albright’s first patent jury trial since he took the bench in late 2018.

Other top patent districts may soon follow suit. In mid-September, the District of Delaware entered the second phase of its reopening plan, under which jury trials are allowed subject to a detailed set of safety guidelines. Additionally, the Northern District of California’s district-wide continuance of all civil trials expired on September 30, clearing the way for patent trials to resume there as well. Currently, the only venue in the top five not to restart civil jury trials is the Central District of California, where such trials remain postponed indefinitely.

Market Sector Update: Automotive, Medical, and Networking Litigation Outpaces 2019

RPX data show that NPE patent litigation hitting the Automotive market sector remains well above levels observed last year, having risen by 131% in Q1-Q3 2020 compared to the same period last year. Earlier this year, as detailed in RPX’s second-quarter review, a number of notable plaintiffs launched automotive campaigns that continue to see new cases, including one launched by 21ST CENTURY GARAGE LLC over patents divested from Intellectual Ventures LLC. As the third quarter came to a close, prolific monetization firm IP Edge LLC joined the fray through affiliated plaintiff Inspire Licensing LLC, initiating a campaign targeting connected car cybersecurity technology and systems for monitoring automotive manufacturing.

Other sectors that have seen an increase in litigation this year so far include Industrial and Medical, both of which saw a 50% uptick, with growth also observed in sectors such as Networking (42%), Biotech and Pharma (38%), and E-Commerce and Software (21%). The sectors that declined the most, meanwhile, were Media Content and Distribution (which decreased by 30%) and Consumer Electronics and PCs (which went down by 25%).

PTAB Update: CBM Review Program Sunsets as Tech Companies Challenge Discretionary Denial Rule

In the third quarter of 2020, 461 petitions for America Invents Act (AIA) review were filed with the Patent Trial and Appeal Board (PTAB), including 440 petitions for inter partes review (IPR), nine petitions for covered business method (CBM) review, and 12 petitions for post-grant review (PGR). The overall number of AIA review petitions filed in Q3 was 21.3% higher than the previous quarter, during which 380 petitions for AIA review were filed—the third quarterly increase in a row, following four quarters of relatively flat activity.

The nine CBM review petitions filed in Q3 are possibly the last of their kind for the foreseeable future, as the CBM review program expired by statute on September 15, 2020. However, a coalition of companies from certain industries—including banks, which the program was particularly designed to help, as well as retailers—are reportedly pushing Congress for a temporary extension of the program.

A more broadly impactful change has been a pair of PTAB decisions designated as precedential by the Board’s Precedential Opinion Panel (POP): one issued in NHK Spring v. Intri-Plex Technologies (IPR2018-00752), designated in May 2019; and the other in Apple v. Fintiv (IPR2020-00019), designated in May 2020. The two decisions together establish a six-factor test—collectively referred to as the NHK-Fintiv rule—under which the PTAB may deny institution of an AIA review petition based on the status of a parallel district court case.

Among the most significant of these factors is one that allows the Board to consider the proximity of a scheduled district court trial date to the date by which the AIA review final written decision is due. This consideration is particularly impactful for defendants considering a PTAB challenge after having been sued in those venues that move more quickly. Such defendants wishing to avoid a discretionary denial by the PTAB under the NHK-Fintiv rule may therefore find themselves in a race of sorts against the district court’s trial date to file a PTAB petition. This race to file might be particularly pronounced in the Western District of Texas, which as mentioned above is now the most popular patent venue; there, District Judge Alan D. Albright has touted his district’s fast time to trial as a selling point to attract plaintiffs to his district.

As recently reported by RPX, a coalition of tech companies have sued USPTO Director Andrei Iancu to challenge the NHK-Fintiv rule, arguing that it violates the AIA, is arbitrary and capricious, and is procedurally unsound, not having been “adopted through notice-and-comment rulemaking” under the Administrative Procedure Act (APA).

Section 101 Update: Supreme Court Declines to Revisit Alice as Berkheimer Dip Persists

The US Supreme Court handed defendants a major defensive tool through its landmark 2014 Alice decision, but the nation’s highest court has stepped back as the Federal Circuit has nudged the pendulum in favor of patent owners. In particular, the Supreme Court has repeatedly denied certiorari for a series of petitions challenging various aspects of the Alice test and decisions applying it—most recently, declining on October 5 to revisit the Federal Circuit’s controversial ruling in Chamberlain Group v. Techtronic Industries, commonly referred to as the “garage door” case.

In that decision, the Federal Circuit invalidated a patent claiming a smart garage door opener as unpatentably directed to the abstract idea of “wirelessly communicating status information about a system”, but the patent owner had argued in its petition that the court erred by distilling the patent to “a single supposed point of novelty” rather than considering the claims as a whole—allegedly leading courts taking this approach to nullify “concrete and specific” inventions. Senator Thom Tillis (R-NC), the chair of the Senate IP Subcommittee, has argued that the decision highlights the need for Section 101 reform, stating that “nothing better demonstrates the madness” of how courts have applied Alice.

As always, it remains unclear whether the Supreme Court will continue to avoid wading into the Section 101 debate once again—but for her part, Federal Circuit Judge Kathleen M. O’Malley recently remarked that she does not think the Supreme Court has “any stomach” to take on such a case.

These latest developments follow the Court’s January 2020 decision not to review the Federal Circuit’s 2018 rulings in Berkheimer and Aatrix, which have arguably done the most of any subsequent appellate decisions to limit the practical applicability of Alice. In those cases, the Federal Circuit held that courts may not grant early dismissal under Alice when a patent owner establishes a material factual dispute over a patent’s inventiveness.

The result has been a significant drop in Alice invalidation rates, which stood at around 67% before Berkheimer but have now dropped to 43% for decisions issued since Berkheimer and through Q3.

A breakdown of this data by procedural stage shows that Rule 12 and summary judgment—by far the two most common avenues for Section 101 challenges—both remain similarly affected by Berkheimer, each decreasing by about the same amount as the overall invalidation rate. Post-Berkheimer decisions issued through Q3 and under Rule 12 resulted in a 45% invalidation rate, up slightly from Q2 (compared to 70% pre-Berkheimer), while summary judgment stayed at 38% (compared to 58% before Berkheimer).

Additionally, per RPX data, plaintiffs are still much less successful when trying to block an Alice ruling at the Rule 12 stage than at summary judgment. Limiting the analysis to decisions that turned on Berkheimer or Aatrix, meaning a plaintiff asserted that a factual issue precluded early resolution and the court’s order actually addressed that issue, courts found sufficient facts to rule about 48% of the time for Rule 12, or 92 of the 192 patents challenged at that stage (down slightly from 50% as of the end of Q2).

In contrast, for summary judgment decisions turning on Berkheimer, courts found that they had sufficient facts to move forward just 30% of the time (or just eight patents out of 27)—though all eight of those patents saw claims invalidated. This datapoint has remained the same since Q1, as none of the handful of Alice summary judgment rulings that issued in Q2 and Q3 turned on Berkheimer.

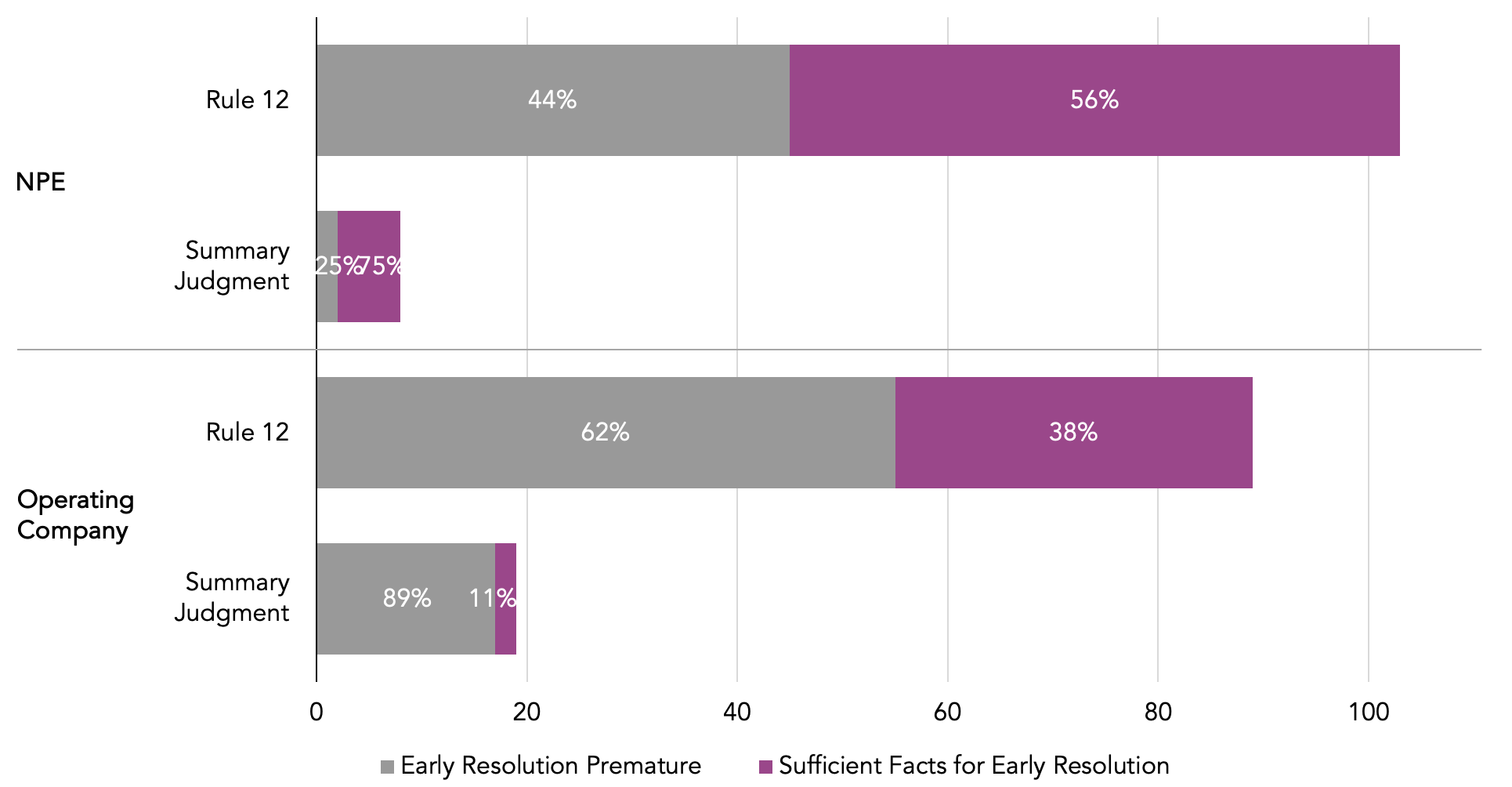

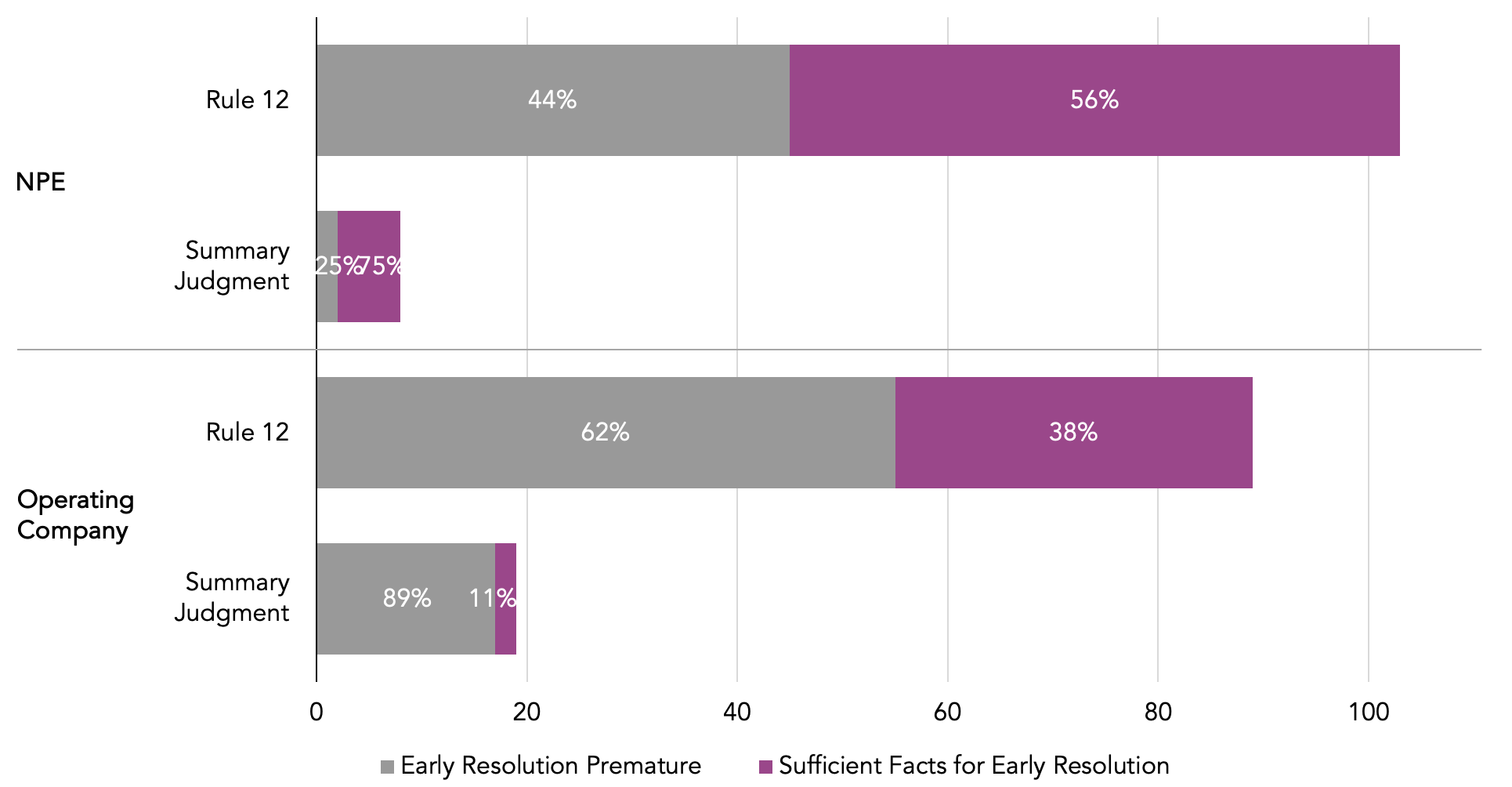

Furthermore, breaking this analysis down by plaintiff type shows that NPEs are still significantly less successful than operating companies at blocking Rule 12 challenges under Berkheimer/Aatrix, with courts finding sufficient facts to issue a ruling 56% of the time for motions against NPEs but 38% of the time for those against operating companies. NPEs fare even worse at the summary judgment stage, as courts found sufficient facts to rule in 75% of Alice summary judgment motions against NPEs—whereas for summary judgment motions against operating companies, courts found sufficient facts just 11% of the time.

Overall, since the Alice decision’s June 2014 issue date and through the end of Q3 2020, 58% of patents have had claims invalidated under its rationale. Alice outcomes diverge based on plaintiff type; while operating company patents have an Alice invalidation rate of about 49% during that period, around 65% of NPE patents had claims invalidated.

Limiting the timeframe to 2020 through the third quarter reveals that NPE and operating company patents have fared quite differently from one another under Alice. While 60% of NPE patents adjudicated under Alice in that period had all claims invalidated, just 17% of operating company patents had claims invalidated. Nonetheless, it is important to acknowledge the effect that individual orders can have on a dataset like this one for an analysis considering a more limited window of time, especially since courts often address multiple patents in a single ruling. In this instance, the numbers for 2020 thus far include a pair of decisions from earlier in the year that each addresses a relatively large cluster of patents; these orders impact the 2020 numbers to a greater extent than they would have for a larger sample size.

FRAND Update: DOJ’s Policy Advocacy Bears Fruit as Top FRAND Jurisdictions Expand SEP Jurisprudence

The third quarter of 2020 saw a series of important developments impacting the licensing of standard essential patents (SEPs) in some of the world’s top patent jurisdictions.

The US

The US, for its part, continued to see the impact of a shift in the policy of the Department of Justice (DOJ) toward fair, reasonable, and non-discriminatory (FRAND) patent licensing. Since 2017, the DOJ’s Antitrust Division, led by Assistant Attorney General Makan Delrahim, has reassessed its posture toward antitrust enforcement in SEP disputes, arguing that such disputes should be handled under contract law, not antitrust; placing more emphasis on implementer hold-out (which occurs when a potential licensee declines to take a license to a SEP, forcing the patent holder to turn to litigation) rather than patent owner hold-up (the assertion of a SEP to gain an unduly high license rate); and favoring the availability of injunctive relief in SEP disputes (a remedy previously deemed anticompetitive in this context).

The DOJ has advocated for this policy shift through multiple channels, including through coordinated outreach to industry associations in Q3. On September 10, Delrahim took what he acknowledged to be the “extraordinary step” of urging the Institute of Electrical and Electronics Engineers (IEEE), a standard-setting organization (SSO), to make several changes to its patent licensing policy—in part, asking it to relax its prohibition on patent owners seeking injunctive relief and to revisit its recommendation that the smallest saleable patent practicing unit (SSPPU) be used as the basis for a reasonable royalty. The DOJ has also pushed its SEP goals in the courts by filing briefs in existing litigation—a strategy that saw some recent success in the third quarter, with the Ninth Circuit adopting the DOJ’s viewpoints in its August reversal of the Northern District of California’s FTC v. Qualcomm decision. Additionally, in early September, a Texas judge adopted the DOJ’s positions in an order dismissing with prejudice an antitrust lawsuit filed by automotive supplier Continental against Internet of Things patent pool operator Avanci, LLC.

The UK

Meanwhile, courts in other key SEP jurisdictions made significant new rulings on FRAND licensing in the third quarter. In the UK, the country’s Supreme Court issued a landmark decision on SEP licensing on August 26, holding that UK courts have the jurisdiction to impose global licenses for multinational patent portfolios and determine what terms would be FRAND. In that opinion—resolving appeals in Unwired Planet v. Huawei and two other cases—the court ruled that it has the authority to resolve licensing disputes over portfolios including non-UK assets because those disputes turn not on patent law but on contract law, since a patent owner’s FRAND commitments stem from contractual agreements made to SSOs. Stakeholders have raised the possibility that this decision may encourage forum shopping, arguing that plaintiffs with multinational SEP portfolios may increasingly litigate FRAND licensing disputes in the UK as a result.

Germany

Another important ruling came in Germany, where the Federal Court of Justice (Bundesgerichtshof) established, in its written opinion in Sisvel v. Haier in early July, a series of criteria concerning the conduct expected of patentees and implementers during negotiations in SEP licensing disputes. The decision imposed a higher bar for accused infringers hoping to show that their prior licensing behavior had been FRAND-compliant, with the court explaining that defendants must go well beyond merely stating their willingness to take a FRAND license. The court also laid out additional requirements and guidelines for patent owners—in part, stating that portfolio licenses do not violate antitrust law, under certain conditions, and can be global in scope. Stakeholders have interpreted the decision as largely favoring SEP owners; should it survive a pending constitutional challenge from Haier, it could serve to strengthen Germany’s position as the most popular destination for SEP litigation in Europe.

China

Moreover, Chinese courts have continued to expand the country’s body of FRAND jurisprudence, potentially further encouraging of Chinese courts as SEP venues. In September, the Supreme People’s Court reportedly granted China’s first anti-suit injunction, a measure commonly used by US and European courts to block parallel litigation in other countries. The court’s decision reportedly barred Conversant Wireless Licensing S.à r.l. from enforcing a German injunction against Huawei. Weeks later, the Wuhan Intermediate People’s court imposed an even broader anti-suit injunction against InterDigital, Inc. in litigation against Xiaomi, barring the NPE from seeking injunctive relief or the determination of a FRAND licensing rate as to the relevant patents in China or any other jurisdiction.

Marketplace Update: Litigation Finance, IV Divestitures, and Operating Company Assets Drive NPE Filings

Despite the broader economic downturn caused by COVID-19, NPEs continued acquiring and asserting patents throughout the third quarter—including some plaintiffs with prominent financial backing and others wielding patents with notable pedigrees.

Third-Party Funders Continue to Fuel New Litigation

As previously reported by RPX, a trio of Irish NPEs—Data Scape Limited, Neodrón Limited, and Solas OLED Limited—have launched campaigns with the backing of Magnetar Capital, a hedge fund currently reporting $12.1B in assets under management. Public records now reveal a growing roster of other Irish entities linked to Magnetar: in addition to Sonraí Memory Limited, an entity flagged by RPX earlier in 2020, two newly identified entities also share the same management—Arís Technologies Limited and Scramoge Technology Limited. While the latter two have not yet received patents—at least, according to currently available assignment data—Sonraí has acquired at least two sets of patents this year, one from Microchip in February 2020 and the other from HP Enterprise (HPE) in April. Sonraí has since farmed out some of its patents to still another Irish NPE, Arigna Technology Limited, leaving both in a position to launch new litigation.

Meanwhile, a familiar name among publicly traded NPEs—ParkerVision, Inc.—has further expanded its long-running, third-party funded Wi-Fi campaign with a new suit against Hisense. In February 2016, ParkerVision reported receiving $10M from litigation funder Brickell Key, and SEC filings indicate that the NPE has since received additional backing from the firm, including funds earmarked for ParkerVision’s enforcement campaign in Germany. As recently reported by RPX, public records also confirm that ParkerVision has received at least $200K from the US government’s Paycheck Protection Program, a financial assistance program meant to aid small businesses in the wake of COVID-19.

Intellectual Ventures Files New Litigation, While Other NPEs Assert Divested Patents

In April 2017, Intellectual Ventures LLC (IV) announced that it would wind down its last remaining fund and focus instead on monetizing existing assets. IV has since dramatically reduced its own litigation efforts following years of mixed results, although 2020 has seen the NPE file several new patent cases.

After filing just one district court case in 2019, IV has brought a trio of new lawsuits in 2020, starting with a March case against Dell (VMware) over various products related to virtualization and cloud computing. IV then filed two additional cases in the third quarter: one against HP, targeting printing technology; and the other against Arista Networks, focusing on networking products and services.

RPX data indicate that since 2016, NPEs have collectively launched over 80 separate litigation campaigns asserting patents received from IV. The third quarter of 2020 saw a variety of NPEs do so, including Kioba Processing, LLC—one among a group of NPEs controlled by Atlanta-based monetization firm IPInvestments Group LLC (d/b/a IPinvestments Group) that collectively received over 3,500 US assets from IV in 2019. Kioba Processing began a campaign in July targeting the financial services industry and filed additional litigation in August and October.

Among the other plaintiffs that also recently began asserting IV divestitures was Shamrock Innovations, LLC, which in late July launched a campaign targeting Serial ATA technology. Additionally, Liberty Patents LLC, an NPE with ties to several other litigating plaintiffs, began targeting a wide range of computing products in early September over former IV patents originating with Conexant Systems (f/k/a Rockwell Semiconductor), SmartPower, and Lite-On. One of those other litigating plaintiffs linked to Liberty Patents is American Patents LLC, which throughout the third quarter added several defendants to an ongoing campaign asserting IV patents—targeting mobile devices—that it launched in 2018.

The string of NPEs asserting patents received from IV continues, with Dominion Harbor Enterprises, LLC (through Vista Peak Ventures LLC) adding more cases in July to its campaign over former NEC patents; BCS Software LLC adding more cases to its web-based software campaign in July and August; and 21ST CENTURY GARAGE LLC adding Mazda to the automotive campaign it began in May. The list further includes Longhorn HD LLC, which in early August filed new cases in the network security campaign it launched over IV assets last year, and Cedar Lane Technologies, Inc., which has continued to add cases to its first, sprawling campaign asserting former IV patents, which passed the sixty-defendant mark in July.

Cedar Lane is one of several NPEs apparently poised to launch even more litigation over former IV assets, as it acquired 93 US assets directly from IV, as well as counterparts in Asia, Europe, and elsewhere, earlier this year. Another such NPE is Display Vectors, LLC, to which IV transferred a portfolio of 54 US assets in late 2019, an assignment not recorded until July. That as-yet-unasserted portfolio includes assets originating with Chungwa Picture Tubes, Industrial Technology Research Institute, IBM, Motorola, Olympus, Polaroid, Rockwell Automation, Samsung, or Sanyo. Display Vectors is linked to more than ten litigating NPEs, including several that recently launched their first campaigns: Digiframe Frame Technologies, LLC (targeting digital photo frames); Script Transform LLC (focusing on baby monitoring products); and Symmetrix Video Systems LLC (targeting videoconferencing platforms).

RPX has published a comprehensive report providing an overview of IV’s many entities—which include two patent plaintiffs, multiple investment funds, and thousands of shell companies—and the roles they play in its business today. It provides highlights of IV’s litigation history, including trials, and it also identifies the top NPE assignees of IV divestitures since January 1, 2016, with brief summaries of notable litigation resulting from those transactions. RPX members can download a copy of the report from RPX Insight here.

NPEs Keep Acquiring and Asserting Operating Company Patents

Operating company patents, meanwhile, have remained a driver of NPE litigation. In early September, Sun Patent Trust—an entity with a portfolio reportedly comprising over 3,000 patent assets providing “protection in North America, Europe and Asia”, filed its first US patent case over four wireless communications patents received from Panasonic. Additionally, prolific litigant IP Edge LLC has continued to assert former Xerox patents, having acquired yet another set of patents from the company—over 130 such assets—through affiliated entity Majandro LLC. Majandro has since moved those patents to sister entities Fusion IP LLC, Milestone IP LLC, Paradise IP LLC, and Realm Licensing LLC, each of which has subsequently filed litigation in August or September.

Assignment records also indicate that in July, IP Edge affiliate Magnolia Licensing LLC acquired over 700 US assets, and many more foreign assets, from Technicolor SA, a provider of services and products for the communication, media, and entertainment industries.

USPTO data further suggest that yet more NPEs holding former operating company patents are waiting in the wings, having acquired such assets in assignments recorded throughout Q3. Among them is Quarterhill Inc., which on the last day of the quarter announced that it had acquired a portfolio of patents from IBM through subsidiary Elpis Technologies Inc., after acquiring hundreds of other patents from the company earlier this year. Assignment records released this past quarter also reflect two April 2020 transfers from Huawei to Crystal Clear Codec LLC, an NPE with ties to litigating entity EVS Codec Technologies, LLC. Acacia Research Corporation appears to have operating company patents in its pipeline, too, having transferred this summer over 100 US assets—including patents acquired from L3Harris earlier in the year—to subsidiary Stingray IP Solutions LLC.

Additional RPX Patent Market Intelligence

For further analysis and up-to-date information on patent litigation and market trends, visit RPX Insight.