Q4 in Review: NPE Litigation Holds Steady in 2022 Despite Top Venue Headwinds

January 10, 2023

The story of patent litigation in 2022 was one of ongoing stability—at least, for NPEs. This past year, NPE filing levels were virtually the same as 2021, continuing a long-term trend, with Q4 unchanged as well. NPEs maintained that status quo despite upheavals in two of the nation’s top patent venues: a West Texas order that threatens the dominance of District Judge Alan D. Albright, and new disclosure requirements in the courtroom of Delaware Chief Judge Colm F. Connolly that have caused trouble for some familiar plaintiffs. However, operating company plaintiffs named 12% fewer defendants in 2022, a drop that was even steeper when excluding cases targeting generic drugmakers.

Meanwhile, the Patent Trial and Appeal Board (PTAB) saw a variety of significant changes this past year from USPTO Director Kathi Vidal, who hit the ground running after her April confirmation. At 2022’s close, Vidal characterized her reforms of the PTAB’s discretionary denial practices as promoting “certainty and clarity” as institution rates in America Invents Act (AIA) review trials continued to climb. Vidal also took increasingly pointed steps to deter misconduct in AIA reviews, imposing sanctions on a pair of third-party petitioners for abusing the inter partes review (IPR) process—and hinted that further PTAB reforms could come as soon as the end of Q1.

2022 was also a landmark year for issues related to standard essential patent (SEP) litigation. In the US, the Biden administration withdrew a pro-injunction SEP policy without replacing it, leaving a void that could be filled by a newly emboldened Federal Trade Commission (FTC). Courts in the UK have also continued to clarify rules on injunctive relief in litigation over fair, reasonable, and nondiscriminatory (FRAND) licensing, while the European Commission has pushed forward on its complaint against China over anti-suit injunctions (ASIs) in multinational SEP disputes.

Finally, NPEs continued to amass US patents throughout 2022, including several entities that began asserting their newly acquired assets in Q4—some with third-party backing. Investments kept pouring into the litigation finance industry last year, including some notable large fundraises focused specifically on patent litigation. As stakeholders debated disclosure requirements for funding sources, a prominent trade group also raised national security concerns over transparency into litigation funding.

RPX members are also exclusively invited to join a live RPX Community webinar covering highlights from this report. Live sessions are scheduled to accommodate US, APAC, and European time zones starting on January 12 (US); CLE credit may be available. Members can register on RPX Insight.

Litigation Update: NPE Filings Remain Stable as Operating Company Activity Dips

PTAB Update: Vidal Signals Further Changes Are Coming, Issues New Sanctions in Closely Watched Case

Litigation Update: NPE Filings Remain Stable as Operating Company Activity Dips

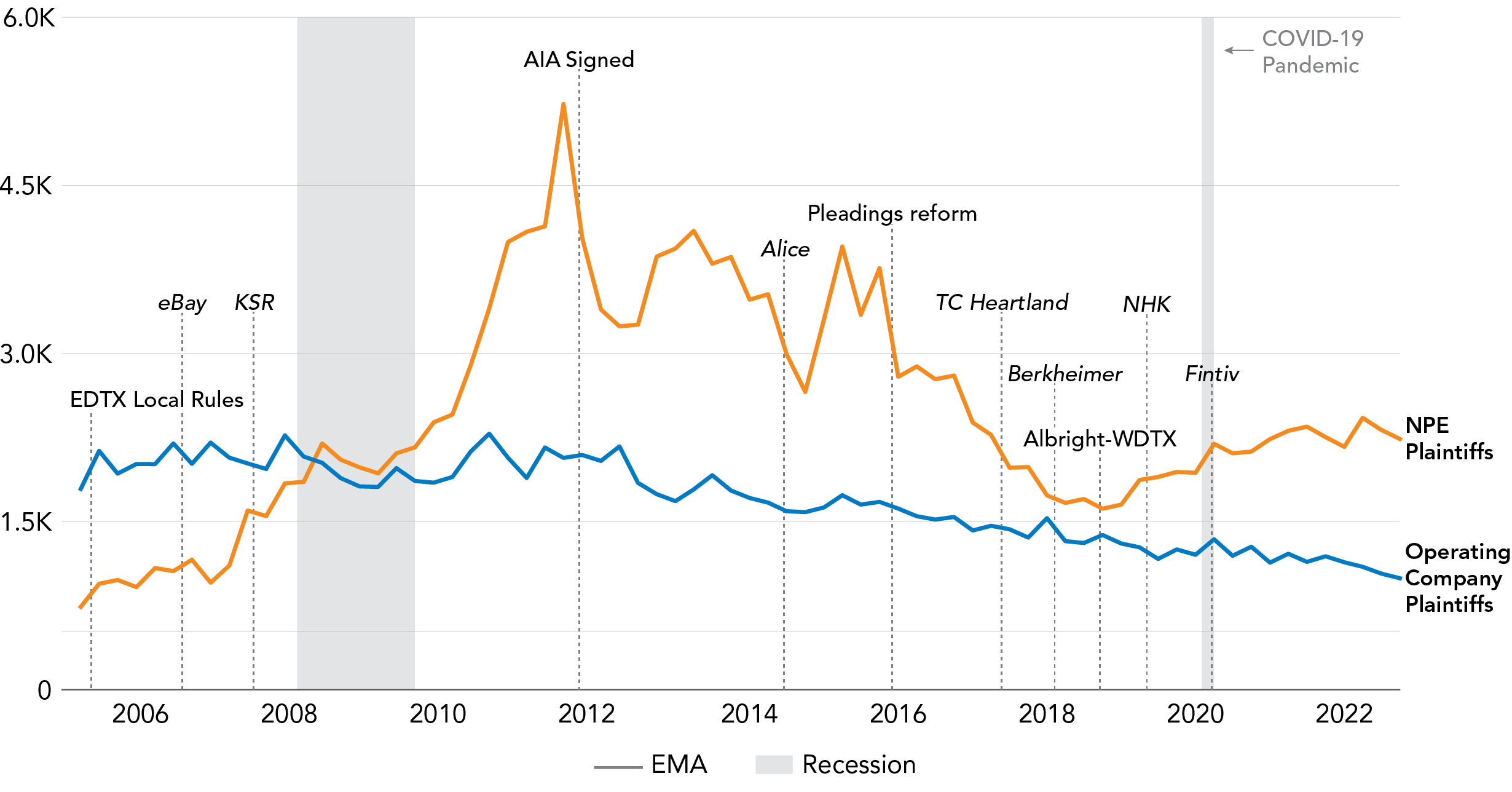

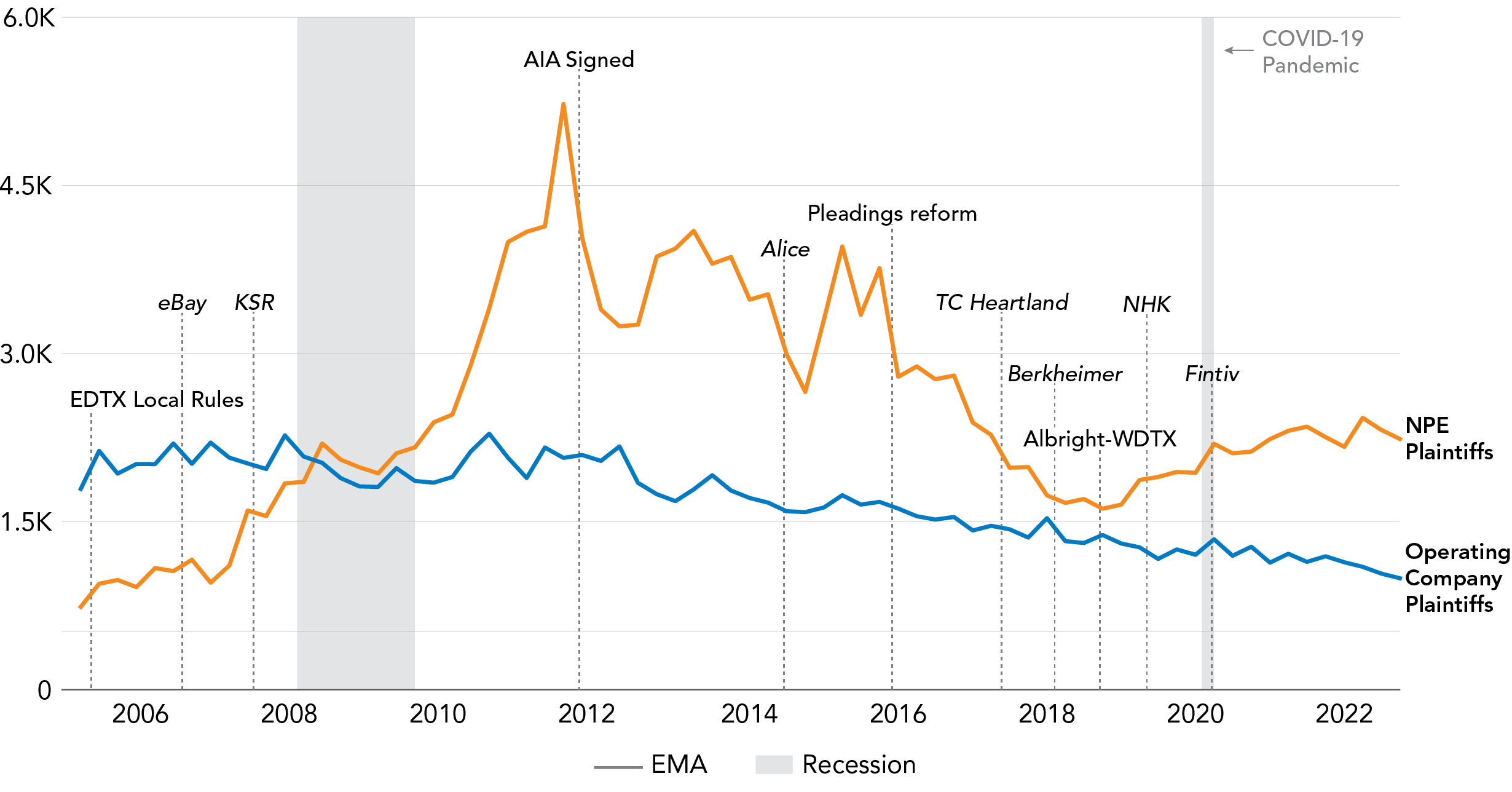

Despite notable events impacting NPE behavior in key venues, 2022 was practically a repeat of 2021 in terms of litigation volume—continuing the long-run trend under which such plaintiffs have named around 2,200 defendants per year since 2019. Long-term NPE filing levels are down from a 2011 peak and up from a 2018 nadir, but have generally been stable since. Following that low point in 2018, NPE litigation has increased by 40-45%, though half of that increase has come from plaintiffs associated with prolific monetization firm IP Edge LLC.

In contrast, operating company patent litigation—as previously reported by RPX—has remained on a gentle decline over the last 15 years, from approximately 2,000 defendants per year in 2005-2008 to around 1,000 for each of the past three years.

More specifically, NPEs added 2,290 defendants in 2022, down by 1% from 2021 and up by 7% from 2020. Operating companies added just over 1,000 defendants last year, which was 12% lower than 2021 and 20% less than 2020. As noted above, the operating company decline from 2021 was even sharper—at 16%—when excluding Abbreviated New Drug Application (ANDA) litigation.

Overall, 3,303 defendants were added to patent campaigns this past year, a 5% drop from 2021 and a 3% dip from 2020.

NPEs added 540 defendants to litigation campaigns in Q4 2022—matching the same quarter last year almost exactly, trailing Q3 by 2%, and exceeding the trailing fourth-quarter 2018-2020 average by 4%.

For their part, operating companies added 236 defendants in the fourth quarter, or about 24% less than the year-ago quarter, 5% lower than Q3 2022, and 28% less than the trailing quarterly average.

| Defendants Added | Change Compared to: | ||||

| Q4 2022 | Q4 2021 | Q4 2019-2021 Average | Q3 2022 | ||

| NPE | 540 | 1% | 4% | -2% | |

| Operating Company | 236 | -24% | -28% | -5% | |

| Total | 776 | -8% | -9% | -3% | |

Overall, plaintiffs added 776 defendants to patent litigation campaigns in Q4, down by 8% from the same quarter one year prior, 3% less than Q3 2022, and 9% below the trailing average.

As noted in prior reports, the operating company data above exclude another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e-seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to a typical patent suit: These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts for the same ultimate parent. Additionally, plaintiffs mainly seek injunctive relief instead of damages, and their cases often end with the e-seller defendant’s failure to answer, followed by a default judgment.

This category of litigation, which began to spike in Q3 2020, is shown in grey below to illustrate its magnitude. As evident from the rightmost bar, e-seller litigation in Q4 2022 accounted for 1,271 defendants added, or 62% of all litigation during the quarter (subject to the caveat about defendants with multiple online storefronts noted above).

Please note that apart from the graph below, the remaining analyses in this report exclude pure design patent and e-seller litigation.

Venue Update: Judge Albright Stays on Top After Rule Change in West Texas; IP Edge Flees Delaware Amid Disclosure Debacle

The Western District of Texas was the top district for overall litigation and NPE litigation in 2022, holding the number-three spot for operating company litigation. Meanwhile, Delaware was the second most popular venue for overall litigation, the number-three district for NPEs, and the top venue for operating companies. The Eastern District of Texas was in third place for overall litigation, though it held the number-two spot for NPEs. Additionally, the top-three rankings in each category were largely the same for litigation filed in Q4, except that the District of New Jersey took third place for operating company activity, with West Texas falling to fourth.

The nation’s top district judge in 2022, with 14% of new patent litigation filed in his courtroom, was District Judge Alan D. Albright of the Western District of Texas, while District Judge Rodney Gilstrap of the Eastern District of Texas held a distant second place. However, the two judges swapped places for the fourth quarter, though they were separated by just a handful of defendants: Judge Gilstrap had 85 defendants in Q4 compared to Judge Albright’s 80 (each around 8% of the quarter’s total).

In recent years, West Texas and Judge Albright leading the rankings would have been unremarkable given the latter’s long-standing popularity among patent plaintiffs. However, as previously reported by RPX in its third-quarter review, some had expected this to change as the result of a July 25 standing order issued by then-Chief Judge Orlando L. Garcia that seemed designed to reduce Judge Albright’s share of the country’s patent cases. Filing rules previously let plaintiffs pick their division, thus guaranteeing they could select Judge Albright, where he is Waco’s only district judge. But the July order established that Waco’s patent cases would instead be randomly distributed among a group of 12 judges from across the entire district, including Judge Albright.

In the immediate aftermath of the July order, complaints filed in the Western District slowed compared to the same time period in 2021. Yet by the time that year came to an end, the decline was less dramatic than some had anticipated. In particular, as shown below, West Texas litigation dropped significantly compared to 2021 in the three weeks that followed the order. This decline was driven mainly by NPEs, which likely paused their filing activity to reassess assertion strategies. However, filings picked up in September and eventually rebounded significantly, breaking even with 2021 for around a week starting in late October, before slowing again in November and December.

There are two primary reasons why West Texas filings appear to have maintained a relatively steady pace (notwithstanding that dip at the end of the year). The first is that Judge Albright is now getting assigned a disproportionate number of cases compared to the others in the Waco judge pool—over five times higher than the next highest judge and approximately half of all cases filed in Waco, as shown below.

Since the issuance of the July 25 order, the Western District has apparently adopted a practice of assigning cases to Judge Albright when they relate to litigation already before him—in particular, when they share the same patents and parties (and thus fall within an existing litigation campaign), as reported by IAM. This so-called “grandfathering” practice has since been made explicit in docket entries marking case assignments to Judge Albright—e.g., “[c]ase assigned to Judge Alan D[.] Albright due to related case” or “. . . due to previously filed case(s) as having same Plaintiff and patent case numbers”. Before this practice became automatic, the data indicate that those related cases were sometimes assigned to other judges but then reassigned to Judge Albright.

In contrast, cases that fall into new campaigns have been far more evenly distributed, as shown below. Note that Judges Orlando L. Garcia and Xavier Rodriguez received more cases than the rest only because each was assigned a separate group of related cases. The corresponding number of campaigns within which those cases fall (shown as purple dots below) is much more even among the judges in the pool, further confirming that the assignments are indeed random when there are no related cases open in the district.

At some point, the number of defendants available to be added to “grandfathered” litigation campaigns is likely to decline; it remains to be seen how that might affect the popularity of the Western District.

The impact of the West Texas case assignment order was also more muted for a second reason: perennial top-filer IP Edge swam against the tide by filing more cases in West Texas around the time that other NPE plaintiffs were filing less—shifting away from Delaware (for reasons detailed below). This countereffect was not insignificant; in fact, as shown in RPX’s third-quarter review, the slump in West Texas NPE activity that occurred in the wake of the July 25 order lasted about 45 days, not 21, when excluding IP Edge activity.

What Comes Next for West Texas?

A key question for many patent stakeholders is what will happen under new Chief Judge Alia Moses, who assumed the chief judgeship when Judge Garcia aged out of that position on November 18. An early focal point of this uncertainty was an Amended Order Assigning the Business of the Court issued by Judge Garcia three days before that transition; the new order, which took effect on December 1, stated that Judge Albright would be assigned “[a]ll cases and proceedings in the Waco Division”. The wording of the order, which did not refer specifically to patent cases, was interpreted by some stakeholders as overturning the order from July 25. While filings since December 1 were indeed disproportionately assigned to Judge Albright, docket text detailing the reasons for the assignments clarified that each was assigned to him because they were related to existing cases (and thus were “grandfathered”).

On December 16, Chief Judge Moses amended that order to clarify that patent cases would still be assigned “as ordered on July 25, 2022 . . . with the exception that no further cases will be assigned to Senior Judge Frank Montalvo”. In other words, Judge Moses has confirmed that the post-July 25 status quo largely remains in effect as of the end of 2022: Judge Albright is likely to see the bulk of ongoing litigation in existing campaigns for the time being, while cases filed in new campaigns are likely to be spread more evenly among a pool now comprising 11 judges, down from 12.

Judge Connolly’s Disclosure Push in Delaware Forces IP Edge to Change Course

Meanwhile, litigants have been closely watching a “Series of Extraordinary Events” that have been playing out in Delaware as the result of a pair of standing orders issued by Chief Judge Colm F. Connolly in April 2022: one requiring litigants in his courtroom to disclose details related to any nonrecourse funding arrangements with third parties, and the other forcing the broad disclosure of corporate management and control.

While all parties appearing before Judge Connolly must comply with these orders, such compliance began to cause particular problems for a group of familiar NPEs—including monetization firm IP Edge, patent advisory firm Dynamic IP Deals, LLC (d/b/a DynaIP); and global investment manager Fortress Investment Group LLC—after the court learned from a defendant (via RPX reporting) that certain plaintiffs have ties to IP Edge but had not disclosed any such ties to the court.

Throughout the fall, Judge Connolly repeatedly questioned a group of plaintiffs connected to IP Edge for alleged noncompliance with his standing orders, including for their failure to disclose links to IP Edge and an associated entity, the purported consulting firm MAVEXAR LLC. The court held a series of revelatory evidentiary hearings, after which it imposed a set of a sweeping orders requiring some of those plaintiffs to produce a wide-ranging ream of information on their ownership/control, assets, and legal representation. In December, Judge Connolly denied a motion to withdraw one of those production orders from one of those plaintiffs, Nimitz Technologies LLC—rejecting it as “devoid of merit” and ordering it to show cause why he should not sanction the entity for failure to provide the required evidence.

Meanwhile, a parallel fight over his probing is presently playing out before the Federal Circuit, where Nimitz has asked the full appellate court to reconsider the recent denial of a mandamus petition contesting the production order hanging over it, raising new arguments grounded in appellate procedure and protesting Judge Connolly’s alleged violation of the core common-law tenets governing attorney-client privilege. In two other appeals that the Federal Circuit denied in early January, two other plaintiffs linked to IP Edge, Creekview IP LLC and Waverly Licensing LLC, also challenged Judge Connolly’s authority to impose his standing orders in the first place. Those two petitioners argued, in part, that because the Federal Rules of Civil Procedure already provide a framework for disclosures, Judge Connolly may only supplement those requirements by going through the process of establishing a local rule—as has been done in other districts with heightened, yet infrequently enforced, disclosure requirements. The court rejected the petitions as premature, since the district court had not yet found that the patent owners had violated the standing orders—similar to its ruling against Nimitz.

This ongoing saga has apparently pushed IP Edge to press pause on its Delaware filings—likely, as a result, triggering its aforementioned shift into the Western District of Texas. The result has been a dramatic dip for Delaware’s NPE numbers overall. As illustrated below, IP Edge has accounted for the majority of all Delaware NPE litigation since Q3 2020, dropping off only in Q3 2022 (when Judge Connolly began pressuring the entities mentioned above). In the fourth quarter, during which IP Edge filed no new cases in Delaware at all, the district saw just 51 defendants added by other NPEs, a 63% drop from Q4 2021 (during which NPEs collectively added 138 defendants, at that point including IP Edge).

More broadly, IP Edge’s troubles in Delaware may have led to a temporary pause in its filings altogether—as the monetization firm filed no cases whatsoever in December.

Yet as RPX’s reporting has also revealed, signs point to the birth of an “IP Edge 2.0” business model, with some plaintiffs now sporting both a different litigation strategy and structure. While prior IP Edge NPEs have consistently avoided substantive litigation of their cases in favor of rapid settlement, at least one of this newer breed of plaintiff has taken a case to trial—and in IP Edge’s first action before the International Trade Commission (ITC) to boot. Evidence also suggests that IP Edge has received litigation funding and that it plans to expand beyond the US to China. Moreover, state filings indicate that IP Edge’s principals are taking more of a direct role, naming themselves as the managers of these “IP Edge 2.0” plaintiffs rather than farming out the management of their LLCs to individual “passive investors” with no prior connection to patent monetization, as before.

For more on IP Edge’s litigation strategy and filing patterns, see RPX Insight.

Market Sector Update: Plaintiffs Linked to Top Players, Inventors, and Third-Party Funders Hit E-Commerce and Software Space in Q4

The top market sector for NPE litigation in Q4 2022 was E-Commerce and Software, accounting for 27% of new defendants added to patent litigation campaigns. Consumer Electronics and PCs saw the second-most NPE litigation in the fourth quarter, followed by Networking, Semiconductors, and Mobile Communications and Devices.

NPE activity hitting the E-Commerce and Software sector in Q4 included litigation from a variety of familiar names in patent monetization and numerous suits from inventor-controlled plaintiffs—as well as some from a growing group of NPEs with outside funding.

Among the well-known players that hit this sector in the fourth quarter was global investment manager Fortress Investment Group LLC. On December 14, affiliated plaintiff Softex LLC, an NPE formed by a Fortress executive, launched a campaign targeting products with device tracking features, asserting patents from Texas-based security software company Softex Incorporated.

This past quarter also saw multiple other firms engaged in monetization file litigation in new and existing campaigns in this space—including two plaintiffs linked to patent advisory and monetization firm Dynamic IP Deals, LLC (d/b/a DynaIP). Most recently, in early December, DynaIP’s AML IP LLC filed a new round of suits in its ongoing campaign against retail e-commerce platforms, two months after Judge Albright denied a retailer’s Alice motion and doubled down on his well-known inclination against early eligibility challenges. Another DynaIP plaintiff, WirelessWERX IP LLC, kicked off a campaign at the start of October, accusing several defendants of infringement through various products with location-tracking and mapping features.

Meanwhile, the six-year-old targeted advertising campaign waged by Consolidated Transaction Processing LLC (CTP), a file-and-settle plaintiff linked to Nevada-based monetization firm Equitable IP Corporation, passed the 50-defendant mark with a fresh wave of complaints hitting various e-commerce retailers. Such retailers were also in the crosshairs of Gravel Rating Systems LLC, an entity with ties to a growing web of other plaintiffs, which in late November filed a set of lawsuits focusing on user review features offered by the defendants’ e-commerce websites.

Yet another longtime player that hit the E-Commerce and Software space was publicly traded Quest Patent Research Corporation, which through subsidiary Taasera Licensing LLC filed a new case in its ongoing cybersecurity campaign on October 31. In August, the US Judicial Panel on Multidistrict Litigation (JPML) consolidated the campaign in the Eastern District of Texas before District Judge Rodney Gilstrap in what is apparently his first multidistrict case; he has stayed pending Rule 12 motions until a trial currently scheduled for February 2024. October also saw two waves of litigation (see here and here) in a new campaign started by TRON Holdings LLC—a Delaware plaintiff apparently associated with a familiar patent monetization figure—targeting mobile advertising platforms and mobile apps incorporating them.

The fourth quarter also saw a host of inventor-controlled NPEs file litigation in the fourth quarter, as noted above—including two new plaintiffs that kicked off their first campaigns. On December 16, Arizona-based HyperX Networks, LLC filed its first complaint against a provider of network management products with certain device provisioning features. The other new campaign came in late October, when Nevada plaintiff DataNet, LLC filed a pair of inaugural cases against providers of cloud storage platforms, focusing on features related to file archival.

Several ongoing inventor-controlled campaigns also saw new filings in Q4. Among the most recent was Virtual Creative Artists, LLC, which on December 8 sued a second social media company over certain user interface features after its first case headed toward settlement—in the process, dropping a patent currently being challenged by a third party before the PTAB. Also reshuffling its patents was inventor-led AlmondNet, Inc. and subsidiary Intent IQ, LLC, which in November filed a new round of suits against a trio of existing defendants, again alleged to infringe through the provision of products with targeted advertising features. However, the plaintiffs behind an ongoing database search campaign with new suits in December, a “Vilox Technologies, LLC” and a “Vilox, LLC”, appear to have some basic questions to answer—namely, whether the purportedly inventor-managed Texas LLCs actually exist, and how they share rights to the asserted patents.

Finally, as detailed further in the Marketplace Update section below, a variety of inventor-controlled entities that have all granted a security interest to the same litigation funder began asserting patents in the fourth quarter. Four of those plaintiffs have targeted various products in the E-Commerce and Software sector: Pardalis Technology Licensing, L.L.C. (which launched its first campaign on November 22), Mobile Data Technologies LLC (on November 23), DigitalDoors, Inc. (on November 29), and Entangled Media LLC (on December 16).

PTAB Update: Vidal Signals Further Changes Are Coming, Issues New Sanctions in Closely Watched Case

The Patent Trial and Appeal Board (PTAB) saw 1,358 petitions for America Invents Act (AIA) review in 2022, including 1,323 petitions for inter partes review (IPR) and 35 petitions for post-grant review (PGR). Filings largely held steady last year, with just 28 fewer petitions than in 2021 (a dip of 2%).

In the fourth quarter, 330 petitions for AIA review were filed with the PTAB, including 326 IPR petitions and four PGR petitions. Filings in Q4 were around 3% lower than both Q3 2022 (when 340 petitions were filed) and the fourth quarter last year (which saw 339 petitions).

Discretionary Denial Reforms: Vidal Touts Resulting “Clarity and Certainty” at Year’s End

2022 was a year of change for the PTAB in the wake of USPTO Director Kathi Vidal’s April confirmation, with some of her most notable reforms impacting the PTAB’s practice of discretionary denials in AIA reviews based on the status of parallel litigation.

Under that practice, known as the NHK-Fintiv rule, the Board can tie institution to a variety of factors based on certain aspects of a district court case asserting the same patent. The rule has long been a point of contention for frequent defendants, especially the NHK-Fintiv factor allowing the PTAB to deny institution when its final written decision deadline would fall too close to the district court’s scheduled trial date. Given the popularity of venues, like West Texas, that hold trials as early as possible, this forces petitioners to file earlier than they might otherwise—essentially, further compressing the one-year window within which defendants may file an IPR.

One key result of this time pressure is that district court defendants have been filing IPR petitions closer to the date on which they are sued in the two years after the Fintiv decision was designated as precedential (the earlier NHK Spring decision having received that designation one year prior), as compared to the two years before. A breakdown of this shift is shown below. Note, in addition to the increase in five of the six earliest two-month periods (counting months from the district court filing date), that the share of petitions filed within the first six months rose from 20% to 29%, and for those filed in the first four months, from 6% to 11%. Additionally, although 44% of pre-Fintiv petitions were brought just before the time bar expired, at 11-12 months from the district court filing date, that fell to 26% post-Fintiv.

As detailed further in RPX’s second-quarter report, the NHK-Fintiv rule—and in particular, its factor contemplating time to trial—was the focus of the first major set of reforms implemented by Vidal after her confirmation. In June, the director issued a new guidance establishing that the Board may consider data on actual time to trial, possibly blunting objections that the scheduled dates are too speculative of a metric; and endorsing a series of existing practices allowing parties to stipulate around certain NHK-Fintiv factors by agreeing to be estopped by their petitions.

A USPTO study issued alongside that June guidance indicates that discretionary denials were already on their way down in 2021. After peaking in the first quarter of that year, there were just six such denials issued in Q4 2021, compared to 85 decisions granting institution after analyzing NHK-Fintiv.

Meanwhile, data also indicate that the overall institution rate has since been on the rise—increasing from 59% in 2021 to 67% in 2022. Breaking down the past year even further suggests that the June guidance is having an effect, as the institution rate was 68% in the second half of the year (compared to 66% for the first half).

Another post-NHK-Fintiv trend that appears to be shifting is defendants’ use of ex parte reexaminations, which are not subject to discretionary denials to the same extent and offer other advantages as well (including lower cost and the lack of estoppel). The number of reexam requests went up by 21% in 2020 and then by 53% in 2021, with an increasing share of those patents having previously been litigated in district court and subjected to PTAB challenges—together, indicating that this prior uptick was the result of NHK-Fintiv.

However, with the recent decline in NHK-Fintiv denials, the data show that reexam requests have now leveled off. While quarterly reexam filings peaked in Q2 2022 at 101 requests total, they dropped to 75 in each of Q3 and Q4; as a result, the 2022 total came in just below last year’s (322 reexam filings vs. 331). Data also reveal that a decreasing share of patents subjected to reexam requests have previously been asserted in district court litigation (from 64% in 2021 to 59% in 2022), while the share of those patents also challenged in AIA reviews has gone down slightly as well (from 36% to 33%).

Yet Vidal suggested in a December 22 interview with Stanford University that the impact of her office’s recent guidance is more than just what is reflected in the numbers, explaining that “at a high level” the guidance has “created more certainty and clarity”. Vidal stated that apart from the guidance’s “compelling merits” test, the guidance is largely “just making it clear what the PTAB was already doing”—referring, for example, to the aforementioned practice of letting parties stipulate to certain estoppel that the guidance endorsed. Additionally, she underscored the value of applying the same practices consistently among PTAB panels to promote greater consistency in outcomes.

Vidal also reiterated that further changes are coming, confirming that the USPTO was working on an advance notice of proposed rulemaking to let stakeholders weigh in on her office’s next batch of discretionary denial reforms—and expressing the hope that this proposal would be released in Q1 2023.

Vidal Boots Petitioners in Follow-On Sanctions Rulings, Considers Future of Director Review

Another closely watched aspect of Vidal’s first eight months has been her use of her post-Arthrex director review authority, triggering such reviews sua sponte (i.e., entirely on her own initiative) to implement reforms and issue policy clarifications in response to stakeholder criticisms. Arguably the most dramatic example has been her use of that power to intervene in an ongoing debate over petitioner misconduct and sanctions—one that began brewing in the first quarter and reached a new crescendo in December.

The underlying dispute involved claims of gamesmanship in IPRs filed by two third-party challengers, OpenSky Industries and Patent Quality Assurance (PQA), against VLSI Technology LLC. This past spring, after the PTAB had already instituted trial in both actions, VLSI disclosed that OpenSky had offered to sabotage its own IPRs in exchange for payment, prompting widespread outcry and leading Vidal to initiate director review in those proceedings. It soon came to light that OpenSky had also sought payments, and even an acquisition offer, from joined copetitioner Intel. Vidal issued a sweeping sanctions order against OpenSky in October, finding that it abused the IPR process through this behavior and by failing to comply with discovery ordered during the director review. However, Vidal stopped short of dismissing OpenSky altogether, demoting it to a silent understudy role with Intel as lead petitioner for further proceedings on remand.

In December, though, Vidal issued two follow-on sanctions orders that went even further. With the benefit of “additional time to consider this case” alongside PQA’s, Vidal now determined that “the best course of action is to dismiss OpenSky from its IPR to ensure that OpenSky does not benefit from its abuse of the IPR process”. This time Vidal also sanctioned PQA, concluding that it also had abused the IPR process and dismissing it as well—based on similar findings that PQA had also improperly sought to extract payments from VLSI and failed to comply with mandated discovery. Further justifying sanctions, Vidal held, was PQA’s misrepresentation that its engagement with an expert had been exclusive, as a result of which OpenSky was unable to separately retain that expert for crucial testimony—which led the Board to deny its petition. The rulings leave Intel as the sole petitioner in both proceedings.

As director review comes to play an increasingly prominent role in USPTO policy, Vidal has suggested that the program will likely evolve further, both in terms of its structure and the role she will play in it. In her December 2022 Stanford interview, Vidal cited the necessary but significant time commitment required for director reviews and stated that to ensure the program’s long-term sustainability, certain director reviews that serve more of an error correction function (e.g., to address a panel’s misapplication of law), as opposed to matters of greater importance, may in the future be handled by a “different panel”. Such a system would “almost flip[] the model of director review and the Precedential Opinion Panel”, the latter of which—in its current form, at least—is tasked with deciding issues of “exceptional importance” to the PTAB and is comprised of the USPTO Director, the Commissioner for Patents, and the PTAB’s Chief Administrative Patent Judge.

However, Vidal seemed to indicate that her use of sua sponte reviews would continue, stating that the practice has helped her “speed things up so when we identify an issue that we think needs to be taken up” without waiting for a party to request that she do so.

FRAND Update: FTC Asserts New SEP Oversight Authority; UK Clarifies Injunction Rules; EU Spars with China Over Jurisdiction

US: After SEP Policy Withdrawal, FTC Signals Greater Focus on SEP Enforcement

One of the most notable US SEP developments in 2022 was a major shift in the executive branch’s position toward remedies in SEP disputes. In June, the Biden administration withdrew a 2019 policy statement issued by the Department of Justice, USPTO, and the National Institute of Standards and Technology (NIST) that endorsed the availability of injunctions in cases over fair, reasonable, and nondiscriminatory (FRAND) licensing. The withdrawn policy also argued that SEP disputes should be resolved under contract law (via enforcement of patent owners’ agreements with standard-setting organizations, or SSOs) and patent law, not antitrust law. Importantly, the agencies did not reinstate a prior 2013 policy that focused more on patent owner misconduct and counseled against SEP injunctions, nor did they adopt a 2021 policy proposal that attempted to bridge the gap between the 2013 and 2019 versions. Instead, the DOJ, USPTO, and NIST announced that they would shift to a case-by-case approach.

Yet as those agencies have stepped back, the Federal Trade Commission (FTC) has been giving signs that it intends to fill this void and take a more aggressive stance toward SEP disputes. The FTC has been laying the grounds for a more active posture since July 2021, when it withdrew a 2015 policy statement that framed the agency’s antitrust enforcement authority—which stems from Section 5 of the FTC Act, which bars “unfair methods of competition in or affecting commerce”—as limited to anticompetitive conduct as defined by the Sherman Act and the Clayton Act. In announcing that withdrawal, the commissioners voting in favor—Chair Lina M. Khan and Commissioners Rohit Chopra and Rebecca Kelly Slaughter—asserted that the change would restore the FTC’s “congressionally mandated duty to use its expertise to identify and combat unfair methods of competition even if they do not violate a separate antitrust statute”.

The Commission then detailed its views on what conduct may constitute “unfair methods of competition” in a new policy statement issued in November 2022 that encompassed SEP issues. For one, the FTC argues that conduct “indirectly” implicating competition falls under Section 5, including the “misuse of regulatory processes that can create or exploit impediments to competition . . . such as those related to licensing, patents, or standard setting”. The FTC also asserts that its authority covers “[c]onduct that violates the spirit of the antitrust laws”, including “fraudulent and inequitable practices that undermine the standard-setting process”.

Stakeholders may have to wait until the FTC attempts to leverage this newly reasserted authority against a SEP licensor to see what will come of this revamped policy—particularly since its more pointed approach contrasts somewhat with the case-by-case approach touted by the other relevant agencies. Still, this contrast is perhaps less acute than during the Trump administration, when attorneys from the FTC and DOJ argued on opposite sides in the appeal of the former’s FTC v. Qualcomm litigation, which was filed in the waning days of the Obama administration. Note, also, that the DOJ-USPTO-NIST statement announcing the withdrawal of the 2019 joint policy explained that their case-by-case enforcement would focus on “conduct by SEP holders or standards implementers”, following prior comments from a DOJ official (Jeffrey Wilder, the Antitrust Division’s Economics Director of Enforcement) indicating that deceptive conduct by patent owners during the standard-setting process can give rise to antitrust liability. Both statements are broadly consistent with the FTC’s asserted positions, if not their legal basis.

UK: Appellate Court Affirms FRAND Injunction Limits

Another significant SEP development in Q4 came in the UK, where the London Court of Appeal issued a new ruling in Optis v. Apple that clarified the metes and bounds of the country’s so-called FRAND injunctions. Such relief was established as a result of the country’s August 2020 Unwired Planet v. Huawei decision, which held that when an implementer is held to infringe a UK SEP, the company is enjoined from further infringement unless it agrees to be bound by a global FRAND license to be set by the court.

While Unwired Planet involved a circumstance where the court had already determined what license terms were FRAND, the October 27 Optis opinion affirmed a 2021 ruling that an adjudged infringer must agree to take a license even when the court has not yet set the terms of the FRAND license if it wishes to avoid an injunction. However, the Court of Appeal also upheld the lower court’s ruling that an implementer is not permanently barred from later relying upon the patent owner’s FRAND commitment (in other words, from belatedly agreeing to a FRAND license) if it initially declines to accept the court-determined license, agreeing that it would be “unfair and unprincipled” to prevent the implementer from changing its mind.

Notably, the court concluded by lamenting the “dysfunctional state of the current system for determining SEP/FRAND disputes”, arguing that the only way to avoid a similar scenario as in the Optis case (and related appeals) is for standard-setting organizations (SSOs) to require arbitration in their patent policies.

EU: European Commission Asks WTO to Probe Chinese Anti-Suit Injunctions

Finally, as 2022 came to close, an ongoing fight continued to escalate over Chinese courts’ use of anti-suit injunctions (ASIs), which block the litigation of parallel proceedings in another country’s courts as well as the enforcement of the results from such cases, including injunctions. In February 2022, the European Commission filed a complaint against China before the World Trade Organization (WTO) to challenge this practice, arguing that it violates provisions of the TRIPS Agreement (a 1994 treaty establishing minimum standards for IP enforcement) by unduly restricting EU patent owners’ enforcement rights and thereby creating “barriers to legitimate trade”. The complaint implicitly distinguishes Chinese courts’ use of ASIs from the same practice in other countries—such as the US and UK, where courts generally have some degree of independence—by noting that the overarching Chinese policy favoring ASIs has been endorsed by the Chinese government. Additionally, the complaint doubles down on the WTO’s prior, related protest over judicial transparency in China, objecting to concerns over the delayed reporting of major SEP cases and the lack of guidance as to their interpretation.

On December 7, after consultations with China did not lead to a resolution, the Commission announced that it had asked the WTO to convene a panel to address its allegations. However, this is not likely to be a short process; a WTO panel proceeding would begin in January and can last up to 18 months, at which point any resulting appeal could hit a roadblock due to disagreements over appointments for the WTO’s Appellate Body. Should proceedings end up at an impasse, the EU has warned that it could pursue certain unilateral countermeasures.

In the meantime, courts in China do not appear to have issued any ASIs (at least, none that have been made public) since late 2020, though appellate courts confirmed the basis for those decisions in 2021. Moreover, courts in other SEP jurisdictions have countered the jurisdictional threat of ASIs in part through anti-anti-suit injunctions (AASIs), which prevent a party from filing and enforcing an ASI in the first place. Two courts in Germany—the regional courts in Düsseldorf and Munich—have even ruled that AASIs may be granted preemptively where an ASI has not been filed but the movant has shown a risk that one will be, though the Düsseldorf ruling was later overturned on appeal. Additionally, the Munich regional court has held that a party seeking a foreign ASI will be deemed an unwilling licensee, which could also serve as a further deterrent.

Marketplace Update: Third-Party Backed NPE Campaigns Launched in Q4; Patent Assertion the Focus of Multiple New Investment Funds; Transparency into Litigation Funding a Matter of National Security, Says US Chamber of Commerce

Third-Party Backed NPE Campaigns Launched in Q4

US patents continued to spread among NPEs throughout 2022, including to familiar faces in patent monetization. While some of those recipients have yet to file any litigation, several did launch new campaigns during the fourth quarter; for the following NPEs (among others), public records point to the involvement of third-party litigation funding.

Five Plaintiffs, One Funder

Since late 2021, RPX has flagged three batches of security agreements—each batch covering six different patent portfolios—all apparently involving the same third-party funder. Of the 18 funded patent portfolios, all have spawned new litigation campaigns, five having started in Q4 2022.

In November-December, DigitalDoors, Inc. sued IBM (RPX coverage here), eCardless Bancorp Ltd. sued PayPal (here), Entangled Media LLC sued Dropbox (here), Mobile Data Technologies LLC sued Meta Platforms (here), and Pardalis Technology Licensing, L.L.C. sued IBM (here).

Each of the asserted portfolios is subject to a security interest granted to LIT-US Chisum 22-B, LLC, a Delaware entity formed in July 2022 (more information about which is available to RPX members here).

These five plaintiffs join Electrolysis Prevention Solutions LLC (EPS) in federal court. EPS also granted a security interest in its portfolio to LIT-US Chisum 22-B in September but did so well into its litigation, having sued Daimler Truck back in April 2021 (background coverage here). Since then, Western District of North Carolina Judge Robert J. Conrad Jr. has handed down a claim construction order, in May 2022, and has scheduled a trial for January 2024.

Geoscope Technologies Pte. Ltd.

Q4 also saw Singapore NPE Geoscope Technologies Pte. Ltd. file its first litigation with suits against Alphabet (Google) and Apple in the Eastern District of Virginia. The six asserted patents, originating with Andrew Corporation (acquired by CommScope in 2007), are broadly directed to determining the location of a device. The defendants are accused of infringement through the provision of their geolocation services: Google, through the Google Location Services platform; and Apple, through the Location Services platform.

The six asserted patents are among the more than 290 US patent assets that passed from CommScope to Bison Patent Licensing, LLC in June 2022; Bison Patent subsequently assigned the patents in a portfolio of 18 to Geoscope Technologies the following October. For RPX coverage on that assignment, see “Outflow of Patent Portfolios from Operating Companies Remains Steady” (August 2022).

Public records indicate that Geoscope Technologies has received funding from a prominent litigation funder. RPX members can learn more about that funding source—as well as about the NPE’s formation and management—here.

Network System Technologies LLC

Finally, in December, Network System Technologies LLC (NST) launched its inaugural litigation campaign with three district court cases filed in Texas on December 19: the first, against Arteris and Qualcomm in the Western District; the second, against Ford, TI, and Volkswagen (including Audi) in the Eastern District; and the third, against Lenovo, OnePlus, and Samsung, also in the Eastern District. A group of six former Philips patents—from a portfolio of nearly 50—are asserted across all three cases, with infringement allegations trained on certain Systems-on-Chip (SoC) products and automobile infotainment systems or mobile devices that allegedly include such SoCs.

Public records indicate that NST has at its helm patent monetization veterans who have been associated with multiple prior campaigns asserting former operating company patents—and they also point to the involvement of third-party litigation funding in this latest endeavor.

RPX members can get a closer look at the NST campaign, and get background on its management’s previous litigation efforts, here.

Patent Assertion the Focus of Multiple New Investment Funds

Much of the recent reporting on the growth of the litigation funding industry in the US has pointed to a study released in March 2022 by Westfleet Advisors (a “full-service litigation finance advisory firm”). According to Westfleet, a pool of 47 litigation funders active in the US had combined assets under management of $12.4B during the period covered by the report.

That number could in fact be higher now. As of the publication date of this blog post, the league table compiled by The Litigation Finance Insider reflected total assets under management (AUM) of over $14.5B for just nine standalone litigation funders. Publicly available records link at least seven of those funders to patent litigation filed here in the US.

Of course, not all of those funders’ capital is directed to patent litigation; however, according to Westfleet’s study, “patent litigation attracted a significantly higher percentage of new commitments in 2021, comprising 29% of all capital commitments”. In an earlier version of its annual report, published in January 2022, the firm proclaimed that in the context of commercial litigation finance, “patent litigation is king”.

Despite the COVID-19 pandemic and related economic challenges—or perhaps, as a byproduct of it—the litigation finance industry has continued to announce large fundraises over the past three years.

In 2022, at least two relative newcomers to the space announced large fundraises—as well as their intention to focus on US patent litigation. In April, Tenadio Corp, “a consulting firm specializing in advising patent owners and inventors”, announced the completion of $54M in financing for its Patent Capital Funding Program. Waterford Capital reportedly led the deal, “which was privately placed with institutional investors via a platform managed by Finitive”.

According to an October 3 press release, Waterford Capital was the placement agent for the firm’s Q4 raise as well, this one totaling $49M and also “privately placed with institutional investors”. Tenadio’s 2022 announcements follow what appears to be the firm’s first, in late 2021, touting $51M raised for its patent-focused fund.

In late September, commercial litigation finance fund Erso Capital announced the launch of a $500M fund dedicated to patent assertion.

In 2021, UK-based global insurance and asset manager Thomas Miller Group acquired litigation insurance firm TheJudge Group, resulting in the creation of Erso Capital—which reports having since invested in a “wide range of cases”, including IP litigation.

In a September 28 press release, Erso described its capital commitments as typically in the $1M-$25M range for single case investments but also claimed to “have the capability of considering” monetization opportunities requiring in excess of $50M. The firm reports holding “significant financial resources” via institutional investors.

“We’re fortunate to have institutional investors that share our appetite and vision to significantly ramp up our investment exposure in the space, in the US, Europe and internationally”, said California-based Erso co-founder James Blick, adding that the decision to earmark the new fund specifically for patent litigation was borne out of demand, “especially across both tech and life sciences sectors”.

Transparency into Litigation Funding a Matter of National Security, Says the US Chamber of Commerce

Over the past decade, the US Chamber of Commerce’s Institute for Legal Reform (ILR) has repeatedly called for increased transparency into litigation funding, including, most recently, through a proposed amendment to the Federal Rules of Civil Procedure that would mandate the disclosure of third-party litigation funding (TPLF) at the outset of civil litigation. In a report published late last year, the ILR argues that undisclosed nonparty financial stakes in US litigation could harm national economic and security interests.

The ILR’s report cites analysis by the Swiss Re Institute, which claims that the US has emerged as the world’s largest TPLF market, accounting for more than half (52%) of the estimated $17B investment into litigation funding globally in 2020 (i.e., more than half of the estimated $17B invested in litigation finance globally was deployed in the US).

According to the ILR, non-US citizens, including sovereign wealth funds, are active in the US TPLF market, contributing to a drain on the economic resources of targeted defendants and potentially posing “significant threats” to the American justice system and even national security.

The ILR says that foreign actors may seek to exert influence or control over US civil disputes—or even US politics—through the manipulation of common provisions of litigation funding agreements, the exploitation of which might grant funders “access to sensitive or otherwise unavailable information” related to the litigants.

The solution, says ILR, is to require disclosure of TPLF across the board, including “any foreign parties behind such arrangements”. They also propose requiring US persons acting as agents for foreign parties in TPLF arrangements to register with the US government.

As noted in the Venue Update section above, the Federal Circuit denied a petition for a writ of mandamus filed by IP Edge-linked plaintiff Nimitz Technologies that challenged the inquiries underway in Judge Connolly’s courtroom, a ruling that the company has since asked the full court to reconsider. The Federal Circuit has also rejected a related set of petitions from IP Edge’s Creekview IP, Swirlate IP, and Waverly Licensing.

The ILR, together with Lawyers for Civil Justice (LCJ), were among several amici to weigh in on those mandamus petitions, their brief addressing “a single narrow (but fundamental) question raised by the Petition: whether issuance of the challenged Standing Order Regarding Third-Party Litigation Funding Arrangements (‘Standing Order’) was an abuse of discretion warranting the issuance of a writ of mandamus”.

Their answer is no, arguing that Judge Connolly, through that particular order, “properly did what a growing number of courts are doing, which is inquiring whether cases over which he is presiding are being funded through third-party litigation finance (‘TPLF’)—the practice by which non-parties pay money to a litigant or his counsel in exchange for a contingent interest in proceeds from the litigation”. The goals achieved by such disclosure, according to these amici, are to avoid the improper use of litigation, to reduce potential conflicts of interest, to ease settlement, and to “unearth potential threats to U.S. national and economic security to the extent that a case is being funded by foreign money—e.g., sovereign wealth funds, which are increasingly a source of lawsuit funding in this country”.

In September, Bloomberg Law reported that the Government Accountability Office (GOA)—“which provides nonpartisan research to Congress”—had recently conferred with participants from the litigation finance industry to discuss a study requested by lawmakers.

Senator Chuck Grassley (R-Iowa) and Representative Darrell Issa (R-Calif.) (who Bloomberg says “have in the past proposed legislation requiring greater disclosure in litigation finance”), and Representative Andy Barr (R-Ky.), were among the lawmakers who commissioned the study, which is meant to provide “detailed information on how many requests for funding have been received; how many cases funders have backed; how many have concluded; and what types of returns they generated”. There is currently no indication of when the GAO report is expected to be published.

For related RPX reporting, see here. RPX members can also tune into a webinar, available on RPX Insight, taking a closer look at recent developments in TPLF as well as new third-party backed NPE campaigns launched during Q4 2022.

Additional RPX Patent Market Intelligence

For further analysis and up-to-date information on patent litigation and market trends, visit RPX Insight.