Q4 in Review: NPE Litigation Gap Narrows as Top SEP Venues Compete for Jurisdiction

January 9, 2024

NPEs filed 30% less patent litigation in 2023 than they did the year before. This gap was far smaller, however, when accounting for the impact of two notable developments in 2022: a mostly unbroken pause in new litigation from IP Edge LLC due to ongoing pressure over corporate disclosures from Delaware’s chief judge, and a reduction in West Texas NPE filings due to changes that have funneled patent cases away from District Judge Alan D. Albright.

Meanwhile, the debate over potential reforms of the Patent Trial and Appeal Board (PTAB) spilled over into Congress when stakeholders sparred over a bill that could alter fundamental aspects of the America Invents Act (AIA) review system, as the USPTO moved forward on changes of its own in response to public feedback. The fourth quarter also brought new developments in litigation over standard essential patents (SEPs), as a Chinese court issued the country’s first decision imposing a global fair, reasonable, and nondiscriminatory (FRAND) license. Additionally, Europe’s recently launched Unified Patent Court (UPC) has proven to be a popular venue for SEP litigation, with NPEs also getting potentially good news from one of the court’s early rulings on injunctive relief.

Finally, amid the continued proliferation of new third-party backed litigation campaigns, two prominent litigation finance firms announced a secondary market transaction involving 15 IP investments. In addition, a December lawsuit filed against litigation finance firm Longford Capital has provided a rare look at the litigation budget for an Atlantic IP Services Limited plaintiff.

RPX members also have exclusive access to an on-demand RPX Community webinar covering highlights from this post; CLE credit may be available. Members can view the webinar on RPX Insight.

Litigation Update: NPE Filings Decrease Due to IP Edge Standstill and West Texas Downturn

Venue Update: East Texas Widens Its Lead; Delaware Disclosure Battle Takes Its Toll

PTAB Update: Congress Debates Reform as USPTO Implements Its Own Changes

FRAND Update: China’s First Global FRAND Determination; UPC Ruling Could Favor NPEs and SEP Owners

Litigation Update: NPE Filings Decrease Due to IP Edge Standstill and West Texas Downturn

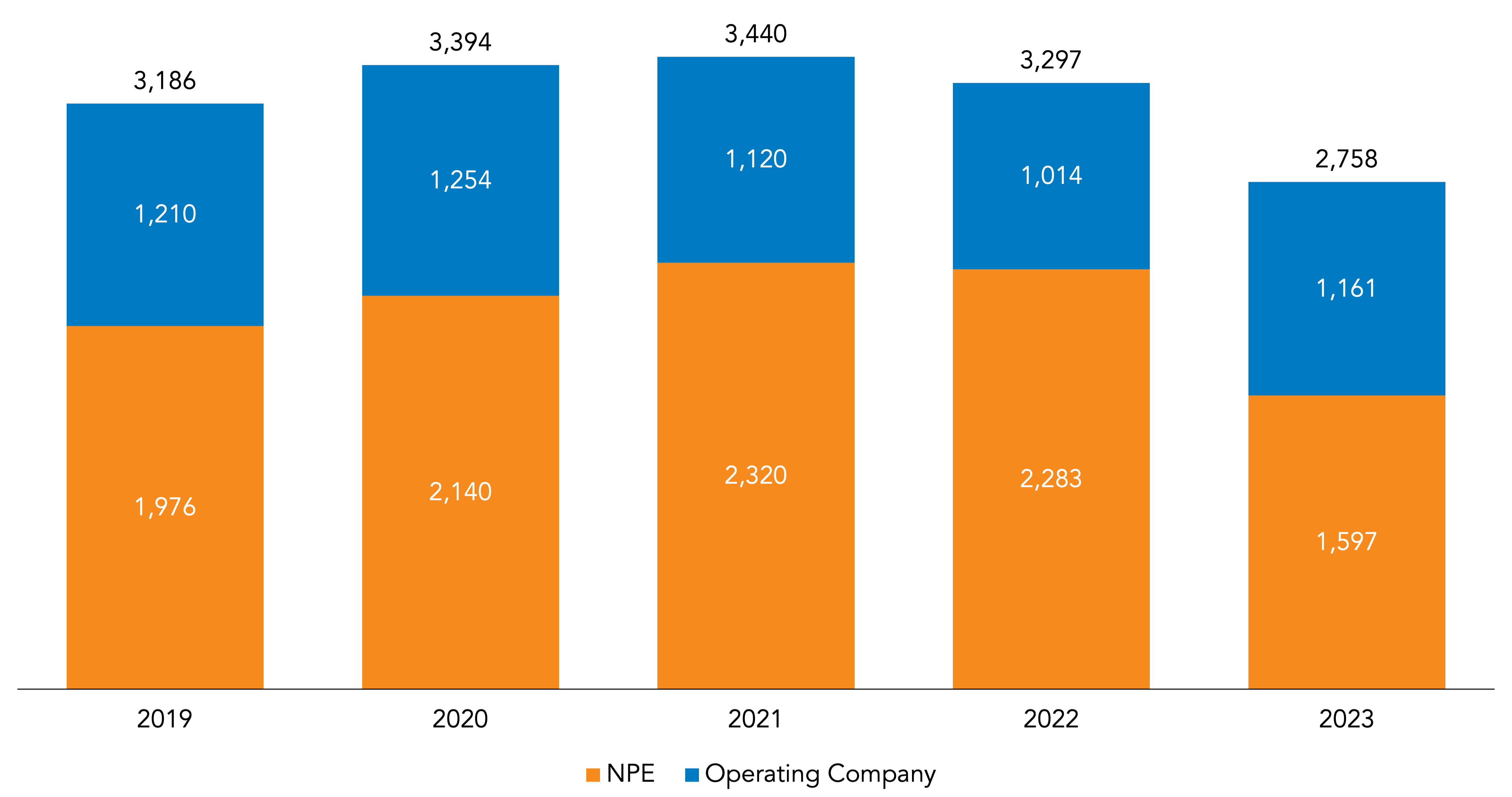

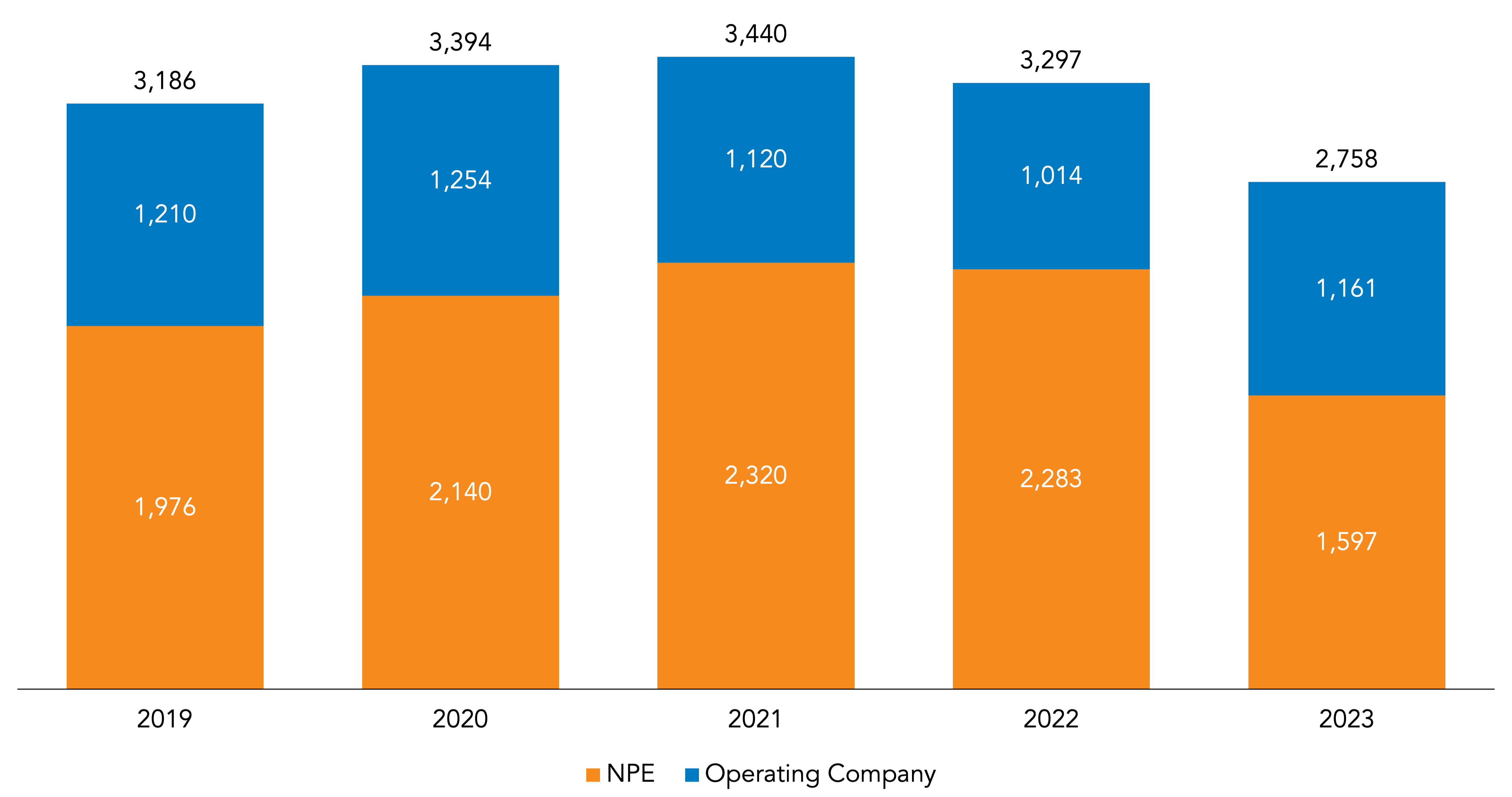

NPEs added 1,597 defendants to patent litigation campaigns in 2023, a decrease of 30% compared to 2022 (when such plaintiffs added 2,283 defendants). Operating companies, in contrast, added 1,161 defendants in 2023, a 14.5% increase from the year prior. Overall, 2,758 defendants were added to litigation campaigns in 2023, a 16.3% drop from 2022 (at 3,297 defendants added).

The decrease in NPE litigation observed in 2023 does not appear to reflect a general trend. Rather, as RPX has previously reported, the drop was primarily caused by two notable developments in 2022. The most impactful of those developments was a pause in litigation by patent monetization firm IP Edge LLC, which stopped filing new complaints starting in December 2022 as a result of pressure over transparency and corporate disclosures in Delaware, where Chief Judge Colm F. Connolly pursued information on the firm’s secretive entity formation strategy in a contentious, drawn-out inquiry that lasted most of 2023. As detailed further below, Judge Connolly has since concluded as a result of that investigation that IP Edge, a related consulting firm, and the attorneys behind them engaged in a litany of misconduct.

IP Edge had long been the top filer of patent litigation by volume prior to that pause, consistently suing about 50 defendants per month and hitting a total of 562 defendants in 2022. However, apart from a small new campaign launched in Q3 2023 and a single refiled complaint, IP Edge filed no new cases whatsoever last year—meaning that by ceasing its activity, the firm was alone responsible for 81.5% of the total NPE decline last year (559 out of 686 defendants). Excluding litigation from IP Edge, NPE activity was down by just 7.4% last year.

The other development contributing to the 2023 drop was a July 2022 order in the Western District of Texas that was designed to undercut the concentration of patent litigation before Waco District Judge Alan D. Albright. The order closed a divisional filing loophole that previously allowed plaintiffs to get Judge Albright by directing their complaints into Waco, where he is the only district judge—providing instead that Waco’s patent cases are to be randomly assigned among a larger group of judges, including Judge Albright. While the district has since developed a practice of assigning cases in existing litigation campaigns to the same judge who has presided over previous filings (i.e., those with the same parties and patents), meaning that Judge Albright still sees an outsized portion of such “legacy” litigation, cases in new campaigns have been more randomly distributed. The fact that plaintiffs are no longer guaranteed to get Judge Albright by filing in Waco has led to a significant drop in NPE filings there: Such plaintiffs added 356 defendants in Waco in 2023, compared to 681 defendants the year prior.

Added together, the reductions from IP Edge and in Waco—771 defendants in total, adjusting for the overlap in IP Edge and Waco cases—accounted for the entirety of the NPE decline between 2022 and 2023 and then some. The net decrease in total NPE filings was 686 defendants, as noted above, a partial offset caused by other plaintiffs shifting from West Texas to other districts in smaller numbers.

In the fourth quarter, NPEs added 442 defendants, or 17% less than Q4 2022—falling 28% short of the trailing three-quarter Q4 average, but exceeding Q3 2023 by 15%. This dropoff was less pronounced than in Q3, which saw over 30% less NPE litigation than the same quarter the year prior. That narrowed gap was partly the result of the mere passage of time since the start of IP Edge’s litigation pause: Since the firm filed no litigation in either December 2022 or December 2023, there was no IP Edge-related decrease during the latter month.

Meanwhile, operating companies added 283 defendants in Q4, a 19% increase compared to the fourth quarter last year. Operating company filings last quarter were 21% lower than in Q3 2023, though they exceeded the trailing Q4 average by 23%.

| Defendants Added | Change Compared to: | ||||

| Q4 2023 | Q4 2022 | Q4 2020-2022 Average | Q3 2023 | ||

| NPE | 442 | -17% | -28% | 15% | |

| Operating Company | 283 | 19% | 23% | -21% | |

| Total | 725 | -6% | -10% | -2% | |

Overall, plaintiffs added 725 defendants to patent litigation campaigns in Q4, down by 6% from the same quarter one year prior, 2% less than Q3 2022, and 10% below the trailing average.

Additionally, the operating company data above leave out another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e-seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to what one might consider the usual patent suit. These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts or aliases for the same ultimate parent. Also, plaintiffs primarily seek injunctive relief instead of damages, and their cases often end with the e-seller defendant’s failure to answer, followed by a default judgment.

This category of litigation, which began to rise in Q3 2020, is shown in grey below to illustrate its magnitude. As evident from the rightmost bar, e-seller litigation spiked in Q4 2023—accounting for 5,592 defendants added, or 88.5% of all litigation during the quarter (though note that this number is still subject to the caveat about the same defendants potentially operating multiple online storefronts mentioned above).

Apart from the following graph, the remaining analyses in this report exclude pure design patent and e-seller litigation.

Venue Update: East Texas Widens Its Lead; Delaware Disclosure Battle Takes Its Toll

The Eastern District of Texas was the top district for overall litigation and NPE litigation in 2023, after vaulting into first place starting with the second quarter this past year. In second for both categories was the Western District of Texas, which was knocked out of its spot atop the venue charts in Q1 2023 due to the aforementioned case assignment changes in Waco. Delaware held third place for overall litigation and NPE litigation last year, though the district was 2023’s most popular operating company venue, followed by the District of New Jersey.

The story was similar in the fourth quarter, at least at the top of the rankings: East Texas again took a wide lead for both overall litigation and NPE litigation, while Delaware was the most popular destination for operating company litigation. However, though Delaware just barely edged out the Western District of Texas as the number-two venue for overall litigation, it fell to fifth place for NPE litigation.

IP Edge, Its Litigation Already on Hiatus, Gets Hammered by Judge Connolly

The likely explanation for Delaware’s waning popularity among NPEs has been an increasingly heated battle over transparency and corporate disclosures in the courtroom of Chief Judge Colm F. Connolly. After multiple litigating plaintiffs linked to IP Edge LLC and a related consulting firm, MAVEXAR LLC, failed to disclose those relationships as required in his courtroom, Judge Connolly began expressing concerns that IP Edge and MAVEXAR had possibly committed fraud on the court and the USPTO by obscuring those connections.

While Judge Connolly had previously stopped short of detailing the possible ramifications of those actions, this changed in dramatic fashion on November 27: In a blistering, 105-page order, Judge Connolly found that IP Edge had been the “de facto” owner of the patents asserted by its litigating affiliates and held that the entity and its principals should face “consequences” for their improper attempt to “use separate LLCs to insulate themselves” from liability: He has now called upon the Department of Justice (DOJ) and the USPTO to potentially investigate these misrepresentations. Judge Connolly has also teed up potential punishment for some of the individuals involved: He has referred certain attorneys employed by IP Edge (which is not a law firm) to a Texas disciplinary body for the unauthorized practice of law and has referred the LLCs’ local and lead counsel to state disciplinary bodies for improperly treating IP Edge as their true client. More detail on this saga can be found on RPX Insight.

IP Edge stopped filing litigation in Delaware as an apparent result of the growing pressure from this “Series of Extraordinary Events”, bringing no new cases there after the end of September 2022 before halting its filings altogether (in every district) after November. Since IP Edge had long accounted for much of Delaware’s NPE caseload, its numbers plummeted due to IP Edge’s pause: The district saw nearly 66% less NPE litigation in 2023 compared to the prior year. (However, as reported by RPX, IP Edge has since ended its litigation pause, launching its first campaign since 2022.)

This saga in Delaware also appears to have had a broader deterrent effect on other NPEs. Excluding IP Edge, NPE litigation was still down in the district by 26%—suggesting that at least some NPE plaintiffs would prefer to avoid the risk of similarly close scrutiny by Judge Connolly.

Meanwhile, Eastern District of Texas Chief Judge Rodney Gilstrap was the nation’s top district judge in 2023, with 12% of all new patent litigation falling in his courtroom. Western District of Texas Judge Alan D. Albright followed in a distant second place at 5%, his patent docket scaled back due to the Waco case assignment reforms mentioned above.

Judge Albright ranked even lower in the fourth quarter, falling out of the top five for the first time since his earliest few months on the bench (overseeing just 2% of the country’s overall patent litigation in Q4 2023). Judge Gilstrap stayed in a comfortable fourth-quarter lead at 14%; in second place was District Judge Amos L. Mazzant III, also of the Eastern District, at 3%.

Though Judge Albright’s overall share of patent filings has dipped, he has continued to attract the scrutiny of the Federal Circuit over his handling of convenience transfer motions, which he has tended not to grant since taking the bench in 2018. Starting in 2020, the Federal Circuit began to repeatedly reverse him on that issue in response to mandamus petitions from defendants with transfer motions he had either denied or ignored—identifying various legal errors and faulting him for repeatedly delaying transfer rulings. That early wave of reversals slowed significantly by 2023, as Judge Albright adjusted his approach in response to those rulings. While a late-2022 venue decision by the governing regional circuit, the Fifth Circuit, appeared to some as requiring a more deferential posture, the Federal Circuit concluded otherwise in February 2023—ruling in In re: Google that not only did it owe relatively minimal deference to a district judge’s weighing of certain factors like relative time to trial, but that NPEs lacked an interest in quick trials altogether.

Judge Albright has since applied that ruling as required, though not without offering criticisms—also filling the gaps with his own attempts to reconcile Fifth and Federal Circuit law. In November, though, the Fifth Circuit issued a decision that appears to firmly support the Federal Circuit’s approach, reversing Judge Albright in a copyright case (in In re: TikTok) based on many of the same reasons previously relied upon by the Federal Circuit. As 2023 drew to a close, the Federal Circuit issued a pair of mandamus rulings applying that latest precedent—one granting Samsung’s request for a writ ordering transfer by Judge Albright to the Northern District of California, and the other denying plaintiff DoDots Licensing Solutions LLC’s request to undo his transfer of a parallel case against Apple to the same venue—confirming that the appeals court is still watching him closely.

Market Sector Update: E-Commerce and Software Products Targeted by Monetization Firms and Inventor-Controlled Plaintiffs in Q4

The top market sector for NPE litigation in Q4 2023 was E-Commerce and Software, accounting for 35% of new defendants added to patent litigation campaigns. Networking saw the second highest amount of NPE litigation in the fourth quarter, followed by Consumer Electronics and PCs, Mobile Communications and Devices, and Financial Services.

Among the wide variety of plaintiffs that hit this sector in the fourth quarter were a quartet of familiar monetization firms. One was Dynamic IP Deals (d/b/a DynaIP): In December, WirelessWERX IP LLC—an entity controlled by DynaIP’s Pueblo Nuevo LLC—filed two new waves of complaints in the location tracking and mapping campaign it launched in late 2022, targeting delivery platforms and family safety products with such features. Another was Equitable IP Corporation, which in December filed a new round of cases in its ongoing push notification campaign through controlled plaintiff Push Data LLC, targeting a host of retailers over their e-commerce apps and websites. Also joining the fray was publicly traded Acacia Research Corporation, which revived the distributed database processing campaign waged by subsidiary R2 Solutions LLC with a new pair of complaints respectively filed in early October and late December, asserting former Yahoo patents. Georgia-based monetization firm IPInvestments Group LLC (d/b/a IPinvestments Group) additionally resurrected a campaign of its own through associated plaintiff Advanced Transactions, LLC, which in mid-October filed a new round of litigation targeting a wide range of e-commerce technologies, including marketing email systems, gift and customer reward programs, e-commerce websites, and in-store/online ordering services.

Several inventor-controlled plaintiffs also filed litigation hitting the E-Commerce and Software sector in Q4. In mid-November, Language Technologies, Inc., an entity controlled by an inventor and professor at the University of Arizona, kicked off a new campaign targeting natural language processing products and services—the company apparently pivoting to patent assertion after previously offering mobile apps for sale. Shortly after, a different inventor-managed plaintiff, DigitalDoors, Inc., added a new case in its ongoing data security campaign, shifting its focus from enterprise cloud storage products to banks with systems compliant with certain financial industry requirements concerning the backup of customer data. Public records suggest that DigitalDoors has the backing of a litigation funder linked to a growing number of other patent plaintiffs. Moreover, inventor-managed ENOVSYS LLC filed another complaint in October targeting driver location-tracking features offered by ridesharing apps, asserting patents from an extensively litigated portfolio that the plaintiff previously wielded against cellular carriers in an earlier iteration of its campaign.

PTAB Update: Congress Debates Reform as USPTO Implements Its Own Changes

The Patent Trial and Appeal Board (PTAB) saw 1,188 petitions for America Invents Act (AIA) review in 2023, including 1,154 petitions for inter partes review (IPR) and 34 petitions for post-grant review (PGR). Filings were 12.5% lower than in 2022, which saw 1,358 petitions.

In the fourth quarter, 278 petitions for AIA review were filed with the PTAB, including 270 IPR petitions and eight PGR petitions. Filings in Q4 were 15.8% lower than Q4 last year (when 330 petitions were filed) but were 5.3% higher than in Q3 2023 (which saw 264 petitions).

Meanwhile, the AIA institution rate was 69% in 2023, climbing slightly from 68% the year before. However, the institution rate was 66% in the fourth quarter, falling from 69% in Q4 2022.

Reform Measures Debated and Implemented in 2023

A recurring debate throughout 2023 has been a familiar one, spurred on in part by a series of changes implemented by USPTO Director Kathi Vidal: whether the PTAB needs reform, and if so, what measures should be taken. Among the measures under consideration is a legislative proposal: the Promoting and Respecting Economically Vital American Innovation Leadership (PREVAIL) Act, introduced in July. The bill would make a series of significant changes favored by some patent holders, including the imposition of a standing requirement (limiting who may file a PTAB petition), the further expansion of IPR estoppel (requiring that defendants choose between challenging validity at the PTAB or in district court), and new restrictions on the filing of multiple petitions against the same patent. The PREVAIL Act would also require the PTAB to use the same, higher evidentiary standard as district courts for a showing of invalidity, mandate that the Board use the same claim construction standard as district courts, and bar the USPTO director from influencing the outcome of PTAB decisions (though Vidal implemented interim rules to this effect in May 2022 and has recently proposed final rules to formalize the practice).

The Senate IP Subcommittee held a hearing on the PREVAIL Act in early November. Witnesses offered competing takes on the proposal, possibly reflecting the lack of broader consensus that has hamstrung similar bills in the past. Representative Lamar Smith (R-TX), the House cosponsor of the AIA, argued that IPR has come to be used inconsistently with the intent behind the law that created it and that changes should be made to ensure that IPR operates as an alternative to, not in addition to, district court litigation. In contrast, Joseph Matal, who previously performed the duties of the USPTO director (essentially, though not formally, serving as acting director), pushed back on points made as to the PTAB’s alleged hostility to patents. Matal also asserted that while some limits are appropriate to prevent gamesmanship, the proposed bill goes too far—objecting to particular changes, including limits on estoppel, the imposition of a heightened evidentiary standard, and the creation of a standing requirement, among others. Additionally, AIA review practitioner Michelle Armond offered her own, more data-focused take on outcomes at the PTAB now that they have “settled down” and expressed support for reassessing the burden of proof and provisions related to “duplicative litigation”.

While it is far from a given that any legislative proposal will gain enough traction to become law, the USPTO itself has been making a series of refinements in response to stakeholder feedback. One of the most significant has been a revamp of the interim director review process, which was created in June 2021 in response to the Supreme Court’s mandate in Arthrex that the USPTO director must have the authority to revisit PTAB validity decisions.

In its original form, the director review process existed alongside the PTAB’s Precedential Opinion Panel (POP), a body created under former USPTO Director Andrei Iancu in September 2018 that was tasked with deciding issues of “exceptional importance” to the PTAB. Yet as the director review program evolved alongside the POP, Vidal later remarked that the two processes had come to operate essentially “backwards”: The POP could set precedent for the PTAB but was not set up to correct errors by PTAB panels, a function that was handled far more, as a result, by the director—a task that Vidal suggested had been preventing her from spending enough time on more important policy issues. In July, the USPTO eliminated the POP as part of a broader revamp of the director review process—replacing it with the Delegated Review Panel, an “independent panel” to which the director may delegate the review of PTAB decisions for various reasons, including legal and factual errors. The revised process additionally gives parties the ability to request director review of institution decisions for the first time, though on a narrower basis than for final written decisions.

The USPTO is also considering some of the same changes proposed in the PREVAIL Act. In April, the agency released a sweeping Advance Notice of Proposed Rulemaking (ANPRM) that, among a variety of possible reforms, includes a proposed standing requirement, here based on an expanded view of corporate relationships as well as certain exceptions concerning business models. The ANPRM would also codify certain aspects of the PTAB’s existing practices regarding the discretionary denial of petitions based on the status of parallel proceedings—as governed by the NHK-Fintiv rule—with new exceptions allowing petitioners to sidestep discretionary denials for petitions showing “compelling merits” and those filed within six months of the service of an infringement complaint (as opposed to the one-year time bar currently required by statute). Public comments submitted in response to the ANPRM reflect a lack of consensus on these and other issues, with some stakeholders arguing that the above changes in particular would violate the AIA and thus exceed the agency’s rulemaking authority.

More on these reform proposals can be found on RPX Insight.

Reexam Filings Swing Back Upward

Some stakeholders have argued that the NHK-Fintiv rule introduces too much uncertainty into the AIA review process, by conditioning institution on factors like district court trial timing that are out of the petitioner’s control. One of the early results of this uncertainty was a shift by frequent defendants from AIA reviews to ex parte reexaminations, which are not subject to discretionary denials to the same extent. The number of reexam requests went up by 21% in 2020 and then by 53% in 2021, with an increasing share of those patents having previously been litigated in district court and subjected to PTAB challenges—together, indicating that this prior uptick was the result of NHK-Fintiv. Yet reexam requests began to fall in 2022 as PTAB discretionary denials also dropped, in part due to a June 2022 guidance designed to address certain criticisms of NHK-Fintiv.

However, the data now indicate that reexams are on the upswing again: Filings have increased each quarter this year, with Q4 2023 outpacing that same quarter last year by 25% (though the full year came in slightly below 2022 by number of requests filed). Moreover, while the share of reexam-requested patents that were previously challenged before the PTAB fell last year, from 33% to 24%, the share of patents previously litigated in district court went up, from 59% to 61%—suggesting that reexams remain an attractive tool for at least some defendants.

FRAND Update: China’s First Global FRAND Determination; UPC Ruling Could Favor NPEs and SEP Owners

China: Chongqing Court Imposes Global License

The fourth quarter also saw a key development in the ongoing jurisdictional back-and-forth between national courts over international FRAND claims. In early December, local media reported that the Chongqing Intermediate People’s Court had become the first Chinese court to set the terms of a global fair, reasonable, and nondiscriminatory (FRAND) license, doing so in litigation filed by Nokia against Oppo. The decision comes over two years after China’s Supreme People’s Court became the second national court, following the UK Supreme Court, to assert the power to do so on a global basis, though the litigation in that case—Sharp v. Oppo—settled before the case reached the FRAND determination stage.

While the full Nokia v. Oppo decision has not yet been officially published, the judgment (as described by IAM, via local reporting) establishes lower licensing rates for 4G and 5G devices sold in mainland China and other “price-sensitive” or “lower GDP” countries than for devices sold in other countries, based on a top-down approach (which, generally speaking, contemplates the patent owner’s share of a calculated aggregate royalty that encompasses all patents covering the standard at issue). Those reports indicate that the rates set by the court are lower than those published by the patent owner, which has publicly announced its intent to appeal—the company stating that the ruling’s “impact is limited to the Chinese jurisdiction only and as such represents only one view”.

Although this is far from the first SEP dispute with litigation spanning multiple other countries, it is notable because at least one of those additional cases—a parallel action in the UK—could lead to a second, potentially conflicting global FRAND determination. The UK action has proceeded alongside the Chongqing one, the former court having rejected the defendant’s motion to stay the case pending the outcome of its Chinese counterpart. In July, the UK High Court—having already issued an infringement ruling—held that the defendant would have to accept FRAND license terms to be determined by the court in order to prevent a UK injunction, rejecting the defendant’s argument that it could avoid this requirement based on its commitment to accept the outcome of the Chongqing case. However, while the court has since imposed an injunction, its implementation has been stayed due to the pending appeal in that case, which has also led to the postponement of a FRAND determination trial that had been scheduled for October.

A third parallel case between the parties is also playing out in India before the Delhi High Court, which had reportedly offered the parties the chance for a global FRAND determination from that court as well—the first time that an Indian court had expressed the willingness to set the terms of a global license. However, the court’s proposal would have required the parties to respectively withdraw the UK and Chongqing suits, and only the patent owner had agreed to do so (for the UK action). With the prospect of that court spearheading a global resolution apparently no longer an option (the court having since found that “it is clear the Defendants are not willing for a global FRAND rate to be determined by this Court”), the court has turned its attention to the Chongqing order. On December 18, Justice Prathiba Singh ordered the parties to obtain the unredacted decision from their Chinese counsel for the court’s review, noting that the decision purportedly includes rates for India but had yet to be publicly released (a common scenario in Chinese litigation).

Time will tell if the UK court ultimately does issue its own global FRAND determination, and if the UK and Chinese rulings then both survive on appeal. If so, the likely conflicts between those orders could trigger a newfound jurisdictional battle between the two courts, one that potentially could take the form of a new round of antisuit injunctions (ASIs), which block the litigation of parallel proceedings in another country’s courts—a step that Chinese courts do not appear to have taken since late 2020.

UPC: Early Filings Include OpCo SEP Suits; Ruling Could Allow NPEs to Win Preliminary Injunctions

Another key milestone this year was the June launch of the Unified Patent Court (UPC), a European Union (EU) venue for infringement and validity actions with jurisdiction over 17 participating EU member states. The UPC has the authority to impose both damages and injunctions spanning all 17 countries, making the new court a powerful tool for patent owners. Early data reflect a small but growing number of cases that were filed in the court’s first several months in operation: Numbers presented in early December by Dr. Klaus Grabinski, President of the UPC Court of Appeal, indicate that plaintiffs have filed 57 actions for infringement as of November 17, 2023.

As RPX has previously noted, the UPC’s jurisdiction over SEP matters is somewhat narrower than national courts, as litigants may not raise FRAND defenses in affirmative complaints and may only do so through counterclaims. Nevertheless, that initial batch of cases has included some notable FRAND litigation, totaling at least 18 SEP cases (as reported by IAM in early December). Each of those SEP suits has been filed by an operating company patent owner as part of a broader, multijurisdictional litigation strategy. Those filed closer to the court’s launch (including Wi-Fi 6 networking litigation filed by Huawei and Qi wireless charging litigation from Philips) joined previously filed cases in other venues, while more recent enforcement efforts (cellular networking litigation filed by Panasonic and video codec litigation from Amazon) included UPC actions from the get-go.

Apparently absent from the list of initial UPC plaintiffs are entities solely focused on patent assertion. RPX has previously observed that the principals behind some familiar NPEs, including Acacia Research Corporation, Harfang IP Investment Corp., and Dominion Harbor Enterprises, LLC, had expressed optimism about the court in the leadup to its launch but indicated that their firms would follow a wait-and-see approach.

While NPEs may still be waiting to dip their toes into UPC waters, such plaintiffs got some good news from one of the court’s first decisions on injunctive relief. In mid-September, the UPC’s Munich Division granted a preliminary injunction in litigation filed by the President and Fellows of Harvard College and licensee 10x Genomics, rejecting an argument by defendant NanoString Technologies that Harvard, as an NPE (albeit, one filing alongside an operating company licensee), lacks a “legitimate interest” in enforcing a preliminary injunction because as a licensor it only sought monetary damages. Not so, countered the UPC, holding that the relevant provision of the UPC Agreement “shows that the status as an NPE in itself has no significance for standing to file an application” for preliminary relief.

Additionally, at least some practitioners have argued that certain other aspects of the 10x Genomics decision could also enable preliminary injunctions in SEP matters—historically seen as an unlikely proposition in countries like Germany and France due to the complexity of such litigation. For example, as noted by attorneys from Simmons & Simmons, the UPC Munich Division adopted an apparently more permissive view of the “urgency” requirement (mandating that an applicant not unduly delay its motion for a preliminary injunction) for litigation asserting unitary patents, a new type of European patent that can only be asserted at the UPC. Even though the plaintiff had been aware of infringement since 2022, the UPC held that this requirement was satisfied because the asserted unitary patent could not have been litigated before the court began its operations in June 2023. This could benefit SEP owners “with large patent portfolios with pending patent applications”, since unitary patents can issue relatively quickly—“making swift action in summary proceedings a viable option”. Also potentially beneficial for SEP owners was the fact that the UPC was willing to address more complicated legal issues like antitrust law, a license defense, the application of foreign law, and “economic valuations”—all of which could be implicated by a FRAND defense—at the preliminary injunction stage.

Patent Market Update: More Third-Party Backed Litigation; Lit Funders Announce a Secondary Market Transaction Involving IP Investments; $49M Litigation Budget Detailed in Complaint Against Longford

RPX research has tied multiple litigation campaigns started in Q4 2023 to specific third-party litigation funders, with targeted defendants spread across market sectors including Mobile Communications and Devices, Networking, E-Commerce and Software, and Consumer Electronics and PCs. RPX members can access a summary of those new campaigns here.

Lit Funders Announce a Secondary Market Transaction Involving IP Investments

In December, publicly traded litigation finance firm Omni Bridgeway announced that it had completed the sale of a 25% interest in a portfolio of 15 IP investments to another litigation funder, GLS Capital. While this type of deal is not entirely novel—for example, Gerchen Capital Partners raised a $750M fund focused on buying positions in existing legal investments—the Omni Bridgeway-GLS transaction is particularly notable in light of the funders’ prominent positions in the patent monetization space.

Generally considered to be one of the world’s largest litigation finance firms, Omni Bridgeway (f/k/a IMF Bentham Limited) is also one of the earliest known investors in US patent litigation, and its focus on the practice reportedly remains strong. In a 2023 investor presentation, the firm identified IP litigation as the fastest area of growth in its portfolio of investments, with IP representing 12% of new commitments compared to 7% two years ago. Public records associate Omni Bridgeway with several active patent litigation campaigns; more details are available here.

GLS, on the other hand, is a new entrant to litigation finance, having been formed in 2018 by three former Burford Capital employees. In 2020, GLS announced that it had raised $345M for its inaugural litigation finance fund, GLS Capital Partners Fund I, LP. The firm reports having a “diverse institutional investor base” that includes “global financial institutions, endowments, foundations and family offices”.

In 2021, GLS revealed that its subsidiary Celerity IP, LLC—an IP management company led by patent monetization veterans Chad Hilyard and Tim Berghuis—had been made the exclusive agent for the licensing and litigation of two portfolios of declared SEPs originating with ASUSTek.

2023 saw Celerity kick-off its litigation efforts, the plaintiff first suing LG Electronics in June, followed by Samsung in September, and finally, a trio of wireless carriers via multiple suits filed against each in October. For an entry point into Celerity’s ongoing campaign, see “Celerity IP and Its ‘Partners’ Dial Each of the Three Major US Wireless Carriers Twice” (October 2023).

According to an ASX announcement filed on December 11, Omni Bridgeway sold a 25% interest in a portfolio of 15 IP investments from its Fund 4 to an affiliate of GLS Capital Partners Fund II, LLC for an initial amount of $21.5M, “representing a multiple on invested capital (MOIC) of 2.0x of the apportioned aggregated deployments to date”.

GLS will now receive a preferred return on the investments, with Omni Bridgeway also retaining certain profit rights on the 25% interest. Per Omni Bridgeway, the total committed capital of the transacted investments is $104.4M, with total deployed capital of $42.9M, and the full estimated portfolio value of the investments was $3.3B as of September 30, 2023.

$49M Litigation Budget Detailed in Complaint Against Longford

Also in December, Arigna Technology Limited, one of more than a dozen plaintiffs associated with Dublin-based patent monetization firm Atlantic IP Services Limited, filed a complaint for declaratory judgment against litigation finance firm Longford Capital. Surprisingly, a complete and unredacted copy of a funding agreement between Longford and Arigna’s litigation counsel, Susman Godfrey, LLP, was included as an exhibit to Arigna’s December 18 complaint (which has since been sealed), providing a look at the budget for an expansive patent litigation effort that has targeted automotive makers as well as mobile device makers across multiple venues in the US and Germany.

The debate over disclosure of third-party litigation funding is approaching a boiling point, with certain industry groups and lawmakers calling for increased transparency—and some judges and courts now explicitly requiring it. Yet, the proposed and newly instituted disclosure requirements largely focus on relationships between litigants and funders, not law firms and funders.

The funding agreement between Susman and Longford, two established and familiar faces in the IP space, should serve as a reminder that the practice of law firm funding does indeed exist. Further, this once novel practice may become more widespread as attorneys feel pressure to consider models that—in least in theory—offer their clients a lower cost of capital and their firms the opportunity to offload some of the financial risk inherent to litigation.

The dispute between Arigna and Longford should likewise serve as a reminder that as the number of parties invested in the outcome of the litigation rises, so does the potential for complications, including complications serious enough to spawn litigation of their own.

RPX will continue to monitor this trend closely; in the meantime, members can access a Q4 2023 RPX Community webinar focused on litigation funding, including law firm funding, here, with in-depth coverage of Arigna’s lawsuit and the underlying agreements available here.

Additional RPX Patent Market Intelligence

For further analysis and up-to-date information on patent litigation and market trends, visit RPX Insight.