Q2 in Review: Proposed PTAB Reforms Spark Debate as UK Court Doubles Down on SEP Approach

July 11, 2023

NPEs filed 34% less patent litigation in the first half of 2023 than they did during the same period last year. However, that downturn was again largely the result of two key developments in 2022: a prolonged pause in litigation from a once-prolific litigant, and a judge assignment order targeting Western District of Texas Judge Alan D. Albright that caused a drop in NPE litigation in the Waco Division.

Meanwhile, the USPTO has caused a significant controversy through a rulemaking proposal that could dramatically reshape Patent Trial and Appeal Board (PTAB) proceedings, as stakeholders from across the spectrum weighed in on potential changes to discretionary denial practices. Additionally, the US Supreme Court has declined to overturn a 2022 ruling that broadened the circumstances under which PTAB petitioners are barred from later raising certain invalidity arguments in parallel district court litigation.

Q2 also saw the UK High Court issue its Optis v. Apple decision, the second time this year that the first-instance court has rejected a standard essential patent (SEP) licensor’s damages case and imposed a global fair, reasonable, and nondiscriminatory (FRAND) license with rates far closer to those sought by the licensee. Another landmark event in Europe was the June 1 launch of the Unified Patent Court (UPC), a single judicial body with jurisdiction over infringement and invalidity claims spanning up to 17 EU member states. While structural limitations limit parties’ ability to bring FRAND claims there, the appeal of a single court with such a broad reach has nevertheless led some NPEs to eye the UPC with interest.

Finally, Catapult IP Innovations Inc. attempted in Q2 to unwind BlackBerry’s $200M patent sale to Malikie Innovations Limited, with recent interest rate hikes possibly playing a part in the completed deal’s economics. Those interest rate hikes—and multiple regional bank collapses during the quarter—also signal potential changes to IP financing in the future. Meanwhile, RPX research and public records tie at least eight patent litigation campaigns launched during the second quarter to third-party litigation funders.

RPX members will also soon have exclusive access to a live RPX Community webinar covering highlights from this post; CLE credit may be available.

Litigation Update: NPE Activity Down in 1H 2023, Though Largely Due to IP Edge Pause and Waco Dip

Venue Update: East Texas Jumps Back to First Place as West Texas and Delaware Downturn Continues

Market Sector Update: Consumer Electronics and PCs Saw the Most NPE Activity in Q2

Litigation Update: NPE Activity Down in 1H 2023, Though Largely Due to IP Edge Pause and Waco Dip

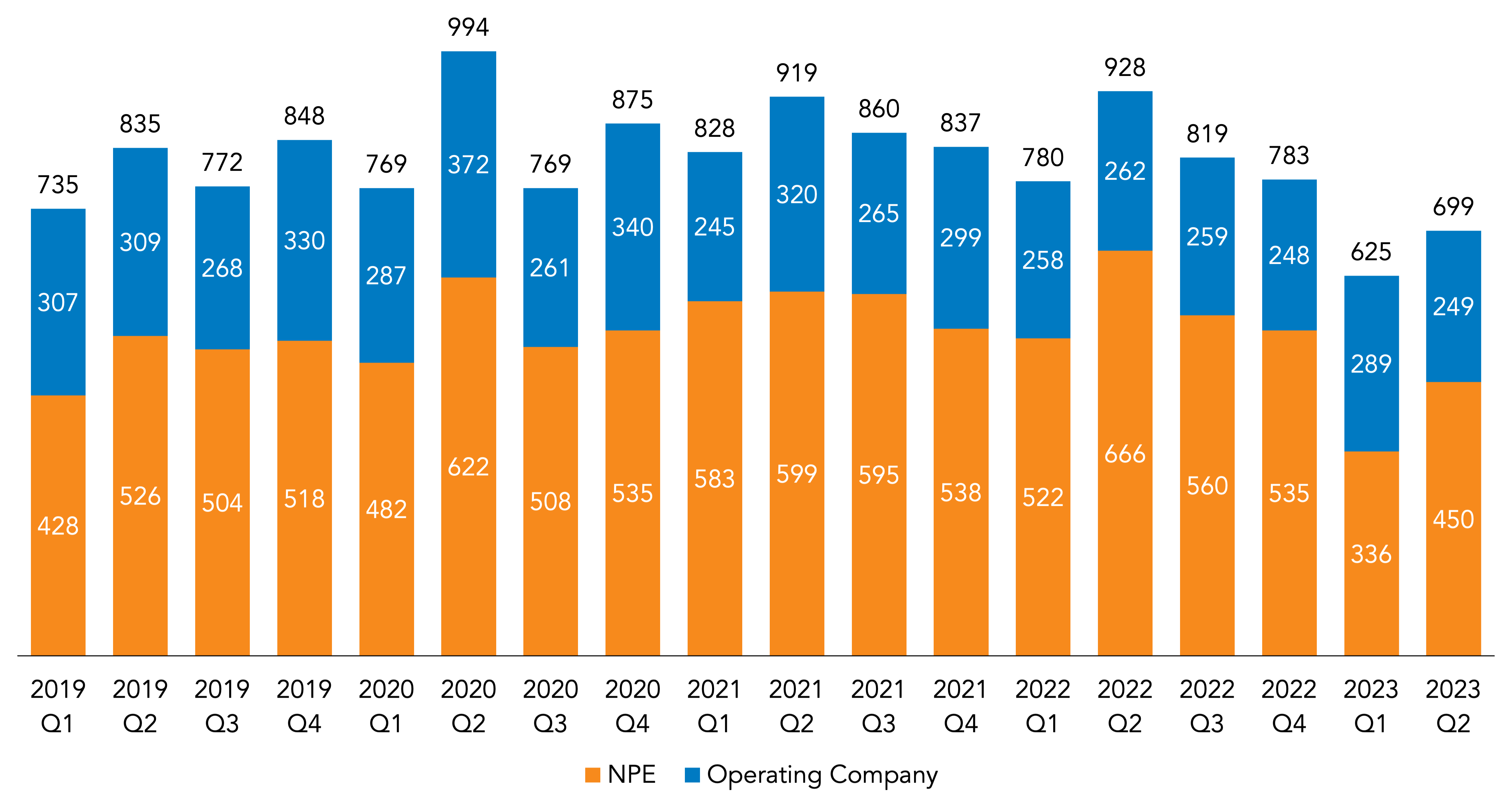

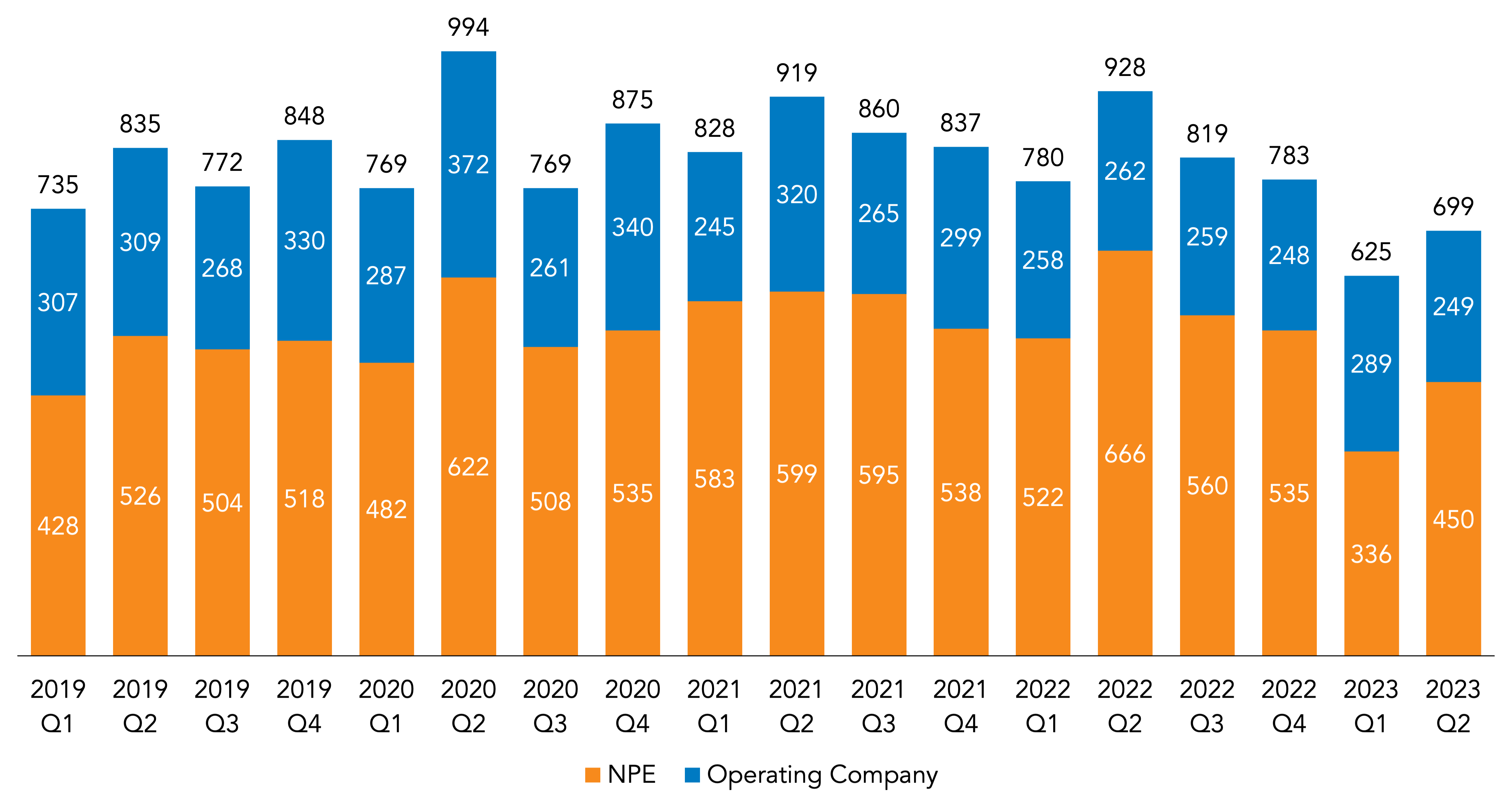

NPEs added 786 defendants to patent litigation campaigns in the first half of 2023, a 34% decrease from that same period last year (when NPEs added 1,188 defendants). Operating company litigation, in contrast, held fairly steady in the first half of this year, at 538 defendants added—exceeding 1H 2022 by 18 defendants (or 4% greater).

In the second quarter of 2023, NPEs added 450 defendants to patent campaigns, a decrease of 216 (32%) compared to Q2 2022, when NPEs added 666 defendants. NPE litigation was 28% below the trailing three-quarter average for 2020-2022 but 34% more than in Q1 2023.

Operating companies added 249 defendants in Q2, which was just 5% lower than the year-ago quarter, though it fell short of the trailing three-quarter average by 22% and lagged behind Q1 by 14%.

| Defendants Added | Change Compared to: | ||||

| Q2 2023 | Q2 2022 | Q2 2020-2022 Average | Q1 2023 | ||

| NPE | 450 | -32% | -28% | 34% | |

| Operating Company | 249 | -5% | -22% | -14% | |

| Total | 699 | -25% | -26% | 12% | |

Two primary developments continued to drive the decline in NPE litigation through the first half of the year. The most significant was a pause in litigation by patent monetization firm IP Edge LLC, which used to be the most prolific plaintiff by a large margin but stopped filing new litigation in December 2022—apparently as a result of still-ongoing pressure from Delaware Chief Judge Colm F. Connolly over disclosure rules that he imposed in his courtroom in April 2022 (as detailed further below). IP Edge usually added 50 defendants per month before that pause, so while it added 302 defendants in the first half of 2022, there were virtually none in 1H 2023 (apart from a single refiled complaint in one IP Edge campaign that was quickly dismissed). Put another way, three quarters of the decline in NPE litigation during that period (or 301 out of a drop of 402 defendants) is attributable to IP Edge alone. Excluding IP Edge, NPE litigation in 1H 2023 was down by just 11% compared to the same period a year ago.

The second development was a downturn in the Western District of Texas—in particular, within the Waco Division, which has experienced a drop in newly filed NPE litigation in the wake of a July 2022 standing order designed to undercut the concentration of patent cases before District Judge Alan D. Albright. Filing rules previously allowed plaintiffs to target his courtroom by letting them bring cases directly in Waco (where Judge Albright is the only district judge), but the July order required patent filings in that division to be randomly assigned among a group now consisting of 11 judges in total (including Judge Albright). While the district has since taken to assigning new cases in existing campaigns (those with the same parties and patents) to the previously presiding judge, meaning that Judge Albright has gotten the lion’s share of new cases in those “legacy” campaigns, assignment of suits filed in entirely new campaigns has been far more random. This dispersion has apparently undercut the district’s overall appeal for NPE plaintiffs, which added 187 defendants in Waco in 1H 2023, compared to 400 in 1H 2022 (a 53% drop).

Added together, the reductions from IP Edge and in Waco (457 defendants in total, adjusting for the overlap in IP Edge and Waco cases) accounted for 100% of the decline in NPE activity in the first half of the year and then some. The story was similar in Q2 2023, when IP Edge’s pause and the drop in Waco filings were, in combination, responsible for over 100% of the decline compared to the year-ago quarter.

Additionally, the operating company data above leave out another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e-seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to what one might consider the usual patent suit. These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts or aliases for the same ultimate parent. Also, plaintiffs primarily seek injunctive relief instead of damages, and their cases often end with the e-seller defendant’s failure to answer, followed by a default judgment.

This category of litigation, which began to spike in Q3 2020, is shown in grey below to illustrate its magnitude. As evident from the rightmost bar, e-seller litigation in Q2 2023 accounted for 3,069 defendants added, or 82% of all litigation during the quarter (though note that this number is subject to the caveat about defendants with multiple online storefronts outlined above).

Apart from the following graph, the remaining analyses in this report exclude pure design patent and e-seller litigation.

Venue Update: East Texas Jumps Back to First Place as West Texas and Delaware Downturn Continues

The Eastern District of Texas was the top district for overall litigation and NPE litigation in Q2 2023, jumping from third and second place, respectively, with the Western District of Texas trailing in second place in both categories. Delaware, meanwhile, fell from first to third place for overall litigation, remaining in the number-three spot for NPE filings, though the district is still the most popular venue for operating company cases.

Delaware’s downturn is largely the result of an ongoing “Series of Extraordinary Events” in the courtroom of Chief Judge Colm F. Connolly. As noted above, Judge Connolly has been pressuring a group of plaintiffs, particularly those tied to IP Edge, over their apparent lack of compliance with heightened disclosure requirements that he imposed in April 2022. As he has forced more and more of those plaintiffs to reveal details on their corporate control, assets, and legal representation, Judge Connolly has expressed increasing concerns that IP Edge’s unusual entity formation strategy—under which the firm has named individuals with no prior experience in patent assertion as the managers of entities under its apparent control—is part of a “fraud upon the court” designed to shield IP Edge and its principals from liability.

As an apparent result of that pressure, IP Edge stopped filing in Delaware after the end of September, before ceasing its litigation altogether after November. As IP Edge had consistently accounted for the bulk of Delaware’s NPE litigation since Q3 2020, the district’s numbers took a tumble and have not rebounded since. For instance, IP Edge plaintiffs accounted for nearly 70 of the roughly 120 defendants added by NPEs in Delaware in the second quarter last year—and in Q2 2023, NPEs (this time not including IP Edge) added just 34 defendants there.

Late last year, Judge Connolly took matters a step further for several of those IP Edge plaintiffs by ordering them to produce a ream of materials relevant to those issues, in each instance triggering an extended fight over the propriety of the orders: One (Nimitz Technologies LLC) asked the Federal Circuit to intervene, while three more (Backertop Licensing LLC, Lamplight Licensing LLC, and Mellaconic IP LLC) moved the district court to set aside the orders against them, all unsuccessfully—each raising a similar host of objections, including claims of overbreadth and that the court had sought the production of materials covered by the attorney-client privilege and/or the attorney work product doctrine.

The past few months have seen Judge Connolly dig even further into this issue after reviewing materials produced by some of those entities. In particular, this review led him to grill the two attorneys of Backertop Licensing—who have been seeking (thus far without success) to withdraw from the case—over the inadequacy of the NPE’s production, in a June in-person hearing that revealed further details bearing on the court’s concerns over the underlying IP Edge monetization framework that brought these cases to his courtroom. Judge Connolly’s concerns over the materials already produced also prompted him to order Backertop’s sole owner, a Texas paralegal with no prior involvement in patent monetization, to appear before him in person. That owner’s attempts to avoid an in-person hearing, citing personal and professional obligations, have led to an escalating dispute in which Judge Connolly sent materials related to the case to her law firm employer—triggering accusations that Judge Connolly was engaging in gender discrimination.

Meanwhile, the top patent judge in Q2 2023 was Eastern District of Texas Judge Rodney Gilstrap, who used to oversee the bulk of the nation’s patent litigation in the days before the US Supreme Court’s decision limiting patent venue in TC Heartland. In second place was Western District of Texas Judge Alan D. Albright, who held the top spot every quarter since Q3 2019 until losing it in Q1 2023, as a result of the aforementioned changes in Waco.

While Judge Albright has not seen as much NPE litigation as in quarters past, he has maintained the same approach to certain substantive issues that previously drew plaintiffs to his courtroom. For instance, Judge Albright has tended to deny contested motions to stay pending the outcome of PTAB proceedings—with a recent ruling indicating that not just motions to stay pending IPR, but also those pending ex parte reexamination, have a low probability of success in his courtroom.

Judge Albright has also continued to spar with the Federal Circuit over the proper handling of convenience transfers, which he has often denied since taking the bench in 2018. As noted in RPX’s prior coverage, the court has repeatedly reversed him on that issue starting in 2020, identifying a series of recurring legal issues in his orders applying the relevant transfer factors. Some had expected the Fifth Circuit’s October 2022 In re: Planned Parenthood ruling to tip that back-and-forth in Judge Albright’s direction, since that decision appeared to require more deference to district judges on venue. This February, though, the Federal Circuit held otherwise, doubling down on its prior approach in In re: Google. Judge Albright has since acknowledged the binding impact of that holding, though not without offering a passing criticism. In refusing to reverse a prior order granting transfer of a Motion Offense, LLC case against Alphabet (Google), Judge Albright remarked that the Federal Circuit’s determination in Google that NPEs lack an interest in getting cases to trial quickly “appears to be made out of whole cloth”.

Market Sector Update: Consumer Electronics and PCs Saw the Most NPE Activity in Q2

The top market sector for NPE litigation in Q2 2023 was Consumer Electronics and PCs, accounting for 26% of new defendants added to patent litigation campaigns. E-Commerce and Software saw the second highest amount of NPE litigation in the second quarter, followed by Networking, Financial Services, and Consumer Products.

A wide variety of NPE plaintiffs hit the Consumer Electronics and PCs sector in Q2 2023—among them a number of familiar patent monetization and licensing firms. For instance, Empire IP LLC’s IoT Innovations LLC added a set of new complaints targeting home alarm and/or security systems and related products to the campaign it launched last November, asserting patents acquired from Intellectual Ventures LLC (IV). IV itself also joined the fray in April via subsidiaries Intellectual Ventures I LLC and Intellectual Ventures II LLC, filing a fresh group of cases to a campaign it has waged since late 2011—here suing makers of a wide array of devices, ranging from access points to smartphones that include certain processors and memory and that support various Wi-Fi networking standards. Another firm targeting Wi-Fi products was Acacia Research Corporation, which in May further expanded the campaign in which subsidiary Atlas Global Technologies LLC has been asserting patents from its Wi-Fi 6 portfolio, this time training those patents on laptops and desktops supporting that standard. Meanwhile, Longitude Licensing Limited—a subsidiary of patent advisory firm IPValue Management (d/b/a IPValue), itself held by Vector Capital Corporation—brought more litigation hitting this sector throughout the quarter, targeting a variety of devices incorporating liquid crystal display (LCD) devices, panels, and/or modules in June and certain smartphone image processing tools in April. SmartWatch Mobileconcepts LLC, an NPE affiliated with monetization firm Dynamic IP Deals (d/b/a DynaIP), filed a second round of cases in May, targeting smartwatches with biometric authentication, in the campaign it started last June. Additionally, computing products that include hard disk drives, solid-state hybrid drives, and dual-drive hybrid systems were at issue in complaints filed in April and May by Elite Gaming Tech, LLC, an entity linked to Alpha Alpha Intellectual Partners LLC.

A variety of other interrelated NPEs also filed litigation in this space last quarter—including two plaintiffs apparently associated with a familiar figure in patent monetization, a former inventor who in recent years has shifted to the assertion of patents acquired from others. Most recently, Multimodal LLC kicked off a new campaign in June (see here and here), targeting the provision of smart locks equipped with fingerprint sensors; while the other, Gametronics LLC, initiated its own campaign earlier in the month, training its sights on gaming controllers with joysticks. Also starting its first campaign was Wildcat Licensing LLC, which started the third litigation campaign that has been linked to another familiar individual, an Illinois attorney, in June, focusing on drones with features related to obstacle avoidance, waypoint navigation, and/or orthophoto (geographical photo) capture. Moreover, Freedom Patents LLC—a plaintiff linked to a growing web of other NPEs controlled by a Texas patent attorney—initiated a campaign in April over MIMO Wi-Fi technology, adding more suits in May.

The second quarter also saw NPEs hit the Consumer Electronics and PCs sector with the backing of third-party funders. Among those plaintiffs were Polaris PowerLED Technologies, LLC, which began a third campaign in May with the disclosed backing of a prominent litigation funder. Moreover, CogniPower, LLC, which expanded its campaign over power adapters and chargers in April, has filed disclosures indicating that it has received funding from another notable litigation finance firm—one that has recently launched a campaign of its own through a subsidiary (filing as coplaintiff along with the asserted patents’ licensee).

RPX members can also access an overview here that covers other Q2 NPE litigation with third-party backing, including campaigns outside this sector.

PTAB Update: USPTO’s NHK-Fintiv Rulemaking Proposal Garners Controversy; Courts Clarify Estoppel Rules

The Patent Trial and Appeal Board (PTAB) saw 302 petitions for America Invents Act (AIA) review in the second quarter of 2023, including 297 petitions for inter partes review (IPR) and five petitions for post-grant review (PGR). Filings were down by 14% compared to Q2 2022, which saw 352 petitions filed; and down by 12% compared to the preceding quarter, during which 345 petitions were filed.

The PTAB instituted trial for 68% of the AIA review petitions addressed in Q2, down from that same quarter last year (during which the institution rate was 71%) but up from the preceding quarter (65%). The institution rate held steady for the first half of 2023, at 67% (the same as 1H 2022).

One of Q2’s most important institution-related developments came in April, when the USPTO released an Advance Notice of Proposed Rulemaking (ANPRM) that detailed a potentially sweeping revamp of AIA review proceedings. Through that ANPRM, the agency sought comments on rules that would codify and possibly expand upon a variety of discretionary denial practices currently followed under the NHK-Fintiv rule, exempt petitions from such denials if they meet a new “compelling merits” standard, and impose sweeping requirements with respect to party relationships and mandated disclosures, among other changes.

The proposal has proven controversial across the spectrum. As reflected in some of the numerous comments submitted by the June 20 deadline, a large group of licensees and industry organizations, and even some licensors, have argued that certain aspects of the USPTO’s proposal overstep the boundaries set by the AIA. Especially controversial was the “compelling merits” standard, which a host of licensees criticized as effectively overriding the default “reasonable likelihood” standard applicable at institution with a higher one, in violation of the statute. Even some stakeholders engaged in patent licensing and assertion, as well as certain industry groups, argued that the standard introduces too much uncertainty due to its apparent subjectivity, has too much potential for arbitrary enforcement, and could possibly trigger a wave of additional litigation in each proceeding.

Another area of focus for commenters were provisions related to standing—i.e., what types of entities may and may not file PTAB petitions—based on an expanded view of corporate relationships and certain exceptions concerning business models. In particular, the ANPRM floats a potential new “substantial relationship” test that opponents argue could result in a far greater range of parties than just a petitioner’s real party-in-interest or privy being bound by the outcome of prior petitions. That test would in part cover instances where “multiple entities are defending infringement claims in district court litigation”, under which the USPTO notes that parties may pool their resources to file a single challenge to a patent, and might also bar certain third-party organizations from filing IPRs.

This aspect of the ANPRM has also attracted extensive pushback, as shown by comments submitted in response—some of which argue that the “substantial relationship” test would violate the AIA, as the statute does not include a standing requirement (which was initially considered but rejected for the final bill). Some arguing from the licensee/petitioner side have further contended that this test is problematic for its breadth; Amazon, for instance, argues that it encompasses “at least litigation co-defendants and parties that are in a supplier-customer relationship”. Others, including Apple, Ciena, and Red Hat, have asserted that the rule could encourage gamesmanship by incentivizing patent owners to target under-resourced alleged infringers, in the hope that those companies would file inadequate and thus unsuccessful IPRs that would then reduce the options of subsequent defendants to challenge the same patents’ validity at the PTAB.

See RPX Insight for a deep dive into these and other issues addressed in comments responding to the ANPRM.

Reexam Filings Continue to Dip in the Wake of the USPTO’s June 2022 NHK-Fintiv Guidance

One particularly notable result of the uncertainty caused by NHK-Fintiv was a shift by frequent defendants from AIA reviews to ex parte reexaminations, which are not subject to discretionary denials to the same extent. The number of reexam requests went up by 21% in 2020 and then by 53% in 2021, with an increasing share of those patents having previously been litigated in district court and subjected to PTAB challenges—together, indicating that this prior uptick was the result of NHK-Fintiv.

However, discretionary denials began to fall in 2021, according to a USPTO study, and RPX data indicate that they remained lower in the wake of a June 2022 guidance designed to address criticisms of the NHK-Fintiv rule (and upon which portions of the April 2023 ANPRM are based). Among other changes, the guidance established that for the NHK-Fintiv factor allowing discretionary denial based on the proximity of a district court trial date to the PTAB’s final written decision, the Board may consider data on actual time to trial, possibly blunting objections that scheduled dates (which previously formed the sole basis for this factor) are too speculative of a metric. The guidance also endorsed a series of existing practices allowing parties to stipulate around certain NHK-Fintiv factors by agreeing to be estopped by their petitions.

As those changes began to reduce the impact of NHK-Fintiv, this in turn appears to have triggered a corresponding decline in reexam filings. After one last spike in the second quarter of 2022, reexam requests dipped in Q3 (the first full quarter after Vidal’s late-Q2 guidance), plateaued in Q4, and then declined even further in Q1 2023. The drop was even steeper in Q2 of this year, which saw the lowest number of reexam requests since Q3 2020. Year-to-date reexam filings are 35% lower compared to the first half of 2022. Moreover, the share of patents at issue in those reexam requests that have also been challenged at the PTAB (25%) is also less than the numbers for 2022 (33%), though the amount of patents that have been hit with reexam requests and also litigated in district court remains relatively steady at 60% (compared to 59% last year).

Supreme Court Leaves Broadened IPR Estoppel Standard in Place

In June, the Supreme Court decline to step into a dispute over the proper scope of inter partes review (IPR) estoppel, which bars (or estops) a defendant from raising certain IPR validity arguments in subsequent district court challenges. This has been at issue since February 2022, when the Federal Circuit issued a precedential decision that significantly expanded the reach of such estoppel. In Caltech v. Broadcom, it held that a petitioner is estopped not just from later asserting arguments actually raised in a successful petition, but also from including those arguments that they “reasonably could have” included. The court’s June 26 denial of a certiorari petition from codefendants Apple and Broadcom effectively upholds Caltech with respect to estoppel.

Yet that decision is far from the last word on the issue. In addition to the proposals in the USPTO’s aforementioned ANPRM that relate to estoppel, which also include a potential requirement that parties must agree to Sotera stipulations (consenting to broader district court estoppel) to avoid discretionary denial, the Federal Circuit has since clarified other uncertainties with respect to estoppel that were not resolved in Caltech. In Ironburg Innovations v. Valve, the court addressed two underlying considerations. The first, the question over the proper standard for determining whether a party “reasonably could have raised” an argument in its PTAB petition, had not been fully dealt with before by the appellate court but was not disputed by the parties here, who both agreed with the district court that the standard covers any grounds that “a skilled searcher conducting a diligent search reasonably could have been expected to discover”. The Federal Circuit adopted this position as well, concluding that this standard correctly delineates which grounds the petitioner “reasonably could have raised” in its petition.

Second, the Federal Circuit addressed the issue of which party holds the burden of proof under this standard, noting that the district court appeared to have treated petitioner Valve as holding that burden. However, the appellate court instead agreed with the petitioner that the “burden of proving, by a preponderance of the evidence, that a skilled searcher exercising reasonable diligence would have identified an invalidity ground rests on the patent holder, as the party asserting and seeking to benefit from the affirmative defense of IPR estoppel”. The Federal Circuit treated this conclusion as “consistent with the general practice that a party asserting an affirmative defense bears the burden to prove it”.

FRAND Update: UK Court Rejects Another SEP Licensor’s Royalties Case; NPEs Eye UPC Launch with Interest

UK: High Court Issues Country’s Third FRAND Determination

One of the most notable Q2 developments related to standard essential patent (SEP) licensing came in the UK, where the High Court of Justice issued the country’s third determination of a global fair, reasonable, and nondiscriminatory (FRAND) license, this time in Optis v. Apple. The June 7 decision, released only in heavily redacted form, imposed a global FRAND rate for Optis’s 4G portfolio of $5.13M, determining that five years of payments, or $25.65M, would cover all future use; and that an additional $30.78M would cover past infringement (beginning in 2017, when Optis “first asserted themselves”)—for a total of $56.43M plus 5% annual compound interest. That interest rate is “firm but provisional”, with the final amount, plus the question of a 5G license, to be determined at a later hearing.

The licensing rate sought by Optis had reportedly been “considerably larger” than the final amount, but Justice Marcus Smith, writing for the court, rejected its proposed rate-setting methodology. In particular, the court took issue with Optis’s attempt to scale up from the benchmark royalties in the Unwired Planet v. Huawei case, finding that approach to be “utterly unreliable”—in part, due to its “apples and oranges” attempt to mix data sources, including key values based on that case’s specific evidentiary findings. The court also rejected Optis’s attempt to unpack and scale rates from a set of allegedly comparable Optis licenses, finding that the resulting valuation failed to account for the value of other portfolios with SEPs bearing on the same standard. Justice Smith further found that the licenses were unreliable because they were all with smaller companies, finding that Optis had leveraged Unwired Planet and the parties’ unequal bargaining power to obtain higher rates—rates obtained not for their resulting revenue, but for the purpose of creating comparables usable in later litigation. Justice Smith also rejected Optis’s third approach, a top-down cross-check, criticizing its failure to justify its reliance on ad valorem rates (those based on the value of devices sold) and its use of rates derived from “headline” rates. In contrast, Justice Smith found Apple’s proposed framework—broadly, calculating a stack price that gets prorated based on “the proportion of the portfolio under consideration simply by reference to size—to be in essence sound”, though he criticized its reliance on patent-by-patent examination and a smallest salable patent-practicing unit (SSPPU) approach.

Additionally, while the court found that neither Optis nor Apple had engaged in hold-up or hold-out, respectively, it took much greater issue with Optis’s conduct during negotiations. Specifically, it characterized Optis’s approach to negotiation as “inept”: It had failed to persuade Apple that its offers represented proper value, rather than just a mere set of demands for money, leading the court to conclude that Optis was not playing “hardball” so much as that “they were simply bad negotiators”. As for Apple, the court found that it had neither “failed to engage” nor “operated in bad faith”, finding that it was merely a “process-driven company”, albeit one for which its preferred FRAND negotiation framework was, in certain respects, “indefensible” or “not pragmatically possible” in the context of this dispute.

In several key respects, the Optis decision echoes the outcome of the decision earlier this year in InterDigital v. Lenovo, the UK’s second FRAND determination, in that the court set a relatively lower rate and soundly rejected the licensor’s damages case, relying heavily on comparable licenses. However, the opinions diverge in multiple respects, including the starting point from which infringement had been addressed: the InterDigital judgment accounted for all past infringement, whereas in Optis the court calculated infringement from the date when the patent owner first “asserted themselves” against Apple, as noted above. Optis also places greater focus on interest on past royalties than InterDigital, which deferred the question of whether such interest should be awarded and in what amount to a later hearing (though, as noted below, the court has since resolved that issue more conclusively). The facts in InterDigital were also distinct in various respects, including that the court found that the patent owner had not behaved as a willing licensor during negotiations.

On June 27, InterDigital saw another setback in that litigation when the court issued a follow-up judgment that declared Lenovo the overall winner, requiring InterDigital to pay the bulk of Lenovo’s costs. On the other hand, more favorable to the patent owner was the court’s ruling that Lenovo must pay interest on the $138.7M judgment in that case, applying a 4% rate compounded quarterly to arrive at $46.2M in total interest.

UPC Launches: New EU Patent Court Has Broad Reach, but Uncertain FRAND Jurisdiction

Another significant SEP enforcement milestone—and for patent litigation in the EU more broadly—was the June 1 launch of the Unified Patent Court (UPC). The UPC offers a single European venue for patent infringement and invalidity actions—those involving both SEPs and other patents—that can award damages and issue injunctions spanning up to 17 EU member states. That said, the UPC Agreement (UPCA) that led to the court’s creation does not explicitly address FRAND issues, since SEP licensing was not as significant of an issue in 2013, when the UPCA was finalized, as it is now. As a result, there are some key uncertainties with respect to the extent to which the UPC may deal with FRAND claims. For instance, as noted last year by JUVE Patent, it appears that neither patent owners nor implementers have the ability to assert independent FRAND claims, such as seeking a declaratory judgment of FRAND compliance, a judgment that a given license is FRAND, or to ask the UPC to set the terms of such a license. However, a FRAND defense could possibly be raised through a counterclaim in an infringement action, which could in turn open the door for the court to award a FRAND injunction—though is not clear whether the UPC will allow for conditional injunctions like those available in the UK (which provides for FRAND injunctions that remain effective until an adjudged infringer agrees to be bound by a court-determined license). The Global Competition Review also observes that it remains to be seen whether courts will impose more restrictive rules for injunctive relief in SEP disputes.

Early indications are that the initial round of infringement cases filed at the UPC have been from operating companies spanning a variety of different market sectors. A JUVE Patent report from late June indicates that the bulk of those cases have been filed in Germany—not a surprising development, since the UPC may apply the law of national courts, among other sources of law—with the most falling in the pharmaceutical sector. Others include a suit filed by Philips against Belkin over Qi wireless charging technology, following the filing of national proceedings in Germany; and a case filed by Ocado against AutoStore over robot-assisted automation systems, following parallel litigation filed in the UK. Another case filed by Broadcom (Avago) against Tesla targets self-driving car technology, while one filed by Huawei against NETGEAR focuses on wireless networking. Contrary to expectations, the early filings have not included SEP cases. (Note, however, that while IAM notes that it is unclear whether the Huawei suit asserts a patent it considers to be standard essential, the case is part of a broader Wi-Fi campaign involving SEPs).

Also absent from initial list are any known NPEs. With few exceptions, such plaintiffs have historically not focused much of their assertion strategies on Europe given the complexity of litigating in multiple smaller markets. However, some NPEs have expressed some preemptive interest in the UPC in the leadup to its launch—including some familiar names in the NPE space. Among them is Acacia Research Corporation; its Chief IP Officer, Marc Booth, told Managing IP last March that his company had mostly avoided Europe in the past due to the “difficulty of managing cases between different countries with different rules”, and that its last lawsuit there ended in 2019. In contrast, the single, large-market venue offered by the UPC would make litigating in Europe much easier, Booth remarked. In particular, he noted that this would make Europe its second choice, behind the US, for litigating its SEP portfolio. That said, Booth has expressed some caution, saying that while it is “inevitable” that Acacia will head to the UPC, they “might not want to be the first to jump in”. Others expressing interest in the UPC include monetization firm Harfang IP Investment Corp., which has reportedly been “planning for the UPC for a few years already”; while David Pridham, the president of Dominion Harbor Enterprises, LLC, has said he is “cautiously optimistic” about the new court.

While it is still early days for the UPC—and though it remains to be seen how long NPEs like these firms will stick to a “wait-and-see” approach—it seems likely that the prospect of NPE litigation at the UPC is a question of when, not if.

Patent Market Update: Catapult IP’s Attempt to Unwind BlackBerry Deal; IP Financing Update; RPX’s New Report on TPLF

Catapult IP’s Attempt to Unwind BlackBerry’s Patent Sale to Malikie

In early May, BlackBerry completed the sale of “substantially all of its non-core patents and patent applications” to Malikie Innovations Limited—a subsidiary of Irish patent monetization firm Key Patent Innovations Limited—for $200M in upfront and guaranteed payments, plus a profit-sharing agreement. The deal closed roughly 16 months after BlackBerry announced a tentative agreement to sell the same portfolio to York Eggleston’s Catapult IP Innovations Inc.—which is now seeking to compel Malikie to participate in an arbitration against BlackBerry.

The Catapult deal would have provided BlackBerry with $450M up front and a $150M promissory note, but it ultimately fell apart when Catapult was unable—or perhaps took longer than expected—to line up the equity investment required by Catapult’s lenders.

Catapult appears to have had until early May 2022 to line up that required financing. That apparent deadline came and went, and in June 2022, BlackBerry issued a press release stating that it was no longer under exclusivity with Catapult, and, given the length of time that the transaction had taken, the company had begun “exploring alternative options”.

According to BlackBerry, it terminated the deal with Catapult in December 2022.

However, in a complaint filed against Malikie Innovations in June in the Eastern District of Virginia, Catapult proffered a markedly different timeline, suggesting that the deal was alive and well going into 2023 and claiming that it was scheduled to close on March 14 of this year.

According to Catapult, it had been “ready to close the transaction” on that date, but on March 13, 2023, BlackBerry informed Catapult that it “would not close the transaction” and that it had signed a new patent sale agreement (PSA), this one with Malikie.

Catapult reports having commenced an arbitration on April 6, 2023 against BlackBerry seeking relief for alleged breach of contract—including “an order requiring BlackBerry to unwind its later transaction with Defendant Malikie, and to instead assign the patents to Catapult on the terms agreed to in the Catapult PSA”.

Catapult seeks an injunction compelling Malikie to participate in that arbitration—or “an injunction ordering Malikie to reconvey the patents to BlackBerry in exchange for BlackBerry returning the purchase price to Malikie”.

The difference in the amount that BlackBerry stands to make in the Malikie deal, compared to the Catapult deal, undoubtedly reflects changed economic conditions, especially higher interest rates, but they may also reflect a more sober assessment of the licensing potential of the transacted assets—and perhaps the loss of roughly three years of claims for past infringement of patents in a portfolio that has not been substantially refreshed since BlackBerry pivoted its business model.

RPX analysis of the deals, along with background on Malikie and Key Patent Innovations, is available here.

About those higher interest rates…

After years of historically low interest rates, the past 12 months saw the steepest rate hikes in decades, with the Federal Open Markets Committee taking the federal funds rate from less than 1% to more than 5%. Given those hikes, as well as the recent collapse of multiple regional banks, experts predict that more patent holders will turn to IP-backed debt financing.

IP-backed loans can be attractive to companies that lack tangible assets or cash flow to support a traditional credit solution—especially those that are unable to obtain private equity or venture capital funding—and given the hikes in interest rates over the past year, they may be seen as a less expensive financing option (in terms of cost of capital).

In conjunction with new insurance products, these deals may technically lower the cost of capital for some borrowers; however, pledging patents as loan collateral comes with the risk of losing those assets should the borrower default—and borrowers today are facing higher credit rates as well as potentially more challenging economic times ahead.

It remains to be seen whether this trend will lead to a new pipeline of patents flowing into the open market, comprising portfolios leveraged in IP-backed financing deals and subsequently transacted when borrowers default and lenders must reclaim the value of their investments through monetization of the patents.

New TPLF-Backed Campaigns—and an Exclusive Report from RPX

RPX review of public records indicate that at least seven new campaigns tied to third-party litigation funders were launched during Q2, targeting a range of sectors, including Automotive, Consumer Electronics and PCs, E-Commerce and Software, Mobile Communications and Devices, Networking, and Semiconductors. RPX members can access an overview of these new campaigns here.

Also during Q2, RPX released a comprehensive report on third-party litigation funding (TPLF), providing a primer on the practice in the context of patent litigation and examining its impact on settlements (i.e., both size and the process to reach them). Notable developments in the debate over disclosure of TPLF are also discussed, along with recent studies estimating the size and reach of the litigation finance market. Finally, this new report looks at the major funders backing US patent litigation today, as well as insurance products being marketed to litigation funders, patent holders, and lenders in IP-backed debt financing deals. RPX members can download the report via RPX Insight.

Additional RPX Patent Market Intelligence

For further analysis and up-to-date information on patent litigation and market trends, visit RPX Insight.