Q1 in Review: US NPE Litigation Bounces Back as EU SEP Proposal Moves Forward

April 9, 2024

NPE litigation in the US was up by 24% in the first quarter of 2024, with the bulk of those cases filed in the Eastern District of Texas after developments in two former NPE hotspots—the District of Delaware and the Western District of Texas—reduced their appeal for such plaintiffs.

Additionally, the USPTO has indicated that it may soon introduce the final version of a long-promised Patent Trial and Appeal Board (PTAB) rulemaking package that could reshape certain key aspects of the America Invents Act (AIA) review system. In the meantime, Director Kathi Vidal has continued to use her director review power to further clarify existing rules—in one instance, overturning a set of decisions that threatened to limit the rights of defendants sued in certain large, multidistrict patent campaigns.

Moreover, a controversial European proposal to impose a new framework governing standard essential patent (SEP) licensing and enforcement has moved closer to passage despite ongoing divisions among stakeholders, as government officials—in both Europe and the US—came out in opposition.

Also during Q1, the USPTO made public a number of notable patent transactions—including transfers to plaintiffs now in litigation—and public records revealed ties between new patent campaigns and third-party litigation funders. Finally, Westfleet Advisors released its fifth annual market report on litigation finance, providing transactional data for dozens of litigation funders active in the US.

RPX members now have exclusive access to an on-demand RPX Community webinar covering highlights from this post; CLE credit may be available.

Litigation Update: NPE Activity Swings Upward by 24% as OpCo Filings Hold Steady

Venue Update: Delaware Trails in NPE Rankings as Judge Connolly Signals Stronger Transparency Rules

PTAB Update: USPTO Teases Contents of Final PTAB Reform Package as Reexams Start Strong in Q1

Litigation Update: NPE Activity Swings Upward by 24% as OpCo Filings Hold Steady

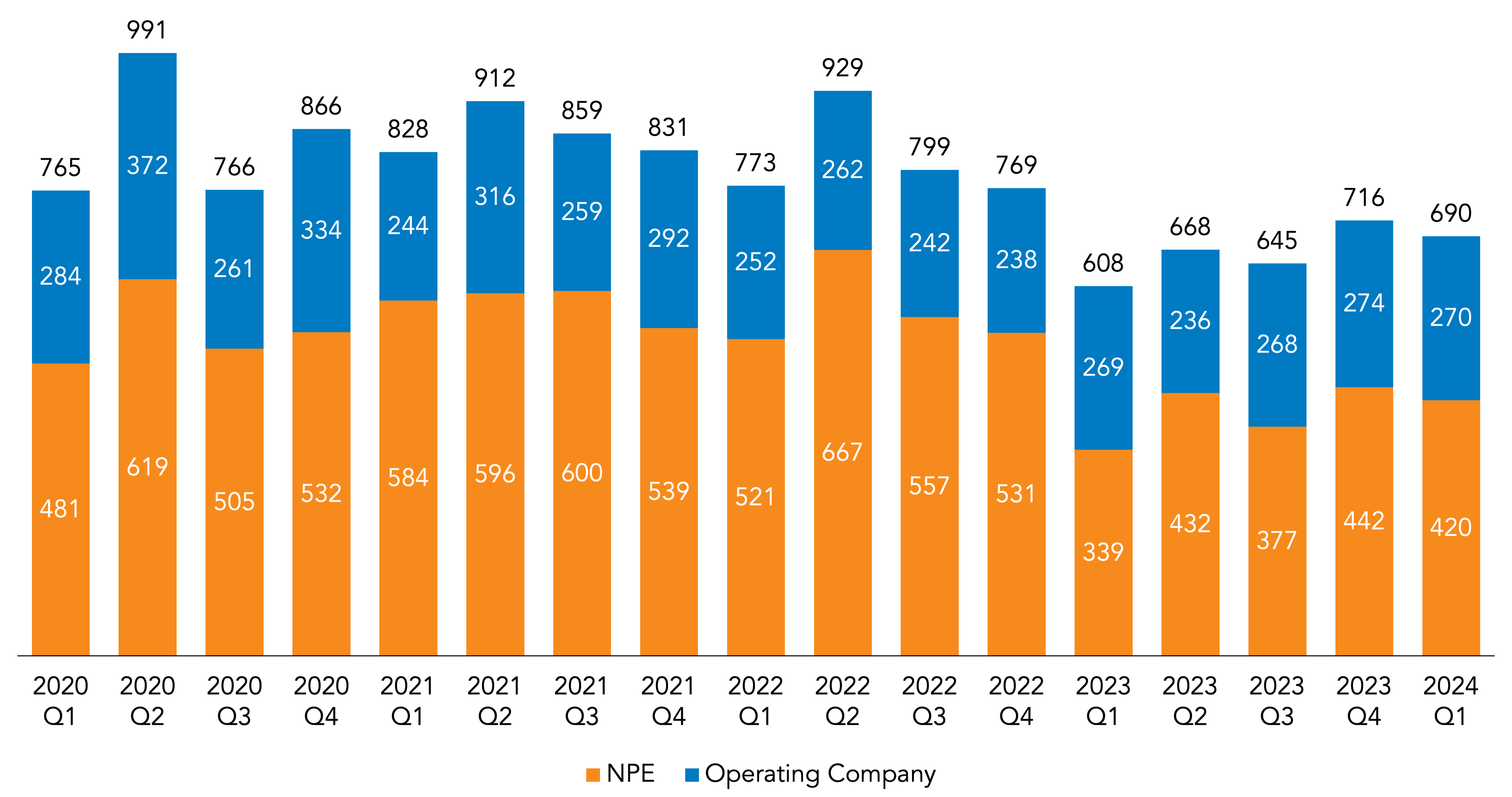

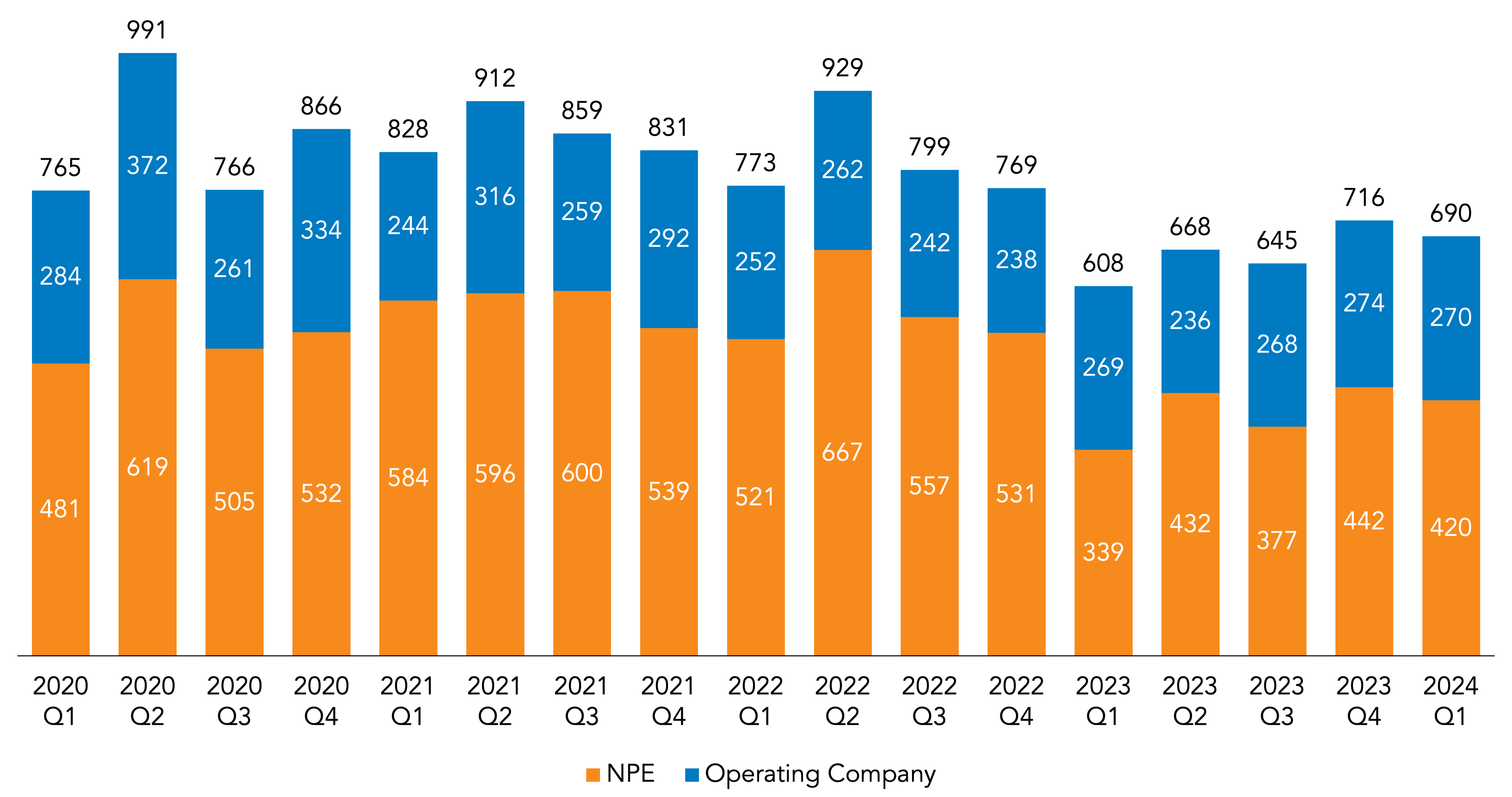

NPEs added 420 defendants to patent litigation campaigns in Q1 2024, up by 24% from the same quarter last year (when NPEs added 339 defendants). First-quarter NPE filings fell by 13% compared to the trailing Q1 average for 2021-2023 and were 5% lower than in Q4 2023.

This increase in Q1 NPE filings stands in stark contrast to the first-quarter change one year prior: Q1 2023 was 35% lower than Q1 2022 (when NPEs added 521 defendants). One of the primary causes of that decrease was the fact that the once-prolific monetization firm IP Edge LLC stopped filing litigation in December 2022, after previously accounting for around 25% of all NPE litigation each quarter (consistently suing around 50 defendants per month) in its most recent active period. As a result, when the firm hit the pause button in response to pressure over disclosure requirements in Delaware (as detailed further below), that change alone caused a significant drop in the relative NPE numbers for each subsequent quarter. Thus, while Q1 2022 included nearly 150 defendants from IP Edge litigation, Q1 2023 did not—with IP Edge filings accounting for most of the decrease. Excluding IP Edge activity, the gap was far smaller (a 10% decrease from Q1 2022 to Q1 2023).

IP Edge’s litigation pause has continued virtually uninterrupted into 2024. As such, because it filed almost no new cases in either Q1 2023 or Q1 2024—hitting just four defendants this past quarter—the impact of this standstill has now abated almost entirely due to the mere passage of time. The firm filed just four cases in the first quarter—all through a plaintiff, Bishop Display Tech LLC, that shows some of the hallmarks of a newer breed of IP Edge NPEs.

– Case Assignments Get Politicized

Another notable development that had a downward impact on NPE filings last year was a change in the Western District of Texas’s rules on case assignments. This change was designed to plug a loophole that allowed patent owners to directly pick District Judge Alan D. Albright (whose approach has been widely viewed as plaintiff-friendly) by filing directly in the Waco Division, where he is the only district judge. Under an order adopted by the district’s chief judge in July 2022, patent cases filed in Waco are now to be assigned randomly among a larger group of judges. However, the district subsequently adopted a practice where new cases involving the same patents and parties as prior litigation are assigned to that same judge, meaning that Judge Albright has received the bulk of these “legacy” lawsuits, though cases falling in new campaigns have been more randomly distributed. That said, the fact that filing in Waco no longer guarantees Judge Albright has caused NPE filings in that division to drop significantly, falling by nearly 48% from 2022 to 2023—and, as a result, causing the Western District of Texas to drop in the NPE rankings.

Waco’s decline continued into Q1 2024, the overall increase in NPE litigation notwithstanding: the division saw just 39 defendants added by NPEs, down from 85 defendants in Q1 2023 (a 54% drop). Excluding Waco from both periods, NPE litigation was up in Q1 2024 by a full 50% compared to the year-ago quarter.

While several of the most prolific NPEs of the past year were also among Waco’s top filers in Q1 2023, some of those plaintiffs scaled back or even halted their filings there in Q1 2024. One was Jeffrey M. Gross, 2023’s top overall plaintiff by volume through NPEs under his control. While Gross filed the second most litigation in Waco in the first quarter of 2023 (19 defendants added out of the 48 in total that he sued that quarter), he filed 37% less litigation there in Q1 2024 (12 defendants added in Waco out of 95 in total). Additionally, Dynamic IP Deals, LLC (d/b/a DynaIP) and affiliate Pueblo Nuevo LLC—together, the number-two overall NPE plaintiff last year—brought the most Waco litigation in Q1 2023 (adding 22 defendants there) but almost entirely stopped their Waco filings in Q1 2024 (adding just one defendant). In contrast, some NPEs kept a similar pace for their Waco filings; for instance, IP Investments Group LLC (d/b/a IPinvestments Group) hit six defendants in Waco in Q1 2023 and five defendants in Q1 2024.

The prior concentration of cases before Judge Albright, and the so-called judge shopping loophole that enabled it, attracted wider attention well before the Western District’s 2022 order, including bipartisan criticism from members of the US Senate: in late 2021, Senators Patrick Leahy (D-VT) and Thom Tillis (R-NC) wrote to Supreme Court Chief Justice John Roberts, in his capacity as presiding officer of the Judicial Conference of the United States (which sets policy governing federal courts), to raise objections to the divisional filing rules that allowed plaintiffs to target Judge Albright as well as the judge’s open solicitation of patent cases.

However, while patent suits were the impetus for the judiciary’s scrutiny of judge-shopping, the issue later became swept up by litigation of a more partisan nature. In early 2023, conservative lawyers and elected officials began to bring cases challenging various Biden administration priorities and policies in single-judge divisions viewed as friendly to their cases. Perhaps the most widely known example is a lawsuit filed by an antiabortion group seeking to overturn the FDA approval of abortion drug mifepristone; the case was filed in the Northern District of Texas’s Amarillo Division, where District Judge Matthew Kacsmaryk, who worked as an attorney for a conservative religious liberty firm before taking the bench, is the only district judge in the Amarillo Division. US Senate Majority Leader Chuck Schumer (D-NY) has led a campaign pushing against this practice, while GOP senators including Minority Leader Mitch McConnell (R-KY) has pushed back against attempts to close such loopholes, arguing that the real issue is courts issuing nationwide mandates.

This more politicized use of judge-shopping would ultimately become the apparent focus of a updated policy on case assignments released by the Judicial Conference in March: While the policy urges courts to adopt a practice of randomly assigning cases to judges throughout a district when they are filed in a single-judge division, the Conference clarified that this should apply just to “those civil actions seeking to bar or mandate statewide or nationwide enforcement of a state or federal law”. Some have observed that this qualification may exclude patent cases from the recommended policy altogether, though the debate has focused mainly on the aforementioned partisan issues—with the Northern District of Texas ultimately declining to institute the policy, despite a letter urging it to do so from Democratic members of the Senate.

– Operating Company Litigation Holds Steady as Anticounterfeit Suits Again Target Thousands of Online Storefronts

Meanwhile, operating companies added 270 defendants in Q1 2024, essentially holding steady compared to Q1 2023 (when such plaintiffs added 269 defendants) and Q4 2023 (274 defendants) and exceeding the trailing average by 6%.

Overall, plaintiffs added 690 defendants to patent litigation campaigns in Q1, 13% more than in the first quarter of 2023 but 6% less than the trailing Q1 average.

| Defendants Added | Change Compared to: | ||||

| Q1 2024 | Q1 2023 | Q1 2021-2023 Average | Q4 2023 | ||

| NPE | 420 | 24% | -13% | -5% | |

| Operating Company | 270 | 0% | 6% | -1% | |

| Total | 690 | 13% | -6% | -4% | |

Additionally, the operating company data above leave out another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e-seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to what one might consider the usual patent suit. These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts or aliases for the same ultimate parent. Also, plaintiffs primarily seek injunctive relief instead of damages, and their cases often end with the e-seller defendant’s failure to answer, followed by a default judgment.

This category of litigation, which began to spike in Q3 2020, is shown in grey below to illustrate its magnitude. As shown by the rightmost bar, e-seller litigation in Q1 2024 accounted for 3,150 defendants added, or 82% of all litigation during the quarter—though this number remains subject to the caveat about defendants potentially having multiple online storefronts noted above.

Apart from the following graph, the remaining analyses in this report exclude pure design patent and e-seller litigation.

Venue Update: Delaware Trails in NPE Rankings as Judge Connolly Signals Stronger Transparency Rules

The Eastern District of Texas was the top district for overall patent litigation (i.e., with no filter for plaintiff type) in Q1 2024, a rank it has held since Q2 of last year. In second place, with roughly half as much overall litigation as East Texas, was the District of Delaware, which was the most popular district for operating companies in Q1 but took a distant third place for NPE litigation. The number-two venue for NPEs, and the third for overall litigation, was the Western District of Texas, its NPE docket slimmed substantially as a result of the case assignment order described above.

Delaware has slid in the rankings over the past year, after taking first place in Q1 2023, as a result of a prolonged battle over transparency and corporate disclosures in the courtroom of Chief Judge Colm F. Connolly that has led NPEs to dramatically scale back their filings there. In April 2022, Judge Connolly imposed a pair of standing orders that forced litigants in his courtroom to disclose detailed ownership information as well as the presence of certain third-party litigation funding. After Judge Connolly became aware that a group of plaintiffs linked to IP Edge LLC had failed to comply with those orders, his resulting investigations into those entities’ ownership and control shined an uncomfortable spotlight on the underlying monetization model historically followed by IP Edge: to identify passive investors in Texas to form LLCs, receive patents, and assert them in litigation using counsel identified by IP Edge (and/or its “consulting” arm MAVEXAR LLC).

That scrutiny led IP Edge to discontinue filing under this model beginning in December 2022, as well as to multiple referral letters from Judge Connolly, including to the USPTO and the US Department of Justice, over a litany of misconduct from the attorneys involved—both those in control of IP Edge and MAVEXAR, whom he slammed for engaging in the unauthorized practice of law; and some who frequently represented IP Edge plaintiffs, through which activity he found they had committed numerous violations of the ethical rules governing attorneys. Judge Connolly continued to grill two of those attorneys in the first quarter, with an in-person hearing leading him to incredulously question their grasp of basic legal and ethical principles and even the English language itself. One of those attorneys has since sought to seal the materials he has finally produced at the court’s request, arguing that Judge Connolly’s inquiry into his misconduct amounts to an “ethics investigation” that must be conducted confidentially.

Recent comments from Judge Connolly indicate that he may soon apply even greater scrutiny to litigants before him. On March 28, speaking at Stanford, Judge Connolly reportedly stated that he was “going to expand the order”, referring to his April 2022 standing order requiring funding disclosures, during a discussion in which he appeared to criticize IP Edge’s business model, lamenting how its activity had incurred an “economic toll”. Judge Connolly also spoke critically about the practice of litigation finance more broadly: “I don’t believe our courts are casinos where people should just go to profit”, he said, stating that he “think[s] that’s bad for the system and [that] it undermines the importance of our courts”. This prompted an objection from his fellow panelist Cindy S. Ahn, a director at litigation funder Longford Capital, who countered that her firm does a “heavy amount of due diligence” and follows “best practices for third-party litigation funding” where “funders do not have any control” over the litigation they end up backing. Judge Connolly responded skeptically: “I’ve heard funders say that before . . . If you control the purse strings, you exercise control”. Judge Connolly also framed his disclosure rules as necessary for the court to identify potential conflicts, citing recent cases in which judges have been accused of conflicts of interest and stating that he does not want to follow suit.

Judge Connolly additionally acknowledged criticisms from some in the patent community that “his transparency efforts were really meant to clear cases from his patent docket”, as paraphrased by Bloomberg. He remarked in response that he is “seeing fewer NPE cases that are funded by third parties”, stating that he is getting 20% fewer lawsuits from such plaintiffs—but that those actions “‘require virtually no work’ because they tend to settle early”. Rather, it is litigation filed by operating companies against competitors that tend to be most “work-intensive”, he explained—noting that he has “about 29% of all the competitor patent cases in the United States”.

Meanwhile, it was Eastern District of Texas Chief Judge Rodney Gilstrap who had the most overall patent litigation last quarter, seeing 18% of the defendants added in Q1. Western District of Texas Judge Alan D. Albright, formerly the nation’s top patent judge before the aforementioned case assignment rules trimmed his patent docket, was tied for a distant third place with District Judge Robert W. Schroeder III of East Texas.

Despite his lower spot in the rankings, litigation in Judge Albright’s courtroom has continued to attract headlines over his handling of convenience transfer motions, long a source of tension between him and the Federal Circuit. The appellate court has frequently overturned Judge Albright’s decisions in response to mandamus petitions objecting to his handling of the applicable transfer factors, including his emphasis on his district’s quick time to trial as relevant to the public interest factor contemplating relative court congestion, as well as his tendency to hold onto such motions while moving forward on claim construction and other substantive issues.

While those reversals have been less frequent in the past year compared to when they began in 2020, further tension has arisen over the Federal Circuit’s interpretation of cases from the Fifth Circuit, the regional circuit that sets the law governing this issue in Texas. Some had expected the Fifth Circuit’s October 2022 decision from In re: Planned Parenthood to require a more deferential approach, but the Federal Circuit held otherwise the following February in its In re: Google opinion. In that case, the Federal Circuit ruled that it owes no deference to a judge’s weighing of the court congestion factor based on a time to trial analysis (only that it must defer to the underlying factfinding), and further determined that a plaintiff that is not “engaged in product competition”—i.e., an NPE—lacks an interest in a quick trial altogether.

Though Judge Albright has acknowledged that he is bound by the Google decision, he has criticized its “product competition” requirement, arguing that “no binding Fifth Circuit precedent . . . compels its conclusion” and remarking that it “appears to be made out of whole cloth”. With no Fifth Circuit ruling having yet addressed this specific issue, parties have continued to echo Judge Albright’s objection here: In March 2024, Red Rock Analytics, LLC—a plaintiff fighting a transfer motion from defendants Apple and Qualcomm that has sat undecided since August 2021—argued in a supplemental brief that the Google decision and subsequent Federal Circuit transfer rulings contradict Planned Parenthood, that product competition should be irrelevant to the consideration of the court congestion factor, and that the Federal Circuit must defer to how a district court in the Fifth Circuit analyzes court congestion. Apple and Google have countered that neither Planned Parenthood nor another cited Fifth Circuit decision from earlier that month contradict Google because neither is a patent case, and that it would be an abuse of discretion for Judge Albright to hold otherwise.

More on this dispute, and the broader history between the Federal Circuit and Judge Albright, can be found on RPX Insight (see here and here).

Market Sector Update: NPEs Linked to Familiar Monetization Professionals and Inventors Hit E-Commerce and Software in Q1

The top market sector for NPE litigation in Q1 2024 was E-Commerce and Software, accounting for 33% of the defendants added to patent litigation campaigns. Consumer Electronics and PCs saw the second highest amount of NPE litigation in the third quarter, followed by Networking, Financial Services, and Mobile Communications and Devices.

A wide variety of plaintiffs hit this sector throughout the first quarter, including several linked to notable individuals active in the patent assertion space. Among them were multiple NPEs apparently associated with a familiar figure in patent monetization—a former inventor who in recent years has shifted to the assertion of patents acquired from others. Those plaintiffs included Media Key LLC, which in late February launched its first campaign over content and/or software update tools; and Webcon Vectors LLC, which two weeks prior kicked off its own campaign against communications platforms with certain videoconferencing features. Another pair of plaintiffs hitting this sector in Q1 are controlled by a second inventor and prolific plaintiff: Secure Ink LLC, which in early February filed its first litigation over web-based and mobile e-signature platforms; and Wyoming Technology Licensing LLC, which later that month added a new complaint to its ongoing campaign over virtual assistants with certain natural language processing and semantic analysis features. Additionally, in late March, Dialect, LLC filed a new case in the voice recognition software services campaign it launched in February 2023. Dialect is connected to yet another well-known figure in patent monetization who has been linked to other established NPE plaintiffs with somewhat rocky litigation histories—including Oyster Optics, LLC and Document Security Systems, Inc.

Also joining the fray were a variety of inventor-controlled plaintiffs. Those targeting this sector in Q1 included Audio Pod IP, LLC, which in late March initiated a funded campaign against certain audiobook services. In addition, Factor2 Multimedia Systems, LLC filed its first litigation in January and added new complaints in March—here, hitting user authentication features offered by social networking apps well as those used in various USPTO systems. The patents-in-suit come from a family previously asserted by its named inventors, Kamran Asghari-Kamrani and Nader Asghari-Kamrani, in a campaign that lost one patent to Alice and saw an unsuccessful attempt to force discovery on the issue of whether the plaintiffs had litigation funding. Factor2’s counsel has since publicly confirmed that the Asghari-Kamranis are behind this latest plaintiff as well. Other inventor-managed plaintiffs hitting this sector in Q1 included Taiwanese entity Laixion Network Technology Ltd., which filed its first litigation over social networking collaboration tools in late March; and Keysoft, Inc., which began its own campaign in late February with suits focusing on data management features found in certain advertising and customer relationship management (CRM) platforms.

PTAB Update: USPTO Teases Contents of Final PTAB Reform Package as Reexams Start Strong in Q1

The Patent Trial and Appeal Board (PTAB) saw 328 petitions for America Invents Act (AIA) review in the third quarter of 2023, including 322 petitions for inter partes review (IPR) and six petitions for post-grant review (PGR). Filings were down by 5% compared to Q1 2023, which saw 345 petitions filed; but were up by 18% compared to Q4, during which 278 petitions were filed.

The PTAB instituted trial for 68% of the AIA review petitions addressed in Q1, down from that same quarter last year (during which the institution rate was 72%) but up slightly from Q4 2023 (67%).

That slight drop from Q1 2023 comes as the USPTO teases the imminent arrival of potentially significant changes to the AIA review regime—including the PTAB’s practice of discretionarily denying institution in IPRs based on the status of parallel litigation under the NHK-Fintiv rule. This reform effort kicked off in April 2023, when the agency released a sweeping reform proposal, in the form of an Advance Notice of Proposed Rulemaking (ANPRM), that included a kitchen sink’s worth of potential reforms. However, public feedback showed that stakeholders are divided on its proposals, flagging some of the suggested changes as undercutting, or even contradicting, certain provisions of the AIA.

Among the most heavily debated changes from the ANPRM are potential new exceptions that would allow petitioners to sidestep discretionary denials altogether: One of those exceptions would apply for petitions filed within six months, in order to incentivize earlier IPR filings (questioned by some stakeholders as contradicting or undermining the one-year time window already provided by statute); and the other, perhaps more controversial one would apply to petitions found to demonstrate “compelling merits”, or an especially high likelihood of prevailing on the merits (criticized as effectively overriding the statutory “reasonable likelihood” standard). Another polarizing proposal would essentially create a standing requirement—i.e., limiting what types of entities may and may not file PTAB petitions—based on an expanded view of corporate relationships as well as certain exceptions concerning business models.

That said, USPTO Director Kathi Vidal subsequently clarified that the USPTO would not necessarily move forward with all of the proposals in the ANPRM and that it had followed a potentially overinclusive approach in order to receive as much feedback as possible.

In the first quarter, the USPTO began to give signs that it may be considering a more limited proposal that focuses on some of the less heavily debated aspects of the ANPRM. In early January, the agency submitted a nonpublic proposed rule for regulatory review with a title that appeared to telegraph a somewhat more narrowly tailored list of priorities: “PTAB Rules of Practice for Briefing Discretionary Denial Issues, and Rules for 325(d) Considerations, Instituting Parallel and Serial Petitions, and Termination Due to Settlement Agreement”. The following month, Vidal stated in an interview that while she cannot comment on the specifics of the rule, the “title is quite descriptive of what you’re going to see in the package”.

The topic of discretionary denials is perhaps the broadest of the issues raised in the title and could potentially encompass either the more dramatic exceptions listed above or more modest changes contemplated in the ANPRM, such as the codification of practices regarding which statistics may be used to weigh the time to trial between two districts. Section 325(d) more specifically refers to discretionary denials where the USPTO has previously considered the asserted prior art or arguments; on this front, among the most significant of the ANPRM’s proposed changes would provide a framework based on the tests laid out in governing PTAB precedent (Advanced Bionics and Becton, Dickonson) but that would take a narrower view of which art and arguments are deemed to be “previously addressed”. The ANPRM’s changes related to “parallel and serial petitions”, or multiple petitions against the same patent, would also potentially bring a more restrictive approach than the current one, which is governed by factors laid forth in the PTAB’s decisions in General Plastic (covering circumstances for discretionary denial of petitions from the same petitioner), Valve I (encompassing follow-on petitions from a district court codefendant), and Valve II (follow-on petitions from a previously joined PTAB copetitioner). Finally, the reference to settlements possibly relates to the ANPRM’s proposed rule changes that would require parties to file copies of all settlement agreements relating to the termination of a PTAB proceeding, in part to facilitate antitrust review.

– Vidal Overturns Controversial Ruling That Limited IPRs Among MDL Defendants

In the meantime, Vidal has used her post-Arthrex director review authority to clarify the application of the Board’s existing precedent on some of these same issues. Most significantly, as Q1 approached its end, the Director reversed a set of controversial decisions that some viewed as improperly expanding the rules for denying parallel and serial petitions. Last December, automakers Ford and Honda sought director review of decisions in which the PTAB discretionarily denied institution of IPRs they filed against Neo Wireless LLC (f/k/a CFIP NCF LLC), holding that those petitioners had a “significant relationship” under General Plastic and Valve I/II with another automaker, Volkswagen, that had previously filed an IPR against the same patent, because they were all codefendants in the same court-imposed multidistrict litigation. In February, Ford and Honda both argued that the rulings would allow patent owners to sue an “entire industry” and unfairly hold all defendants to the results of a “single IPR”. Earlier that month, former Senator Patrick Leahy (D-VT), the AIA’s cosponsor, published an editorial in support of their position, arguing that the panel’s finding of a “significant relationship” here showed “flawed logic that cuts against widely understood concepts of justice”. On March 22, Vidal agreed, reversing the denials of institution and ruling that “the Board does not recognize a ‘significant relationship’ between parties having different accused products that merely engage in court-ordered pretrial coordination”.

– Ex Parte Reexam Requests Remain Near Their Peak Amid Ongoing NHK-Fintiv Uncertainty

Discretionary denials have also continued to push plaintiffs toward ex parte reexaminations, which are not subject to such denials to the same extent as AIA reviews. Ex parte reexam filings first began to rise in response to the initial uncertainty triggered by the NHK-Fintiv rule: The number of such requests went up by 21% in 2020 and then by 53% in 2021, peaking that year.

Since then, yearly reexam filings have held steady, hovering around 330 requests for each of the past two years—with 2023 the second-highest filing year of the past decade. If Q1 2024 is any indication, this could be an even busier year: 89 reexam requests were filed in the first quarter, or 37% more than in Q1 2023.

The share of patents subject to reexam requests that were also previously challenged at the PTAB has fallen each year, from 36% in 2021 to 24% in 2023, and reaching just 18% in the first quarter of 2024. Meanwhile, the share of those reexam patents also litigated in district court has held steady. Together, this suggests that defendants have been placing less emphasis on the PTAB as uncertainty over discretionary denials persists and that reexams have kept their spot as a more frequently utilized defensive tool.

FRAND Update: EU SEP Regulation Moves Closer to Passage Despite Stakeholder Divisions and Political Opposition

One of the most closely watched developments in the standard essential patent (SEP) space has been playing out in Europe, where a controversial proposal for a framework governing SEP licensing and dispute resolution in the European Union (EU) moved forward in the European Parliament (EP) in Q1.

That proposal, introduced in April 2023, seeks to address the European Commission’s concerns over transparency with respect to patent ownership, essentiality, and licensing rates, and concerns over existing dispute resolution mechanisms, through three overarching proposals: The regulation would create a public register in which patent owners would have to register patents they believe to be essential before they can assert them in litigation; a system requiring nonbinding essentiality checks of an annually selected subset of those patents; and a new, out-of-court process for determining fair, reasonable, and nondiscriminatory (FRAND) licensing terms that patent owners must complete before asserting relevant patents in court, though again with nonbinding results. All aspects of this new framework would be administered by the EU Intellectual Property Office (EUIPO), which currently focuses solely on trademarks and design rights, through a newly created “competence centre”. The EUIPO would also be responsible for a new, optional process for determining FRAND rates, which can be initiated by either party unilaterally and would in part determine the maximum aggregate royalty rate for a given standard.

On January 24, 2024, the bill was approved by the EP’s Legal Affairs Committee (JURI) by a slight majority. In doing so, JURI also adopted a set of minor amendments proposed in a late-2023 report from Member of Parliament (MEP) Marion Walsmann, the EP’s rapporteur for the proposed SEP regulation (i.e., the MEP responsible for guiding the proposed legislation toward passage), including new rules setting standards for the qualification and impartiality of the “SEP evaluators and conciliators” to be hired by the EUIPO; and a requirement that the EUIPO create a SEP Licensing Assistance Hub to provide free training and support on SEP matters to small and medium-sized enterprises (SMEs) and startups. The legislation then came before the full Parliament, which passed the bill in the form adopted by JURI in a first-reading plenary vote held on February 28, 2024. This means that Parliament may now begin talks with EU countries regarding what final form the legislation will take—importantly, a phase of the process that will be carried out under a new Parliament, following elections that will take place on June 9, 2024.

– Stakeholder Divisions Persist

The proposal has continued to generate a heated debate among both implementors and licensors, as well as other industry and government stakeholders, in the leadup to that vote. Advocacy on the implementer side has included industry groups like the Fair Standards Alliance, which counts among its membership a host of companies selling products in markets like smartphones and mobile devices (including Amazon, Apple, Fairphone, Google, and Lenovo) and networking and cellular services (Cisco, Juniper Networks, and T-Mobile), as well as a host of automotive OEMs and component suppliers (BMW, Continental, Denso, Ford, Harman, Honda, Hyundai, Mercedes-Benz, MINI, Tesla, Thales, Toyota, u-blox, Valeo, Visteon, and Volvo). The FSA, which has criticized the “secrecy” of some licensing programs and has argued that making SEP licensing terms more “transparently available” would level the playing field, has characterized the proposed EU regulation as a positive “attempt[] . . . to redress imbalance” in the SEP space—touting its provisions on licensing transparency as well as those relating to essentiality determinations and the requirement to engage in pre-litigation mediation. FSA member Continental echoed these points in a February editorial published in Politico EU, arguing that the regulation would increase “transparency and predictability” and that it “would facilitate good faith negotiation on an equal footing with necessary information rather than litigation”.

Among those weighing in on the licensor side has been patent pool operator Sisvel International S.A., for which President Mattia Fogliacco argued in a January editorial that despite the Commission’s stated focus on helping European SMEs in SEP matters, the regulation may in fact harm them: Because the regulation would allegedly lead to lower returns from larger implementers based outside Europe, Fogliacco contends that licensors would either need to target SMEs to “maintain their margins”, meaning that the market would “effectively see European SMEs subsidising large, non-European businesses”, or scale back their European R&D spending on standards development and instead focus more on proprietary technology.

Also weighing in as a licensor was Nokia, which shortly before the start of the first quarter published an editorial that expressed support for the regulation’s goals of “transparency and predictability” but argued that there are better ways to achieve them. In a counterproposal, the company contended that the SEP competence center should be administered by a global standards-development organization (SDO) like the European Telecommunications Standards Institute (ETSI) rather than a regional entity like the EUIPO, to discourage parallel proceedings elsewhere; and that rather than creating a new SEP register, the EU should use an “upgrade[d]” form of ETSI’s SEP database covering only patents their owners believe to be essential. The company additionally asserts that essentiality checks should be voluntary, claiming that such checks (to the extent required by antitrust law) have not helped pools like Avanci get off the ground more quickly; and suggests that the FRAND determination process should run in parallel with SEP enforcement proceedings, not come before them.

– Opposition from Government Officials—in Both Europe and the US

The proposal has also triggered criticism from institutional stakeholders, both within and outside Europe. For instance, on the day of the plenary vote, European Patent Office (EPO) President António Campinos criticized the Commission for moving so quickly to pass the regulation before the election given that there are “still critical issues that need to be resolved if the regulation is to be fit for purpose”. Campinos stated that the EPO “is not convinced that the proposed measures are proportionate, or indeed necessary”, arguing that the legislation lacked an adequate evidentiary basis and had been finalized without a sufficiently “transparent consultation of all stakeholders and thorough impact assessments”.

Even more pointed criticism came from Rian Kalden, a judge on the Unified Patent Court (UPC), the EU court with jurisdiction spanning 17 EU member states that launched this past June. In a March 19 interview at IPBC Europe with Willem Hoyng, the chairman of the UPC’s Advisory Committee, Judge Kalden took particular issue with the Commission’s view that courts were ill-equipped to handle SEP disputes. Judge Kalden estimated that despite the “difficulties” and “challenges” that can flow from the FRAND commitment, 95% of SEP cases “actually don’t pose any problems at all”—and questioned the wisdom of “mix[ing] up the whole schedule that is working for 95% for sake of” the 5% of cases for which “there is a problem”. The European Commission’s apparent conclusion that judges cannot “handle [SEP] cases” is a misjudgment, she continued, as judges are “very well equipped to deal with these cases” based on their experience with determining damages related to license fees in other contexts. Remarking that the UPC had not “even had the opportunity to show [it] can deal with [SEP] cases”, after identifying various aspects of UPC procedures that would be especially helpful in such litigation, Judge Kalden warned that the new framework could lead plaintiffs to enforce their patents elsewhere: “If the SEP regulation is coming to Europe, the cases will go out of Europe”.

The proposal also attracted criticism from across the pond: In early March 2024, USPTO Director Kathi Vidal commented to IAM that the new framework was “likely to exacerbate opposing viewpoints between SEP licensors and licensees”—respectively citing their general arguments in opposition and support (as detailed further above). The Director implicitly contrasted the European Commission’s approach with that of the Biden administration, highlighting the fact that the latter withdrew a prior policy addressing injunctive relief in SEP disputes—a step that, as summarized by IAM, she described as “remov[ing] the perception of special rules for SEPs”. Vidal, who has previously framed SEP issues as inherently international, echoed that same sentiment here, stating that “[t]he international ramifications of any regional SEP rules must be carefully examined to ensure that the consequences are well-known and are fully appreciated”—and that the USPTO would engage with like-minded teams in other countries in pursuit of a “globally harmonized SEP licensing framework”.

More on the US government’s prior response to the EU SEP framework can be found on RPX Insight.

Patent Market Update: Notable Deals and Campaigns; Industry Report Gives the Latest on Litigation Finance

– Notable Patent Assignments and New Funded Campaigns

RPX flagged several patent transactions during Q1 that were deemed notable in light of the involvement of operating company portfolios and/or assignees with a history of litigating patents—some with the backing of third-party litigation funders. A rundown of noteworthy assignments made public in Q1 2024 is available here.

In addition, RPX research indicates that multiple patent campaigns that were started in Q1 2024 can be tied to specific litigation funders, with plaintiffs including established players as well as (apparently) new faces. Targeted defendants spanned several market sectors, including Media Content and Distribution, Mobile Communications and Devices, and Networking, among others. RPX members can access coverage of funded patent litigation here.

– Westfleet Releases Its Fifth Annual Market Report on Litigation Finance

At the close of Q1, Westfleet Advisors released its annual market report on litigation finance, providing transactional data for 39 commercial litigation funders active in the US. As is the case for most reporting on the largely opaque practice of third-party litigation funding, the fifth iteration of Westfleet’s yearly publication is inherently incomplete; however, the report does offer useful metrics by which the growth of the litigation finance market can be measured.

According to Westfleet, its latest report draws on transactional data related to the 12 months from July 1, 2022 to June 30, 2023 and covers 39 litigation funders active in the US—each of which falls into one of three categories: Dedicated funders; multi-strategy funders; and ad hoc funders.

Reported transaction size appears lumpy year-over-year, with overall transaction size ($7.8M) down from the same period in 2022 ($8.6M). The downward trend of new transactions in 2023 is not a result of softening demand for funding, claims Westfleet, but rather a reflection of “macro trends in the financial markets”—including the interest rate hikes of 2022-2023.

According to Westfleet, patent litigation continues to attract the largest portion of new commitments made by the funders covered by its annual report, with the category comprising 19% of all capital commitments in 2023.

Westfleet has also revised its methodology for calculating funders’ assets under management (AUM) “to more accurately account for undrawn capital commitments for certain industry participants”. The figures now provided for 2021 ($13.7B) and 2022 ($15.1B) were previously reported as $12.4B and $13.5B, respectively; for 2023, estimated AUM for the 39 funders covered by Westfleet’s report was $15.1B.

Still, the collective AUM for funders active in the US may be higher. As of today, the league table maintained by The Litigation Finance Insider reflected collective AUM of more than $17B for just nine litigation funders.

In its latest report, Westfleet acknowledged speculation that contingent risk insurance has had a measurable impact on commercial litigation financing activity and may even supersede litigation funding in the future. Yet, the firm claims that it does not believe insurance has yet “materially displaced litigation finance except in areas such as appellate monetizations”.

RPX reported throughout 2023 on the growing range of insurance products being marketed to patent holders and litigation funders, and late last year, Bloomberg highlighted the competition that the insurance sector represented to traditional litigation finance.

RPX members will get a closer look at the interplay between litigation funders and contingent risk insurance in an upcoming exclusive webinar.

Additional RPX Patent Market Intelligence

For further analysis and up-to-date information on patent litigation and market trends, visit RPX Insight.