Q1 in Review: UPC Expands Its Reach as PTAB Sees Fintiv Revamp

April 15, 2025

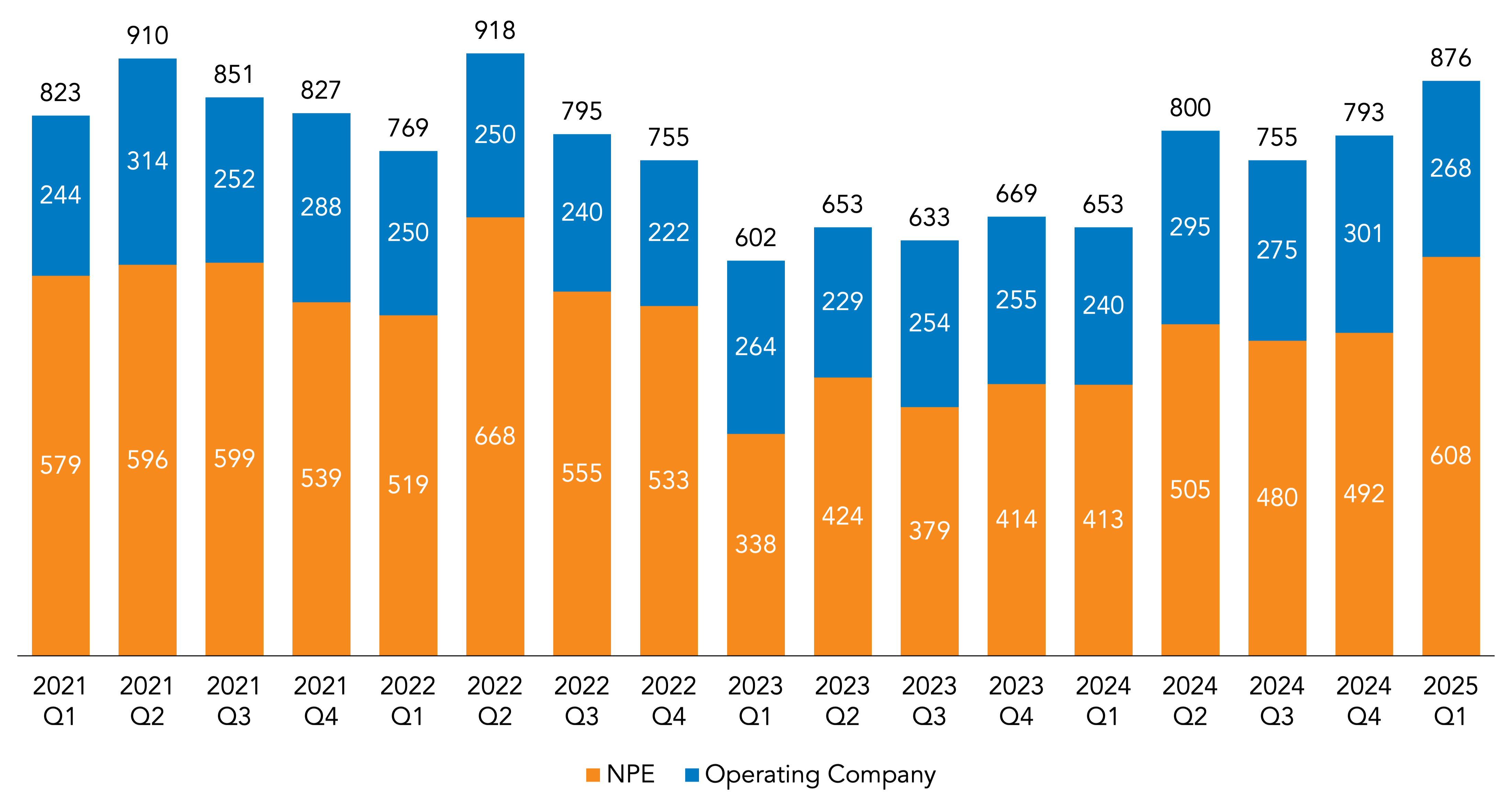

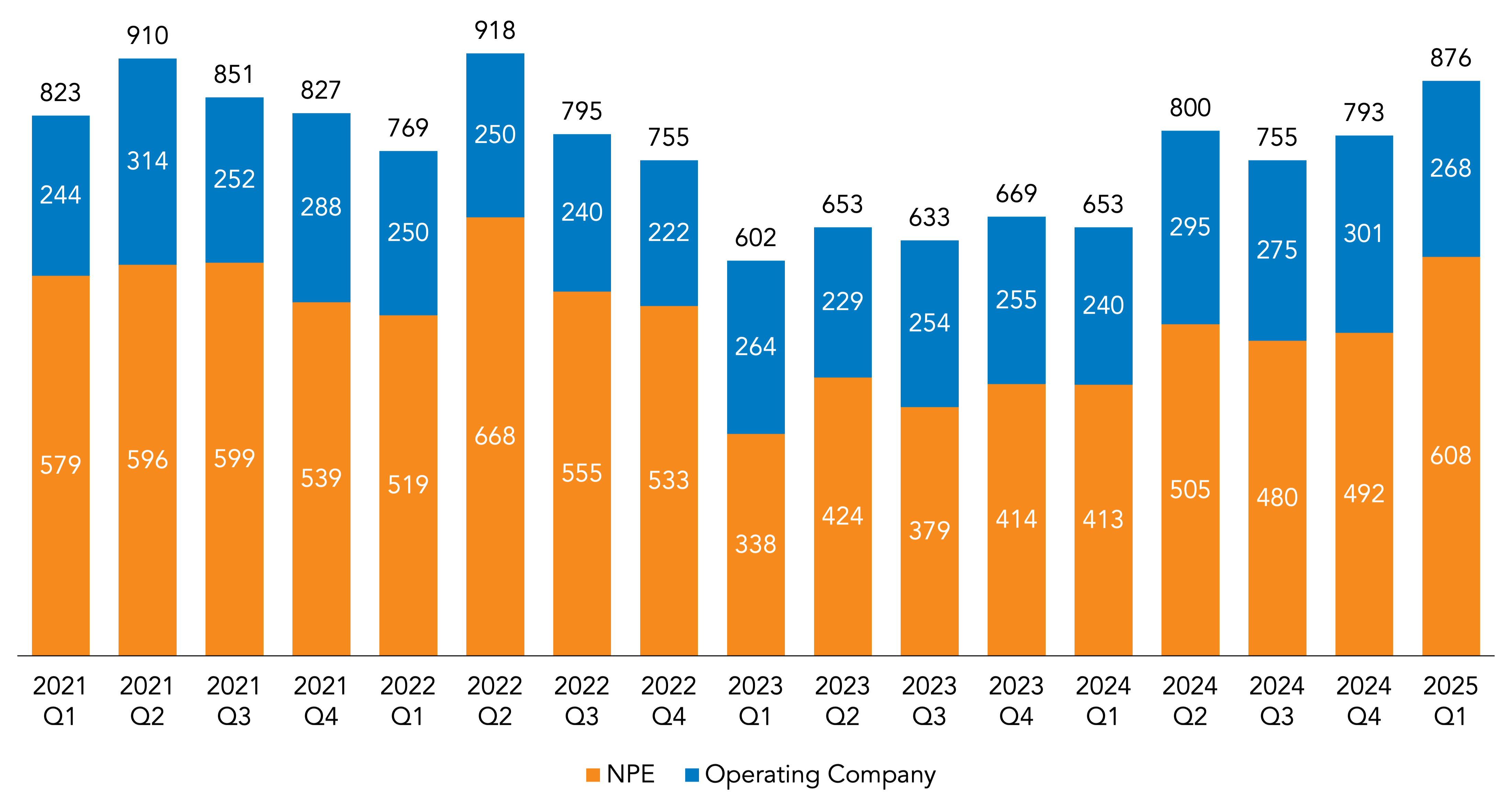

NPE litigation increased significantly in Q1 2025, making it the busiest first quarter in nearly a decade: Such plaintiffs added 608 defendants to patent campaigns, or 47% more than in Q1 2024.

Meanwhile, the Patent Trial and Appeal Board (PTAB) faces newfound uncertainty as a result of recent changes from Acting USPTO Director Coke Morgan Stewart, who rolled back prior limitations on the Board’s use of the NHK-Fintiv rule and created a new two-stage institution process where the director addresses requests for discretionary denial prior to a panel’s evaluation of the merits.

The first quarter also saw a series of rulings that could dramatically expand the reach of the EU’s Unified Patent Court (UPC), as the court held it has the power to issue damages based on infringement judgments from foreign courts and asserted long-arm jurisdiction for the first time. However, the UPC could see increased competition as a pan-European patent venue due to a landmark judgment from the EU Court of Justice that could also encourage cross-border patent litigation by national courts.

Q1 was a particularly impactful period for standard essential patent (SEP) litigation as well. In February, the European Commission unexpectedly withdrew its proposal for an EU-wide SEP framework, while key developments also came in some of the world’s top SEP venues—including notable UK rulings on interim licenses and pool rate-setting claims, and a new approach to fair, reasonable, and nondiscriminatory (FRAND) licensing disputes recently adopted by one of Germany’s busiest courts.

This is also a pivotal time for the US IP system, with the new administration’s policy reforms potentially wielding enormous consequences for innovation, economic stability, and geopolitical relations. RPX has compiled an overview of recent policy developments in the US IP space, including patent-related bills pending before Congress; the White House’s picks for US Commerce Secretary and USPTO Director; and other recent changes at the USPTO.

One of the IP-related bills moving through the legislative branch relates to third-party litigation funding, an investment strategy that appears to be attracting more hedge funds to the patent space. The first quarter of 2025 saw at least two new patent litigation campaigns kicked off by plaintiffs that RPX has tied, based on public records, to New York City-based hedge funds.

Assignment records suggest that one of those hedge funds may have received a portfolio of patents during Q1. RPX flagged this patent transaction, and several others made public during the quarter, in light of the transacted portfolios’ origination, new owners, and/or evidence of third-party funding.

RPX members will also soon have exclusive access to an on-demand RPX Community webinar covering highlights from this post; CLE credit may be available.

Litigation Update: First-Quarter NPE Filings Reach Highest Point Since Q1 2015

Venue Update: East Texas Stays in First as a West Texas Judge Climbs in the Rankings

Market Sector Update: E-Commerce and Software Space Hit by Familiar Figures in Q1

PTAB Update: USPTO Rolls Back NHK-Fintiv Restrictions as Board Faces Layoffs

UPC Update: Court Tackles Non-EU Infringement; CJEU Opens Cross-Border Floodgates

FRAND Update: EU Withdraws SEP Proposal; Key Appellate Rulings in UK and Germany

US Policy Update: Patent Bills, White House Picks, and the USPTO Today

Patent Market Update: New Funded NPE Campaigns and Notable Patent Transactions

Litigation Update: First-Quarter NPE Filings Reach Highest Point Since Q1 2015

NPEs added 608 defendants to patent litigation campaigns in Q1 2025—more than in any first quarter since Q1 2015, when such plaintiffs added just under 1,000 defendants. NPE litigation in the first quarter of 2025 was 47% higher than in Q1 2024 (when NPEs added 414 defendants) and 24% greater than in Q4 2024, also exceeding the trailing Q1 average for 2022-2024 by 44%.

Operating company plaintiffs added 268 defendants this past quarter, a more modest increase compared to Q1 2024 (12%). Litigation by operating companies was down by 11% compared to the fourth quarter but was up by 7% compared to the trailing Q1 2022-2024 average.

| Defendants Added | Change Compared to: | ||||

| Q1 2025 | Q1 2024 | Q1 2022-2024 Average | Q4 2024 | ||

| NPE | 608 | 47% | 44% | 24% | |

| Operating Company | 268 | 12% | 7% | -11% | |

| Total | 876 | 34% | 30% | 10% | |

Overall, patent plaintiffs added 876 defendants in the first quarter of 2025, or 34% more than in Q1 2024 and 10% more than Q4 2024, also beating the trailing average by 30%. This is the highest number of overall filings since Q1 2015, boosted by the NPE activity noted above.

Additionally, the operating company data above leave out another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e‑seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to what one might consider the usual patent suit. These e‑seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts or aliases for the same ultimate parent. Also, plaintiffs primarily seek injunctive relief instead of damages, and their cases often end with the e‑seller defendant’s failure to answer, followed by a default judgment.

This category of litigation is shown in grey below to illustrate its magnitude. As shown by the rightmost bar, e‑seller litigation in Q1 2025 accounted for 1,794 defendants added, or 67% of all litigation during the quarter—though this number remains subject to the caveat about defendants potentially having multiple online storefronts noted above.

Apart from the following graph, the other analyses in this report exclude pure design patent and e‑seller litigation.

Venue Update: East Texas Stays in First as a West Texas Judge Climbs in the Rankings

The Eastern District of Texas was the top patent district for overall litigation (i.e., with no filter for plaintiff type) and NPE litigation in Q1 2025, also holding the number-three spot for operating company litigation. In second for overall litigation was the District of Delaware, which also held a distant third place for NPE litigation but was the most popular district for operating company litigation. Meanwhile, the Western District of Texas was close behind Delaware in third place for overall litigation and comfortably in second for NPE litigation, while not breaking the top five for operating company filings.

The Eastern District of Texas has seen a resurgence in recent years: A longtime patent hotspot, the district was dethroned by the Supreme Court’s 2017 patent venue decision in TC Heartland. However, it vaulted back into first place in Q2 2023 after two unrelated developments caused a drop in NPE filings in the District of Delaware and the Western District of Texas, both of which had risen in popularity post-TC Heartland.

The NPE decline in Delaware was largely the result of two standing orders imposed by Chief Judge Colm F. Connolly in April 2022, one requiring litigants in his courtroom to provide extensive disclosures on their ownership and corporate control and the other mandating the disclosure of certain types of litigation funding. Beginning later that year, Judge Connolly proved that unlike many other courts with heightened disclosure requirements, he was actually willing to go to the mat to enforce those rules—extensively probing the activities of former top filer IP Edge LLC after it came to light that entities under its control had failed to make sufficient disclosures. That investigation led Judge Connolly to uncover what he deemed widespread “fraud” underpinning the business model of IP Edge and its affiliates, as a result of which he referred some of the individuals involved to various disciplinary authorities for related misconduct. The pressure ultimately led IP Edge to stop filing litigation altogether, while other NPEs have largely avoided Delaware since this saga came to a head—perhaps seeking to avoid similar scrutiny.

Some other volume filers have not been entirely scared away from Delaware, however—in some instances, their involvement only being revealed after their cases have ended up before Judge Connolly, forcing them to disclose more about their ownership and control than otherwise would have been required.

Meanwhile, NPEs have filed less litigation in the Western District of Texas in the wake of rule changes that targeted the patent caseload of District Judge Alan D. Albright. Judge Albright, a former patent litigator, openly and successfully sought to attract patent cases to his courtroom since taking the bench in late 2018, becoming the nation’s top patent judge by litigation volume in Q3 2019. The aforementioned rule changes, implemented in a July 2022 case assignment order, focused on the divisional filing rules that previously allowed plaintiffs to file directly in his courtroom by bringing cases in the Waco Division, where he is the only district judge. Instead, the order required that patent cases filed in Waco Division be randomly distributed across a larger set of judges in the district. A practice subsequently developed, though, by which new cases involving the same patents and parties as prior litigation were assigned to the previous judge, meaning that while his overall caseload had fallen significantly, Judge Albright still received the bulk of these “legacy” cases. A May 2024 order zeroed in on that practice, requiring that parties seeking to get their cases consolidated before a single judge must provide sufficient legal and factual justifications. Judge Albright has since moved to the Austin Division.

Relatedly, another West Texas judge appears to have taken steps to make his own courtroom an attractive destination for patent cases. Just one week after the July 2022 case assignment order took effect against Judge Albright, District Judge David Counts of the Midland-Odessa Division—also a former patent litigator—adopted a patent standing order based in large part on Judge Albright’s. Significantly, Judge Counts is the only district judge in Midland-Odessa, and since no special case assignment rules presently target his division, plaintiffs have been free to seek out his courtroom.

By all accounts they have done so: Judge Counts has steadily risen in the judge rankings, overtaking Judge Albright in mid-2024 and tying for fifth place last year overall. As of the first quarter of 2025, Judge Counts is now the number-two patent judge in the nation—albeit, at 6%, in a distant second place.

Holding a commanding lead once again was District Judge Rodney Gilstrap, whose seven-year term as East Texas’s chief judge ended on March 1, 2025—passing the torch to Chief Judge Amos L. Mazzant, who was appointed to the bench in 2014 by President Barack Obama.

Market Sector Update: E-Commerce and Software Space Hit by Familiar Figures in Q1

The top market sector for NPE litigation in Q1 2025 was E-Commerce and Software, accounting for 43% of the defendants added to patent litigation campaigns during the quarter. Financial Services saw the second highest amount of NPE litigation in Q1, followed by Networking, Consumer Electronics and PCs, and Automotive.

E-Commerce and Software also saw the greatest increase in the number of defendants added compared to the same quarter last year—going up by 93% (from 134 defendants to 259 defendants). Also seeing a significant percentage increase, albeit with smaller relative numbers, were Automotive (up by 160%, increasing from 10 to 25 defendants added), Financial Services (up by 88%, from 41 to 77 defendants added), and Semiconductors (up by 85%, from 13 to 24 defendants added).

Among the NPEs that filed the most E-Commerce and Software litigation this past quarter were a variety of plaintiffs associated with notable individuals active in the patent assertion space. One patent monetization professional who appears to be linked to a growing number of NPE plaintiffs was particularly prolific in this space in Q1, hitting E-Commerce and Software products and services through 11 distinct plaintiffs that filed litigation throughout the quarter. Those include nine NPEs formed in New Mexico (listed in reverse chronological order by case filing date): first-time plaintiffs SmartOrder LLC, targeting mobile ordering, pickup, and curbside to-go services (covered here); Fintegrity LLC, products with functionality for authorizing financial transactions and preventing fraud (here); Monitor Systems LLC, traffic monitoring and enforcement systems (here); TicketMatrix LLC, NFL season ticket systems (here); PanoVision LLC, websites and software with tools for customizing room designs (here); BillSure LLC, products with features for monitoring users’ spending data and identifying anomalies (here and here); and Quantion LLC, Wi-Fi systems with features for displaying advertisements to users (here); plus existing litigants Muvox LLC, hitting content recommendation systems that allegedly utilize AI (here); and FrameTech LLC, enterprise products with functionality related to remote operating system upgrades (here). Still more NPEs linked to that same individual, these ones incorporated in Delaware, also added complaints to existing campaigns: Hyperquery LLC, focusing on app stores/marketplaces and game subscription services (covered here); and Secure Matrix LLC, websites with secure authentication (here).

Also hitting this sector was Rothschild Patent Imaging LLC (RPI), a plaintiff tied to a former inventor who in recent years has shifted to the assertion of patents acquired from others. In mid-March, RPI added two new complaints to its ongoing image sharing campaign targeting disparate accused products: cameras with support for filtering images and then transmitting alerts or data to a paired mobile app on the one hand, and an online dating platform with features for showing matches based on a distance filter.

In addition, early February saw Dialect, LLC add a new case targeting virtual assistants and supporting products that utilize natural language processing and voice recognition to the campaign that it launched in February 2023. Dialect, which has procured litigation funding (according to a 2022 filing), is connected to yet another well-known figure in patent monetization associated with established NPE plaintiffs with somewhat rocky litigation histories—including Oyster Optics, LLC and Document Security Systems, Inc. Days later, WinView IP Holdings, LLC, an entity formed by the chairman of sports betting company WinView, restarted a campaign targeting online betting and gaming platforms previously waged by the latter company—this time with funding in hand.

Multiple established monetization firms also hit the E-Commerce and Software space this past quarter—including Empire IP LLC, which, through plaintiff AR Design Innovations, LLC, added a new complaint targeting e-commerce apps with certain augmented reality (AR) features to a campaign started in 2020. Others joining the fray were three NPEs associated with Dynamic IP Deals, LLC (d/b/a DynaIP) and affiliated entity Pueblo Nuevo LLC: Random Chat LLC, which in late February and mid-January collectively added several more retailers to a campaign begun in June 2024, targeting the defendants’ websites’ respective customer support chat features; WirelessWERX IP LLC, which throughout February and January filed a wave of complaints against products with geofencing features (see here, here, and here) to the campaign that it began in late 2022; and AK Meeting IP LLC, which focused on web conferencing products with remote screen control features in a complaint added to the campaign that it also kicked off in 2022. Georgia-based monetization firm IPInvestments Group LLC, through associated plaintiff DataCloud Technologies, LLC, also filed another round of cases targeting mobile apps, website infrastructure, and/or firewalls utilizing certain virtualization technology.

PTAB Update: USPTO Rolls Back NHK-Fintiv Restrictions as Board Faces Layoffs

The Patent Trial and Appeal Board (PTAB) saw 366 petitions for America Invents Act (AIA) review in the first quarter of 2025, including 347 petitions for inter partes review (IPR) and 19 petitions for post-grant review (PGR). Filings were up by 12% compared to Q1 2024, which saw 328 petitions filed; and were 5% higher than Q4, during which 347 petitions were filed.

The PTAB instituted trial for 67% of the AIA review petitions addressed in Q1, down slightly from that same quarter last year (during which the institution rate was 69%) but up from Q4 2024 (60%).

Arguably the most significant factor impacting AIA institution rates in recent years has been the NHK-Fintiv rule, a set of discretionary factors governing the PTAB’s practice of discretionarily denying institution due to the status of parallel litigation. That practice could see a resurgence due to two key changes implemented by Acting USPTO Director Coke Morgan Stewart this past quarter.

– USPTO Withdraws Vidal’s Guidance Limiting NHK-Fintiv Rule

The first of those changes was the rollback of a June 2022 memorandum from Stewart’s predecessor, former Director Kathi Vidal, that had limited the application of NHK-Fintiv in certain respects. That guidance essentially exempted AIA reviews that are especially likely to succeed, explaining that the Board should not discretionarily deny petitions that present “compelling, meritorious challenges”. The guidance also established that the NHK-Fintiv factors apply only to district court litigation and not investigations before the ITC, since the latter lacks the power to issue binding invalidity rulings; and provided that discretionary denial would not occur where petitioners agree not to assert invalidity grounds that they raised or reasonably could have raised at the PTAB in a parallel district court case (formalizing a practice established in the PTAB’s December 2020 precedential decision in Sotera Wireless v. Masimo, now known as a “Sotera stipulation”). Additionally, the guidance lessened the impact of the controversial NHK-Fintiv factor allowing discretionary denial when the PTAB’s final written decision falls after a scheduled trial date, stating that this factor alone cannot tip the scales toward denial under NHK-Fintiv when the other factors are neutral, and further clarified that this determination must be made based on aggregate data, including the district’s median time to trial.

Discretionary denials fell significantly in the immediate aftermath of the guidance’s issuance. They then partially rebounded (see, e.g., here) in the wake of Vidal’s February 2023 precedential ruling, under her post-Arthrex director review power, that limited the “compelling merits” exception: In CommScope v. Dali Wireless, Vidal held that PTAB panels must first apply the five NHK-Fintiv factors and may only address compelling merits if the other factors favor discretionary denial.

However, the USPTO returned the PTAB to the prior status quo with its February 28, 2025 announcement that it had withdrawn the 2022 guidance and all decisions relying upon it, stating that parties should instead refer back to the PTAB’s precedential decisions in Apple v. Fintiv (the underlying decision, designated as precedential in 2020, that memorialized the five NHK-Fintiv factors, building on NHK Spring v. Intri-Plex Technologies, designated in 2019) and Sotera Wireless v. Masimo (discussed above). PTAB Chief Administrative Patent Judge (APJ) Scott Boalick clarified that withdrawal in a March 24 memorandum that explicitly repudiates the key points from the rescinded 2022 guidance: It explicitly established that the NHK-Fintiv factors will also apply for parallel ITC actions; explained that Sotera stipulations may be “highly relevant” but not dispositive on their own; loosened the “time to trial” factor by allowing any evidence bearing on district court trial dates or ITC final determination target dates; and underscored that “compelling merits” alone cannot be “dispositive” in the discretionary denial inquiry, providing instead that the merits are just one of the factors to be considered in a “balanced assessment”.

– Director to Decide Discretionary Denials First in New Two-Stage Institution Process

The second of these two changes was Stewart’s creation of a new two-stage process for AIA review institution, established in a memorandum issued on March 26: First, the USPTO director is to make a determination as to the discretionary denial factors, doing so in consultation with three PTAB APJs, and will then issue a decision explaining the reasons why discretionary denial is appropriate or inappropriate. If the latter, the director will refer the case to a standard three-member PTAB panel that will then make an institution decision that addresses the merits and other non-discretionary statutory considerations. In making her discretionary denial determination, the memorandum provides a broader list of relevant considerations drawn from certain precedent, including Fintiv; General Plastics, which lays out factors under which multiple petitions from the same petitioner can be discretionarily denied; and Advanced Bionics, which covers discretionary denials where the USPTO has previously considered the asserted prior art or arguments.

The memo additionally notes that the director “will also consider the ability of the PTAB to comply with pendency goals for ex parte appeals, its statutory deadlines for AIA proceedings, and other workload needs”. That focus on workload management is of particular significance given the sweeping staffing changes being enacted across the federal government by the administration of President Donald Trump: An executive order banning remote work has led the USPTO to begin ordering PTAB APJs to return to the office, potentially triggering attrition; and the administration encouraged voluntary departures through a deferred resignation program allowing employees that accepted through February 12 to offer their resignation, effective on September 30, in exchange for full pay, benefits, and remote work protections. In late March, Chief APJ Boalick reportedly informed PTAB APJs that there would be a reduction-in-force—essentially layoffs—once those and other voluntary retirement programs expire on April 17, as a result of which the Board “is expected to experience staff reductions”. Remarks by Stewart at a recent conference indicate that PTAB APJ staffing has already fallen from a high of about 280 APJs to about 200.

It will take time for the full impact of these changes to become clear, but initial reactions from stakeholders and the media (see, e.g., here and here) have broadly predicted that the result will be a significant increase in discretionary denials, as well as an increase in uncertainty over how PTAB panels will apply the governing factors. Two of those stakeholders went even further: In a March 11 IAM article, Bracewell partners Christopher “Kit” Crumbley (a former PTAB Lead APJ) and Jeffrey Danley predicted that staffing reductions would lead to an increase in NPE litigation.

In the meantime, Stewart issued her first discretionary denial decision soon after launching the new process, reversing a prior set of PTAB decisions that had instituted trial in four IPRs filed by Motorola Solutions against Stellar, LLC. In a March 28 order issued order sua sponte (on the director’s own initiative, without the request of either party), Stewart found that the PTAB had given too much weight to the petitioner’s Sotera stipulation because its invalidity arguments in the parallel district court case were more expansive than those in its petition. Stewart also determined that the panel had “misapprehend[ed] the relevant inquiry” of the Fintiv factor contemplating the extent of the “investment in the parallel proceeding by the court and the parties” by finding that the PTAB trial could relieve some of the court’s burden, instead pointing to the “substantial time and effort” spent on the litigation as “strongly” favoring denial.

– Reexams Level Off, But Data Indicate Continued Shift Away from AIA Reviews

Uncertainty caused by changes to the standards governing discretionary denials has also led defendants to increasingly choose another alternative for validity challenges—ex parte reexaminations, which among other advantages are not subject to discretionary denials to the same extent.

The number of requests for ex parte reexam increased by 21% in 2020 (the year that the PTAB designated its Apple v. Fintiv decision, which established the five NHK-Fintiv factors, as precedential) and then by 53% in 2021. While they held steady at about 330 requests per year in 2022 (the year Vidal issued the just-overturned guidance limiting NHK-Fintiv) and 2023, they surged by 27% in 2024.

While reexam filings were relatively flat in the first quarter of 2025 compared to Q1 2024 (which in turn was 41% higher than Q1 2023), data indicate that the share of patents with reexam requests that have also been challenged at the PTAB continues to fall, reaching just 15% in Q1 2025 after dropping to 20% in 2024 as a whole—further indicating a shift away from IPR. In addition, 58% of the patents with reexam requests filed last quarter have also been litigated in district court, up from 55% this past year.

UPC Update: Court Tackles Non-EU Infringement; CJEU Opens Cross-Border Floodgates

– UPC Filings at 22 Months

On April 4, 2025, the EU’s Unified Patent Court (UPC) released the latest caseload data since its inception, reporting the receipt of 798 cases since June 1, 2023 through April 1, 2025, including 289 infringement actions.

UPC data indicate that Germany’s four local divisions continue to see the most infringement filings, accounting for more than 76% of all such cases filed with the court since its launch, with the Munich Local Division still receiving the majority of those cases.

This is broadly consistent with longer-term trends, as Germany’s national courts accounted for 50-60% of all European patent litigation prior to the UPC (see here). However, German national courts that specialize in patent cases have since seen fewer filings, falling by 23.6% in 2023 and by 8.2% in 2024—a decline that has been attributed to the launch of the UPC in June 2023 (see here). German national courts have also lost many experienced German patent judges to the UPC (see here).

Plaintiffs’ early and sustained preference for the UPC’s German local divisions may in part reflect a desire to have cases decided in a manner more consistent with German national caselaw—given that national caselaw can serve to fill gaps in the UPC’s caselaw and resolve questions unanswered by the UPC Agreement (or UPCA, the treaty that led to the court’s creation) and its Rules of Procedure. Such gaps have arguably been among the largest for issues pertaining to fair, reasonable, and nondiscriminatory (FRAND) licensing, which is not discussed in the UPCA. Indeed, early decisions from the UPC Court of Appeal and Court of First Instance on issues like claim construction and validity assessments have been consistent with the approach taken by German national courts (see here), and the German local divisions have been the first to weigh in on FRAND issues (see here for a recent update).

In addition to the more regularly reported filing data discussed above, the UPC also published its first-ever annual report on February 14, 2025, providing statistics on various aspects of UPC activity beyond those released in the court’s monthly reports.

For instance, in addition to various breakdowns of UPC case filings over time and by case type, the report gives a snapshot of patent opt-outs: Just under 550K opt-outs were filed from the date that they became available on March 31, 2023 (the beginning of the “sunrise” period) through the end of 2024, the vast majority filed prior to the court’s launch on June 1, 2023 (over 400K).

Data on case timing also underscore the relatively accelerated nature of UPC proceedings: for instance, infringement actions have an average time to case closing of 405.42 days, and for revocation actions, 383.43 days.

Furthermore, the report gives a breakdown of party nationality, revealing that the vast majority of plaintiffs and defendants are German, followed in both categories by those from the US.

Caselaw Update: Key Decisions Expand Scope of Damages, Establish Long-Arm Jurisdiction

The first quarter of 2025 saw a series of rulings that dramatically expanded the potential reach of the UPC—including one decision by the Court of Justice of the European Union (CJEU) that could also trigger additional cross-border litigation in national courts within the EU.

– Damages Claims Based on National Infringement Judgments

The UPC began to issue its first decisions on the merits in July 2024. Since then, much of the focus has been on the court’s handling of injunctions, which are notable in part for their possible scope—as a single claim can result in an injunction spanning up to all 18 UPC member states (though that scope now comes with some new caveats, as discussed below). However, the UPC can also issue damage awards with that same reach, covering a market nearly the same size (by population) as the US.

Now, the breadth of available damages could increase further due to a Q1 ruling from the Court of Appeal. On January 16, the appellate body decided in Fives v. Reel that not only does the UPC have the power to hear a damages-only claim based on a merits judgment from a national court, it may also award damages reaching back before the UPC’s start date—in this case, all the way back to 2016.

It remains to be seen how litigants will respond to this decision—in particular, whether the potential for damages reaching further back in time will lead to additional litigation. The same goes for the court’s ruling that UPC plaintiffs can seek damages based on national court infringement rulings, in part due to the fact that this case only concerned damages over the German portion of the patent-in-suit. However, IP Fray has speculated that “sooner or later”, a plaintiff could seek “multi-country damages” based on a national court ruling—possibly even in this case.

– UPC Asserts Long-Arm Jurisdiction over European Patents Issued in Non-UPC Countries

On January 28, one of the UPC’s busiest local divisions pushed the jurisdictional envelope even further. In Fujifilm v. Kodak, the Düsseldorf Local Division (Düsseldorf LD) held for the first time that the UPC can exercise long-arm jurisdiction and decide claims of infringement for European patents issued in countries not participating in the UPC—here, the UK—when the defendant is domiciled in a UPC member state.

By so holding, the Düsseldorf LD essentially extended a preexisting rule under EU law: Under Article 4(1) of the Recast Brussels Regulation, persons domiciled in an EU member state shall be sued in the courts of that member state—and because that jurisdiction over EU-domiciled defendants is “universal” under applicable EU caselaw and regulations, an EU member state has jurisdiction to hear claims of “infringement of [a] European patent committed in all the States for which it has been granted”. Since Article 71b of that regulation provides that the UPC is a “common court” that, under Article 71a, has jurisdiction wherever a member state’s courts would have jurisdiction for matters governed by the UPC Agreement (the treaty that established the UPC), the Düsseldorf LD concluded that the UPC, too, has that same jurisdiction over infringement of the national parts of European patents committed within those countries, including non-UPC states.

A key issue here was the reach of the exception to the above jurisdiction established under Article 24(4) of the Recast Brussels Regulation, which provides that member states have exclusive jurisdiction over validity actions. Here, the Düsseldorf LD held that Article 24(4) does not extend to infringement actions, such that the UPC is not deprived of jurisdiction over infringement claims on that basis.

That said, the court did not ultimately decide on infringement of the UK portion of the asserted patent, as it ruled that the entire patent was invalid. However, the UPC may soon revisit that issue in another case between the same parties: On April 2, the Mannheim Local Division (Mannheim LD) found that Kodak infringed the German designation of another patent but deferred its ruling on the question of UK infringement for a separate proceeding in which the parties will be able to submit briefing.

– CJEU Further Expands Long-Arm Jurisdiction for UPC and EU National Courts

In early March, the CJEU issued an even more sweeping decision on long-arm jurisdiction that could upend the status quo for cross-border patent enforcement in the EU, for both the UPC and national courts.

While cross-border infringement actions were already possible in EU member state courts, the aforementioned validity exception provided by Article 24(4) was previously understood to provide a key limitation: that when an EU member state was seized with an infringement action over a patent issued in another member state, it had to stay the case when the validity of the foreign patent was challenged. Thus, defendants could prevent cross-border infringement claims from proceeding by filing a defensive validity challenge.

However, in BSH Hausgeräte v. Electrolux, the CJEU not only confirmed that Article 24(4) does not prevent courts in member states from addressing infringement (consistent with the UPC’s Fujifilm decision), it also held that member state courts (and thus, by extension, the UPC) “may, where appropriate, stay the proceedings” pending the outcome of a validity challenge in another EU member state when there is a “reasonable, non-negligible possibility” that the challenge will succeed. Thus, rather than requiring a stay, the opinion gives the court some leeway based on the seriousness of the invalidity claim.

Beyond that, the CJEU further held that courts in non-EU countries (or “third State[s]”) do not fall under Article 24(4) and thus lack exclusive jurisdiction over validity claims. As a result, where a court in an EU member state sees an infringement case over a non-EU patent, that court has jurisdiction to rule on both the infringement and validity of that foreign patent (barring the application of special rules such as the Lugano Convention, which applies similar exclusive jurisdiction over validity claims as Article 24(4) to non-EU countries Iceland, Norway, and Switzerland). However, that validity ruling cannot affect the existence or content of that patent in its country of issuance or cause the patent to be removed from that country’s national register; rather, the invalidity ruling has effect only in the dispute between the parties in suit, such that it results in dismissal of the case between them.

The upshot of BSH Hausgeräte is that national courts in EU countries, as well as the UPC, may now award damages and/or impose injunctions for the infringement of non-EU patents as long as the defendant is domiciled in the EU (for national court litigation) or in one of the 18 countries participating in the UPC (for UPC litigation). Additionally, while the UPC’s jurisdiction remains limited to claims over the national components of European patents as well as unitary patents, some have observed that BSH Hausgeräte now allows EU national courts to hear claims over a much wider range of foreign patents against EU-domiciled defendants. Litigator Roman Sedlmaier of Munich-based IP firm IPCGS has emphasized in comments to IP Fray that the decision now allows patent owners to leverage patents that were “previously irrelevant because they could not be enforced” in their countries of issuance. Moreover, Bird & Bird partner Wouter Pors commented to IAM that the term “third State[s]”, as used in that decision, could extend beyond EPC countries like the UK and Turkey, thereby enabling “world-wide jurisdiction for defendants based in the EU Member State of the court”—and potentially worldwide injunctions.

Even US patents could be in play, though Taylor Wessing partner Paul England remarked to IAM that that he “would be surprised if the US were to give effect to such a decision”. Others expressed similar skepticism that US courts would respect European rulings on US patents as res judicata (see, e.g., here), alongside broader concerns that cross-border litigation enabled by BSH Hausgeräte could trigger a wave of anti-suit injunctions as courts in foreign patents’ countries of issuance seek to protect their jurisdiction.

England also told IAM that while the Brussels Regulation already allowed for cross-border damages and preliminary injunctions, BSH Hausgeräte also appears to enable permanent injunctions in such cases. This could undercut a key advantage of the UPC relative to EU national courts: While the UPC was previously the only option for seeking cross-border injunctions for European patent infringement, Hoffmann Eitle partner C. Thomas Becher has stated that the UPC has now “lost this unique selling point” as courts in EU member states gain a potentially more sweeping version of that power as a result of the CJEU’s decision. Becher further underscored that as BSH Hausgeräte gives plaintiffs “another arrow in the cleaver”, it will make defensive strategies more expensive for potential infringers.

FRAND Update: EU Withdraws SEP Proposal; Key Appellate Rulings in UK and Germany

The first quarter saw the center of gravity for standard essential patent (SEP) disputes shift further toward national courts: With the withdrawal of a hotly debated European Union (EU)-wide SEP regulation, stakeholders will likely continue flocking to their preferred venues—including the UK, which issued a series of rulings on interim licenses and pool-wide rate determinations in Q1; and Germany, despite shifts in the approach of its busiest regional court to fair, reasonable, and nondiscriminatory (FRAND) licensing issues.

– EU: European Commission Withdraws SEP Proposal

One of the most closely watched developments in the SEP space has been the European Commission’s (EC’s) controversial proposal for a framework governing SEP licensing and dispute resolution in the EU. That proposal, introduced in April 2023, sought to create an EU-wide SEP registry, a system for performing nonbinding essentiality checks of certain registered SEPs, and an out-of-court process for determining FRAND terms, also nonbinding—as well as an optional rate-setting process that would in part determine the maximum aggregate royalty rate for a given standard and could be initiated unilaterally. While that legislation appeared to be gaining momentum in early 2024 despite pushback from SEP owners and other stakeholders, the Commission took the unexpected step of withdrawing the proposal entirely on February 11, 2025.

The move followed shifts in the political landscape in Europe and beyond. In particular, the proposal’s momentum appeared to hit a wall due to leadership changes in the wake of the elections held for the European Parliament in June 2024. Soon after the elections, newly reelected President Ursula von der Leyen blocked a second term for Thierry Breton, the bill’s primary sponsor, as Commissioner for the Internal Market. His replacement, Stéphane Séjourné, has been less outspoken on SEP issues, while a strident critic of the SEP regulation, Henna Virkkunen, was named as Executive Vice-President for Tech Sovereignty, Security and Democracy. Additionally, the bill became stalled in the Council of the European Union, which represents the governments of EU member states and is one of two legislative bodies with a veto over bills proposed by the Commission (the other being the European Parliament), after opposition from countries including Finland, the Netherlands, and Sweden.

The bill’s abrupt withdrawal—reportedly even taking some within the Commission by surprise—stated simply that there was “[n]o foreseeable agreement” on the proposal and that “the Commission will assess whether another proposal should be tabled or another type of approach should be chosen”. However, observers have noted a broader shift in the political climate in favor of deregulation (see, e.g., here, here, and here) that could forestall such action in the near term; JUVE Patent, for one, speculates that further changes may not happen until a new Commission is appointed in five years.

– EU: European Commission Targets China’s Global FRAND Rate-Setting Practices in Second WTO Action

The Commission has also weighed in on an ongoing jurisdictional back-and-forth between certain national courts over international FRAND licensing issues. In August 2021, China’s Supreme People’s Court became the second national court, following the UK Supreme Court one year before, to assert the authority to set the terms of a global FRAND license. The Chongqing Intermediate People’s Court then became the first Chinese court to exercise that power in November 2023, issuing a decision in Oppo v. Nokia that reportedly set lower rates for devices sold in China and other “price-sensitive” countries than for those sold elsewhere.

In late January 2025, the European Commission announced that it has challenged these global rate-setting practices before the World Trade Organization (WTO), the second such action it has brought against China over FRAND issues. The Commission argues that these practices “pressure[] innovative European high-tech companies into lowering their rates on a worldwide basis” and that decisions like Oppo v. Nokia and the laws enabling them “unduly interfere[]” with other national courts in violation of the Trade Related Aspects of Intellectual Property Rights (TRIPS) Agreement.

– UK: Court of Appeal Issues Expansive Interim License Ruling

In late 2024, the UK Court of Appeal issued a landmark appellate ruling in InterDigital v. Lenovo that has widely been viewed as relatively implementer-friendly, increasing the royalty rate set by the UK High Court but arriving at a number far closer to the one requested by the defendant. In the first quarter, the court continued that implementer-centric streak: The Court of Appeal held for the second time that a SEP implementer is entitled to an interim license prior to the court’s determination of a final FRAND license. On February 28, the appellate court granted implementer Lenovo’s request for an interim license from patent owner Ericsson, ruling that a willing SEP licensor in Ericsson’s position would grant such a license and finding that the company had breached its obligation to negotiate in good faith by pursuing injunctive relief in other jurisdictions. The decision extended a similar ruling by the same court late last year in Panasonic v. Xiaomi, this time applying such a requirement to a patent owner that had not sought out the court’s jurisdiction (as it was Lenovo, not Ericsson, that filed the underlying UK action) or agreed to be bound by its final FRAND determination.

The Court of Appeal subsequently set a one-week deadline for Ericsson to offer an interim license, holding that if it did not do so by March 10, the court would automatically conclude that it had breached its FRAND obligations to the relevant standard-setting organization (SSO), the European Telecommunications Standards Institute (ETSI), and that it had acted as an unwilling licensor. Ericsson then declined to offer an interim license, as a result of which the court made those determinations regarding its conduct—after which Lenovo reportedly initiated a dispute with ETSI, invoking a clause of its intellectual property rights (IPR) policy concerning license availability. Ericsson then asked the UK Supreme Court for permission to appeal, but the parties announced days later that they had agreed to dismiss all litigation and have their remaining licensing disputes decided through arbitration—just days after another notable settlement in SEP litigation over video coding patents between Nokia and Amazon.

– UK: Court of Appeal Rejects Rate-Setting Claim Targeting Avanci 5G Pool

Implementers have increasingly filed UK litigation seeking FRAND determinations in the wake of the InterDigital decision. The Court of Appeal has held that such cases are permissible where the implementer can show a legal right to such a declaration, chiefly where such a claim for relief is grounded in the patent owner’s relevant FRAND commitment (i.e., its pledge to the applicable SSO that it will offer licenses to its declared SEPs on FRAND terms).

However, in the first quarter, the Court of Appeal affirmed the dismissal of a rate-setting case filed by Tesla that sought a declaration against an entire patent pool—specifically, for the Avanci 5G licensing platform, rejecting certain claims against pool administrator Avanci, LLC and declining to force member InterDigital, Inc. to serve as a “representative” of the other standard essential patent (SEP) owners participating in that pool. The case divided the Court of Appeal, with Lord Justices Stephen Phillips and Philippa Whipple authoring brief opinions in favor of dismissal—both holding that Tesla had not shown that the ETSI IPR policy obliges members to offer their patents for licensing on a “collective” basis. As a result, they concluded that Tesla had not shown the requisite legal right to its claim for relief, rendering it the same type of “free-standing” FRAND claim barred under prior caselaw (in particular, the Court of Appeal’s 2021 decision in Vestel v. Access Advance). Lord Justice Richard Arnold, who had recently authored the court’s interim license decision in Ericsson v. Lenovo, issued a much lengthier dissent explaining why he would have allowed Tesla’s claims.

– Germany: Munich Appellate Court Adopts New Security-Centric SEP Approach

FRAND law is also in flux in Germany, where the Munich Higher Regional Court has adopted a controversial new approach to SEP disputes. That framework, first detailed in a preliminary opinion released last October, places greater emphasis on the security that the implementer must pay to demonstrate willingness as required under EU caselaw: The decision established that a court will only make a full FRAND determination for the patent owner’s last offer if the implementer provides a security equal to the amount of that offer, that the court will otherwise decline to evaluate the FRANDness of that offer, and that this security is required for the implementer to be deemed “willing”. Since defendant HMD had not provided such a security to plaintiff VoiceAge EVS GmbH & Co. KG, the court held on March 20 that HMD’s FRAND defense had failed—and greenlit an appeal to Germany’s Federal Court of Justice.

US Policy Update: Patent Bills, White House Picks, and the USPTO Today

Q1 saw multiple IP-related bills introduced by lawmakers, with several older pieces of legislation still waiting in the wings, possibly in line to be reintroduced amid shifts in leadership and policy.

RESTORE Patent Rights Act of 2025 (S. 708) – “Realizing Engineering, Science, and Technology Opportunities by Restoring Exclusive Patent Rights”

Introduced in 2024 by Senators Chris Coons (D-DE) and Tom Cotton (R-AR), and reintroduced in February 2025 by the same lawmakers, the RESTORE Patent Rights Act is a single-sentence bill aimed at overriding the 2006 Supreme Court decision eBay v. MercExchange, which established that courts must follow a four-factor test to grant permanent injunctions in patent cases and has led courts to issue such relief significantly less often than before. The bill proposes to amend 35 U.S. Code § 283, the statute governing patent injunctions, to add the following language:

“(b) REBUTTABLE PRESUMPTION.—If, in a case under this title, the court enters a final judgment finding infringement of a right secured by patent, the patent owner shall be entitled to a rebuttable presumption that the court should grant a permanent injunction with respect to that infringing conduct.”

If passed, RESTORE would make injunctive relief the standard remedy in cases wherein a patent has been found to be valid and infringed.

The Litigation Funding Transparency Act of 2025 (H.R. 1109) – calling for transparency and oversight of third-party beneficiaries in civil actions

Introduced in 2024 by Congressmen Darrell Issa (R-CA) and (co-sponsor) Scott Fitzgerald (R-WI), and reintroduced in February 2025, this time alongside Congressman Mike Collins (R-GA), this bill seeks to require disclosure in civil lawsuits of third-party litigation funding (TPLF).

If passed, this bill will require litigants to (with some exceptions, as laid out in the bill):

(1) disclose in writing to the court and all other named parties to the civil action the identity of any person (other than counsel of record) that has a right to receive any payment or thing of value that is contingent on the outcome of the civil action or a group of actions of which the civil action is a part; and

(2) produce to the court and to each other named party to the civil action, for inspection and copying, any agreement creating a contingent right referred to in paragraph (1), including any ancillary agreement or document, except as otherwise stipulated or ordered by the court.

PREVAIL Act of 2023 (S. 2220) – “Promoting and Respecting Economically Vital American Innovation Leadership”

In November 2024, the Senate Judiciary Committee voted to advance the Promoting and Respecting Economically Vital American Innovation Leadership Act (PREVAIL Act), a legislative effort that, if passed into law, could effect significant changes to Patent Trial and Appeal Board (PTAB) proceedings.

Introduced in 2023 by Senator Christopher Coons (D-DE), and co-sponsored by Senators Thom Tillis (R-NC), Richard Durbin (D-IL), and Mazie Hirono (D-HI), the PREVAIL Act is being presented as a bipartisan bill meant to “invest in” and “protect the property rights” of US inventors.

While the PREVAIL Act will likely be marked up and amended multiple times as it goes to the Senate floor and then into the House, a press release issued in August 2023 laid out the overarching changes the bill seeks to make:

-

- Require standing for PTAB challengers and limit repeated petitions challenging the same patent;

- Harmonize PTAB claim construction and burden of proof with federal district court;

- End duplicative patent challenges by requiring a party to choose between making its validity challenges before the PTAB or in district court; and

- Increase transparency by prohibiting the USPTO director from influencing PTAB panel decisions.

From here, the PREVAIL Act will be favorably reported to the Senate for a full vote.

As noted above, there are several IP-related bills that have stalled since their introduction by lawmakers, but that may be reintroduced, in some form or another, amid future policy and leadership changes; these bills include the Patent Eligibility Restoration Act (PERA) of 2023 and the Prohibiting Adversarial Patents Act (PAPA) of 2023. For a closer look at these and the more recently introduced bills, see here.

Lutnick and Squires emerge as White House picks

Q1 also saw the Senate confirm former Cantor Fitzgerald CEO Howard Lutnick as US Commerce Secretary. Lutnick has a notable background in patent monetization; per Bloomberg, he is a named inventor on more than 800 worldwide patent assets, much of them gaming and financial services patents, including an estimated 400+ active or expired US patents. Cantor Fitzgerald initiated multiple patent litigation campaigns between 2016-2018; an entry point into those matters is available here.

During his Senate confirmation hearing, Lutnick called out the USPTO’s backlog, blaming it in part on the flood of patent applications being filed at the USPTO by Chinese individuals and entities:

The backlog is unacceptable, and my pursuit will be the rigorous reduction of that to get it down. It used to historically be 500,000 and I thought that was unacceptable. I am a patent holder, I’ve used the patent office over many years, it could be much more productive, but the Chinese are abusing us. They don’t give us protection in China and they come in and use our patent office against us. This is going to end, we are going to study that, and we are going to work on ending that and making sure our American inventors get taken care of quickly and effectively.

Also during the first quarter, the White House announced Dilworth Paxson partner John A. Squires as its nominee to be the next USPTO director. If confirmed by the Senate, Squires will be the first USPTO head to bring a combination of law firm, private sector, IP monetization, and IP finance experience to the role. For RPX reporting on Squires’ nomination, see here.

The USPTO Today

Changes at the USPTO have been coming at a quick clip since President Trump took office, with some notable changes announced during Q1 and more apparently in store for the agency.

– Under the DOGE microscope

Despite the fact that the USPTO is self-funded, the Department of Government Efficiency (DOGE) has set its sights on the agency, claiming that the USPTO’s workforce, comprising more than 13,400 individuals, costs American taxpayers roughly $2B in wages.

Indeed, USPTO employees were among the more than 2 million federal workers who in January received an email from the Office of Personnel Management (OPM) offering a deferred resignation option; this offer allows individuals to resign effective September 30, 2025, retain full pay and benefits through that date, and be exempt from any future reduction measures.

Time will tell how many USPTO employees accept the OPM’s deferred resignation offer, but recent months have already seen an exodus of leadership, including Commissioner for Trademarks David Gooder; Director Review Executive Thomas Krause; and Commissioner for Patents Vaishali Udupa.

– Lutnick is appointing new PAC members

Meanwhile, in March, US Commerce Secretary Lutnick removed all current appointments to the Patent Public Advisory Committee (PPAC) and Trademark Public Advisory Committee (TPAC).

Created in 1999, the PPAC and TPAC each comprise nine private-sector individuals who advise the USPTO Director on “policies, goals, performance, budget and user fees of the USPTO”. Lutnick is expected to appoint new members to these PACs in May.

– Fintiv is back, with a bifurcated institution process for AIA reviews

Earlier in Q1, Acting USPTO Director Coke Morgan Stewart rescinded a memorandum introduced by her predecessor, Kathi Vidal, that had limited the circumstances in which the PTAB could discretionarily deny institution under the NHK-Fintiv rule. More recently, the USPTO has taken two more notable steps on discretionary denials—clarifying the reasons behind that withdrawal, and creating a two-stage process under which the USPTO director first decides requests for discretionary denials.

See the PTAB Update section above for further details on these changes.

Patent Market Update: New Funded NPE Campaigns and Notable Patent Transactions

Through frequent and systematic review of public documents, including court, corporate, and regulatory filings, RPX subject matter experts have identified more than 300 relationships between patent holders and specific third-party litigation funders. Those funders include standalone litigation finance firms, private equity firms, conglomerates, hedge funds, and IP investment firms.

During the first quarter of 2025, RPX flagged multiple new patent campaigns initiated by plaintiffs tied, by public records, to litigation funders, including two New York City-based hedge funds. RPX members can access an exclusive overview of this activity here.

Notable Patent Transactions Completed in Q1

RPX also conducts close and continuous review of USPTO assignment records to identify transactions that may portend future patent litigation. Notable assignees that received patents in Q1 include Erich Spangenberg’s SIM IP (see here); multiple NPEs operating under the umbrella of Dominion Harbor Enterprises, LLC (see here and here); and an entity that is likely associated with a hedge fund that has a history of forming and/or funding patent plaintiffs (here).

Additional RPX Patent Market Intelligence

Visit RPX Empower for further analysis and up-to-date information on patent litigation and market trends.