NPE Filings Drop Due to Since-Ended IP Edge Pause and Downturn in West Texas

October 11, 2023

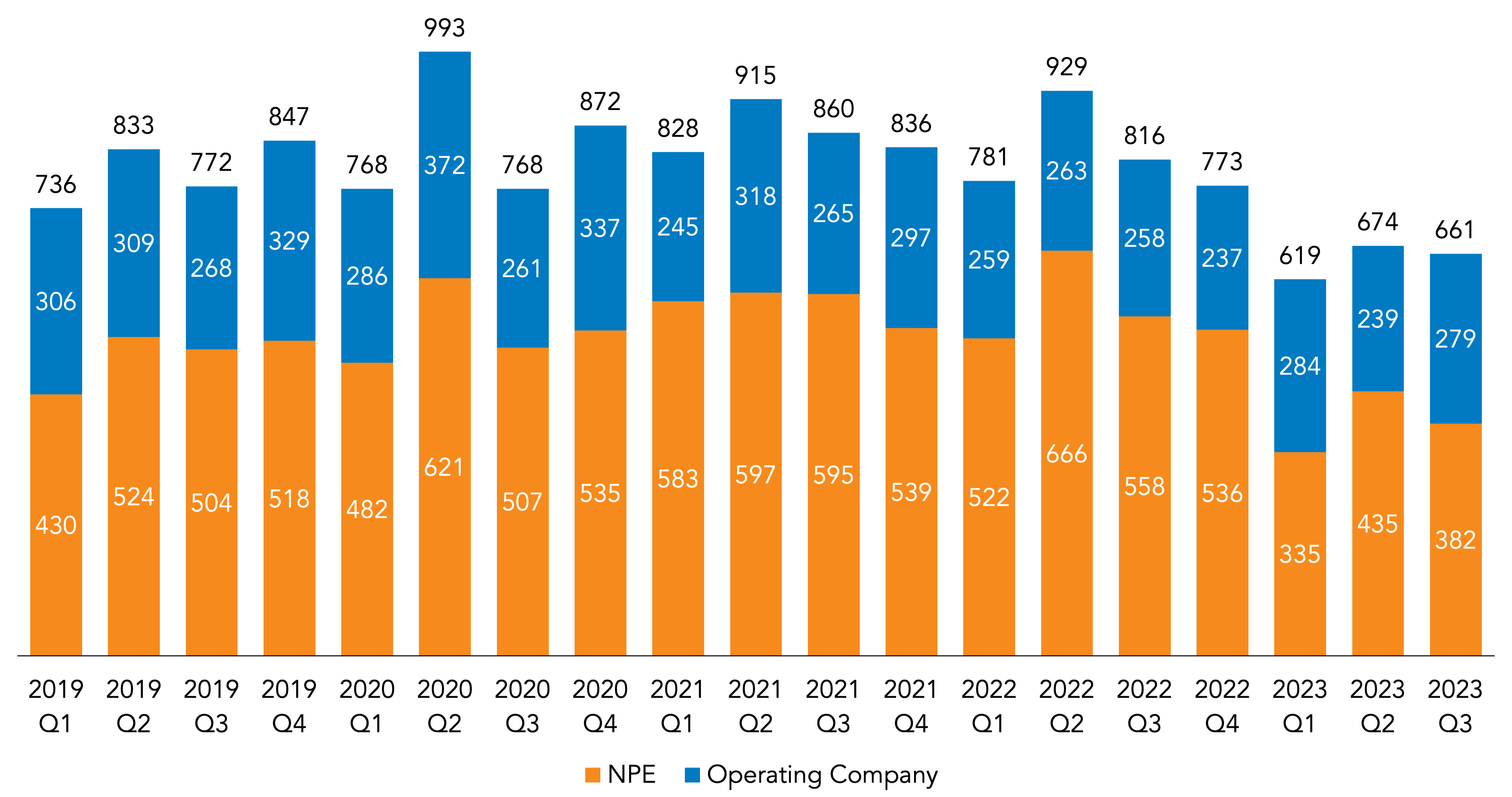

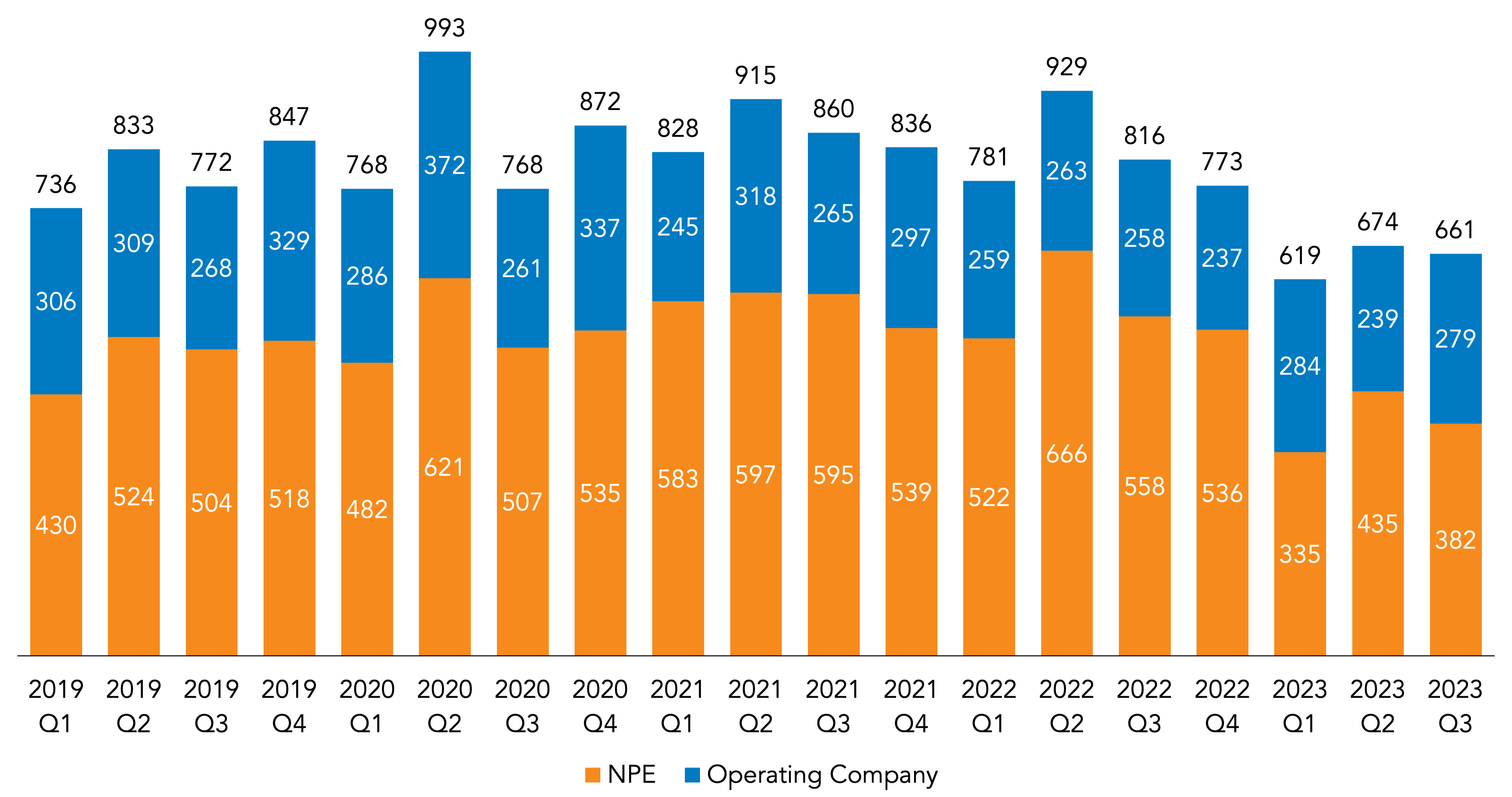

So far this year, NPEs have added 1,152 defendants to patent litigation campaigns as of the end of September, a 34% drop from that same period last year (when NPEs added 1,746 defendants). In contrast, operating company litigation was up slightly in Q1-Q3 2023, at 802 defendants added, a 3% uptick compared to that same timeframe in 2022 (during which operating companies added 780 defendants).

In the third quarter of 2023, NPEs added 382 defendants, down 32% from the same quarter this past year (when NPEs added 558 defendants). This also marked a 31% dip from the trailing third-quarter average for 2020-2022 and a 12% drop from Q2 2023. Meanwhile, operating companies added 279 defendants in Q3 2023, up by 8% from the year-ago quarter, up by 7% compared to the trailing average, and up by 17% compared to the preceding quarter.

| Defendants Added | Change Compared to: | ||||

| Q3 2023 | Q3 2022 | Q3 2020-2022 Average | Q2 2023 | ||

| NPE | 382 | -32% | -31% | -12% | |

| Operating Company | 279 | 8% | 7% | 17% | |

| Total | 661 | -19% | -19% | -2% | |

The decline in NPE filings during Q1-Q3 is largely the result of two primary developments last year. The most impactful has been a prolonged pause in litigation by patent monetization firm IP Edge LLC. While IP Edge, through plaintiffs under its apparent control, had long been the most prolific filer of patent cases by a wide margin, it stopped bringing new litigation in December 2022, likely due to pressure that it has faced from disclosure rules in the courtroom of Delaware Chief Judge Colm F. Connolly (as detailed further below). The sheer volume of IP Edge’s prior litigation meant that its subsequent pause caused a significant slide in the overall NPE numbers: Though it added roughly 50 defendants per month before it hit the brakes, for a total of 455 defendants in Q1-Q3 2022, nearly zero were added during that same period this year. That difference alone accounts for more than three fourths (76.5%) of the drop in NPE litigation so far this year. Excluding IP Edge from both periods, NPE litigation was down by just 10.9% compared to Q1-Q3 2022.

That said, early signs point to an IP Edge revival, as the firm ended its litigation pause on September 13 by filing its first new case since November 2022, targeting Roku over products compliant with H.265/HEVC video compression standards and HDR10+ technology in a complaint filed by new plaintiff Communication Advances LLC. More details on this potential IP Edge revival—including signs that this may be one of a newer breed of IP Edge plaintiff with greater willingness to litigate on substantive matters—can be found on RPX Insight.

The second development impacting NPE litigation this year was a downturn in NPE filings within the Western District of Texas, where a July 2022 order from the district’s chief judge targeted the concentration of litigation before Waco District Judge Alan D. Albright. Plaintiffs previously took advantage of filing rules allowing complaints to be filed in a specific division, thus guaranteeing they could get Judge Albright—who has demonstrated a restrictive approach to transfer motions, PTAB stays, and Alice motions—by filing in Waco (where he is the only district judge). Yet the July order created an exception, ordering that Waco’s patent cases be randomly distributed among a group now comprised of 11 judges, including Judge Albright. While the district has since developed a practice of assigning new cases in existing campaigns (those with the same parties and patents) to the judge who oversaw prior litigation, meaning that Judge Albright has received the bulk of new cases in those “legacy” campaigns, the assignment of complaints filed in entirely new campaigns has been far more random. By eliminating the guarantee that cases would end up before Judge Albright, it appears that the July order has undercut the district’s overall appeal for NPEs: Such plaintiffs added 282 defendants in Waco from Q1-Q3 2023, compared to 544 during that same period last year.

Added together, the reductions from IP Edge and in Waco—633 defendants in total, adjusting for the overlap in IP Edge and Waco cases—accounted for 100% of the decline in NPE activity in Q1-Q3 2023 and then some. The net decrease was 594 defendants, a partial offset caused by other plaintiffs shifting from West Texas to other districts in smaller numbers.

See RPX’s third-quarter review for more on this and other trends impacting patent litigation in Q3 and 2023 to date.